This Dogecoin whale accumulation analysis reveals that large investors bought 11.12 billion DOGE tokens between $0.20 and $0.203, creating a massive resistance wall that could determine the memecoin’s next move. With open interest surging 10% to $1.53 billion and positive funding rates showing trader confidence, breaking through $0.20 resistance could trigger a 33% rally toward $0.27.

Key Insights

- Dogecoin whales accumulated 11.12 billion tokens near $0.20 and created a strong resistance wall.

- Open interest and funding rates indicate that there is steady confidence among traders eyeing a breakout.

- Holding the $0.17 support could fuel a 33% rebound toward $0.22 and beyond.

This Dogecoin whale accumulation analysis shows the memecoin is once again in focus as its price edges closer to the $0.20 mark. This level has now become a major resistance area defined by heavy whale accumulation.

Understanding this Dogecoin whale accumulation is essential for traders, as over 11 billion DOGE were bought between $0.20 and $0.203, turning this range into a critical battleground. The price now sits around $0.18 after rebounding from a strong demand zone near $0.17.

Traders are watching to see whether Dogecoin can finally push through the $0.20 barrier and extend its rally toward $0.27.

Dogecoin Whale Accumulation Analysis: Building Strength at $0.17-$0.18

The Dogecoin whales accumulation analysis reveals that the memecoin bounced sharply after testing support between $0.16 and $0.17, an area that has consistently acted as a buying zone. Market data shows a clear recovery from this region, which confirms fresh interest from bulls.

This rebound also coincides with the lower boundary of Dogecoin’s long-term ascending trendline and indicates that buyers are defending this structure. A sustained hold above $0.176 could thus show that traders remain optimistic.

If momentum continues, DOGE could reach $0.193 before facing the dense resistance at $0.20. Failure to break above this level might lead to a temporary dip back toward $0.17, where buyers are likely to regroup.

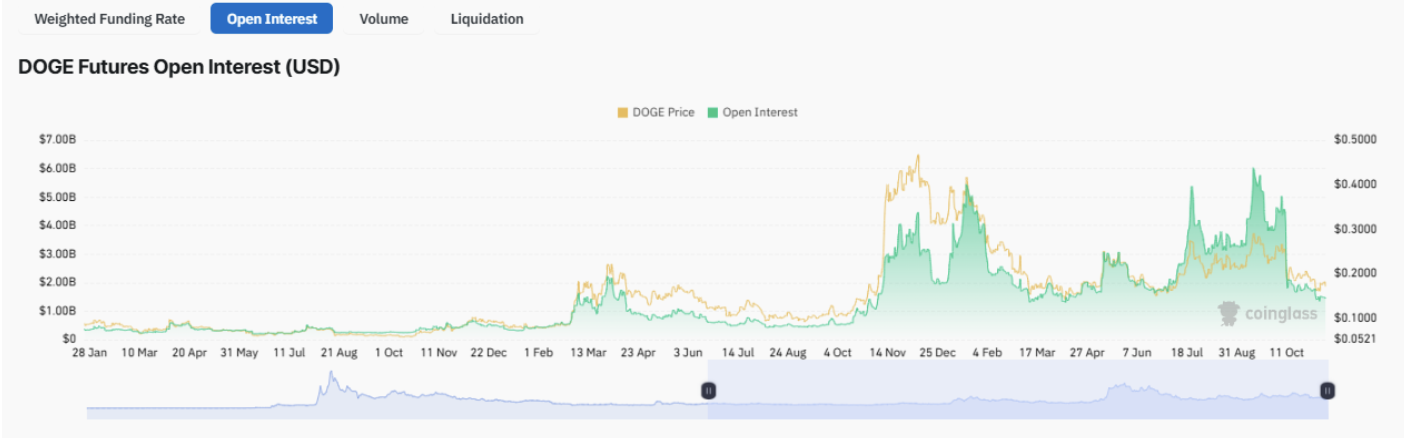

Dogecoin Open Interest Shows Growing Confidence

This Dogecoin whales accumulation analysis gains additional support from CoinGlass data showing open interest has surged nearly 10% to $1.53 billion, indicating traders are adding leveraged long positions. This rise shows that traders are adding leveraged long positions as they eye a breakout.

The increase indicates market confidence, but it also signals higher risk. Large open interest tends to lead to volatile moves when liquidations occur. If traders maintain these positions without creating a funding imbalance, the bullish setup could remain intact.

However, a sudden price drop may trigger a chain of liquidations and cause short-term turbulence. For now, most traders seem comfortable holding their longs as Dogecoin edges closer to $0.20.

Trader confidence has also been rising across the broader crypto market as the Dogecoin ETF approval window opens and Bitwise’s 8(a) move pushes the SEC to respond

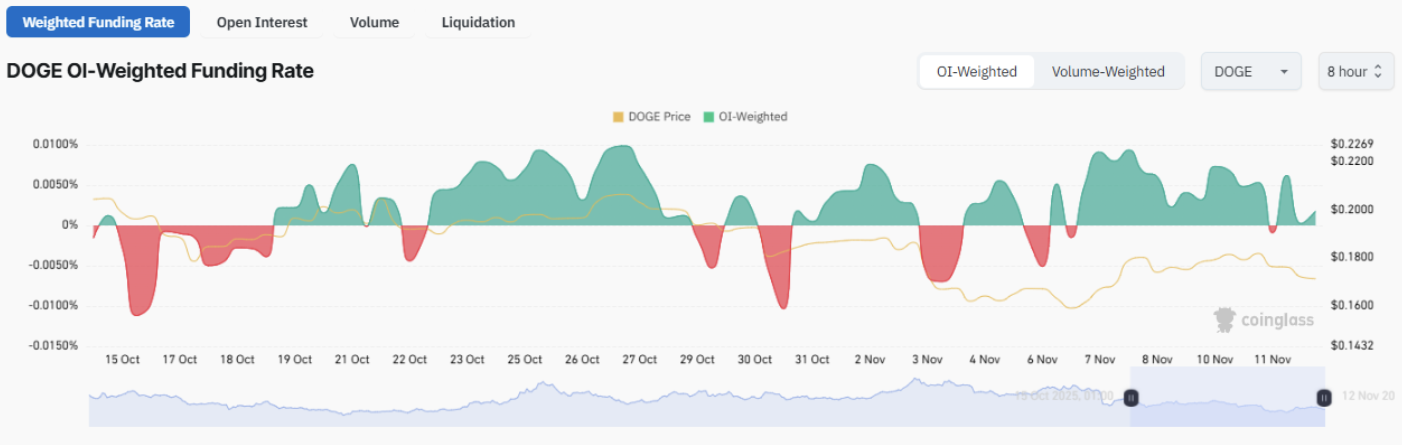

Funding Rates Suggest Sustainable Optimism

The Dogecoin whales accumulation analysis is further strengthened by funding rate data showing an OI-Weighted Funding Rate at 0.0093%, meaning most traders are paying to keep their long positions open. This means that most traders are paying to keep their long positions open. This shows that there is some bullish conviction, but the moderate level indicates that enthusiasm has not reached dangerous extremes.

Such a balance tends to support a gradual price growth rather than sudden spikes.

A steady positive funding rate shows that traders believe the next move is upward, even though any sharp rise in the metric could be a signal for excess leverage.

Market watchers are paying attention to how this funding trend changes as price pressure builds near $0.20. Sustained stability here would strengthen Dogecoin’s bullish outlook into the second half of November.

Dogecoin Bulls Target $0.27

This Dogecoin whale accumulation analysis highlights how large investors have been quietly increasing exposure and now hold billions of DOGE at breakeven levels near $0.20. Their behavior tends to affect price direction, as selling at this level could slow rallies while holding could encourage further gains.

$Doge/daily#Dogecoin is experiencing downward movement as it completes the green triangle for Recovering. https://t.co/Vx0A9lDtnX pic.twitter.com/xYprXhqCvA

— Trader Tardigrade (@TATrader_Alan) November 12, 2025

The Dogecoin whales accumulation analysis suggests that if the coin convincingly breaks above $0.20, the resistance could transform into strong support and open the door for a move toward $0.27. This would open the door for a move toward $0.27, which aligns with the next major Fibonacci retracement level and previous swing highs.

On the flip side, a rejection might send the price back to test $0.17 again.

Still, most analysts agree that the underlying structure is still bullish as long as the coin stays above this lower boundary.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.