Key Insights

- Ethereum is primed for a rally of at least 416%, even by conservative estimates.

- ETH/BTC charts show a pattern similar to 2017-18 when it grew 3000% from 0.005 to 0.15.

- Experts assume that the current dip in the Altcoin markets could be very short-lived.

- ETH has already shown a tendency to undergo a bullish Fibonacci retracement.

The Current Dip is Expected to be Short-Lived

A known crypto analyst, Kevin Capital TA, presents data that shows the current dip in Altcoins could be short-lived. Kevin argues that the altcoin market cap has traditionally never broken the daily super trend (a technical indicator) until the bull market is over.

At present, this indicator’s support part lies just below the 0.786 Fibonacci Retracement level shown in the chart. This data means that the Altcoin market cap has already achieved a golden retracement ratio of 0.618 (typically 61.8%) has already been achieved, and the markets are on their way to overcoming the next resistance.

In a true bull bull market the #Altcoins market cap has never broken the daily super trend until the bull market was over. The current daily super trend of support is currently sitting below at the macro .786 Fib at 324 Billion. That's where you buy the dip if you so desire. pic.twitter.com/QiWMPB6dXg

— Kevin (@Kev_Capital_TA) December 10, 2024

What Caused the Recent Correction in Altcoins?

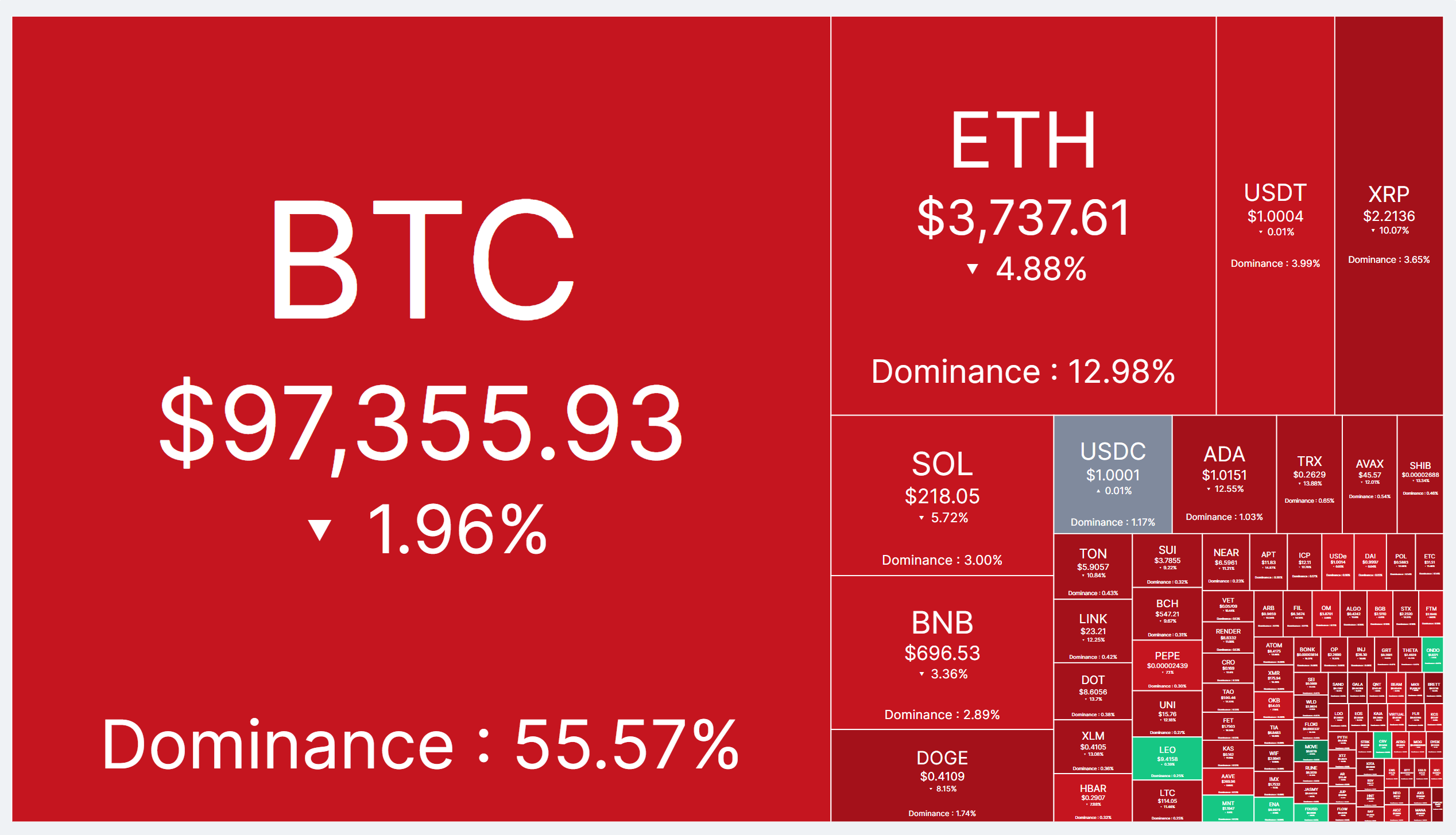

Crypto markets saw a major correction in the last 48 hours, especially in Altcoins. This correction wiped out most of the weekly gains in major Altcoins like ETH, XRP, SOL, BNB, DOGE, and SHIB.

Crypto Market Heatmap Today

Analyst Crypto Yoddha presents a simple reason for these recent corrections. The analyst added that the Altcoin index (a composite crypto index excluding Bitcoin) had increased so high lately that it touched a major resistance level. This resistance caused a retracement in them.

Why did #Altcoins retrace so much, you ask?

The Altcoin index slammed into the previous top, triggering a classic reaction to a major resistance level.

Keep an eye on those Alts that bounced back fast! pic.twitter.com/kefthP3YF7

— Yoddha (@CryptoYoddha) December 10, 2024

Additionally, since most Altcoins, like Solana and XRP, have been at their ATH, a correction in Bitcoin triggered a chain reaction in other cryptos, causing them to buckle under short-selling pressure.

However, the analyst also adds that this correction might not last much longer and will soon vanish, triggering another rally in Altcoins.

In that ensuing rally, we assume the largest gainers would be primarily from utility-driven tokens like XRP and Solana.

The memecoins, too, are expected to make decent gains. Here, Shiba Inu could emerge as the fastest growing among top memecoins due to a bullish rounding bottom pattern.

We could also see a revival in projects like Worldcoin, Algorand, and Sandbox.

Altcoins Repeating Historic Pattern From 2017-18 of 3000% Growth

A Crypto analyst also compared the 2017-18 Altcoin and current rallies. The analyst also said they had so many similarities that the timing seemed almost identical.

#Altcoins 2016/2017 vs. #Altcoins 2024/2025

Even the timing is almost identical (1 month difference).

Sounds strange at first, but this crash yesterday was necessary and is rly bullish. pic.twitter.com/4Eiq7UTLc5

— ⓗ (@el_crypto_prof) December 10, 2024

The chart assumes Ethereum to represent Altcoins and takes the trading pair of ETH/BTC and plots it. It has three distinct phases: accumulation, reaccumulation, and rally.

The first part, an accumulation resulting in a rounding bottom pattern, is almost similar in 2015-16 and 2019-21, the second being a larger pattern. The second part, which showed the accumulation phase in a falling wedge pattern, was similar in 2016-17 and 2021-25. This accumulation phase resulted in a super rally that took ETH/BTC from 0.005 to 0.15. A rally of 3000%.

The events occur on a much larger timeframe in the current market, so they are poised to bring a more significant rally than 2017-18. Even by conservative estimates, Ethereum’s current valuation is $15k, almost 416% away from current price levels.

A 3000% rally could end up ETH at $100k by the end of this current cycle. Though this might be highly optimistic, a similar rally has already happened in the past.

Such a large rally could make Ethereum the most desirable Altcoin in the current markets and uplift all the ETH-based Altcoins like SHIB, ARB, POL, OP, etc.

Additionally, it would push Altcoin markets to new highs, shadowing the recent growth of Bitcoin.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.