Chainlink co-founder Sergey Nazarov thinks the current crypto bear market is fundamentally distinct from past cycles. Despite a sharp drop in total market value, the industry has not seen any of the institutional collapses seen in previous downturns.

Key Insights

- The current market downturn has not triggered major exchange or lending platform collapses.

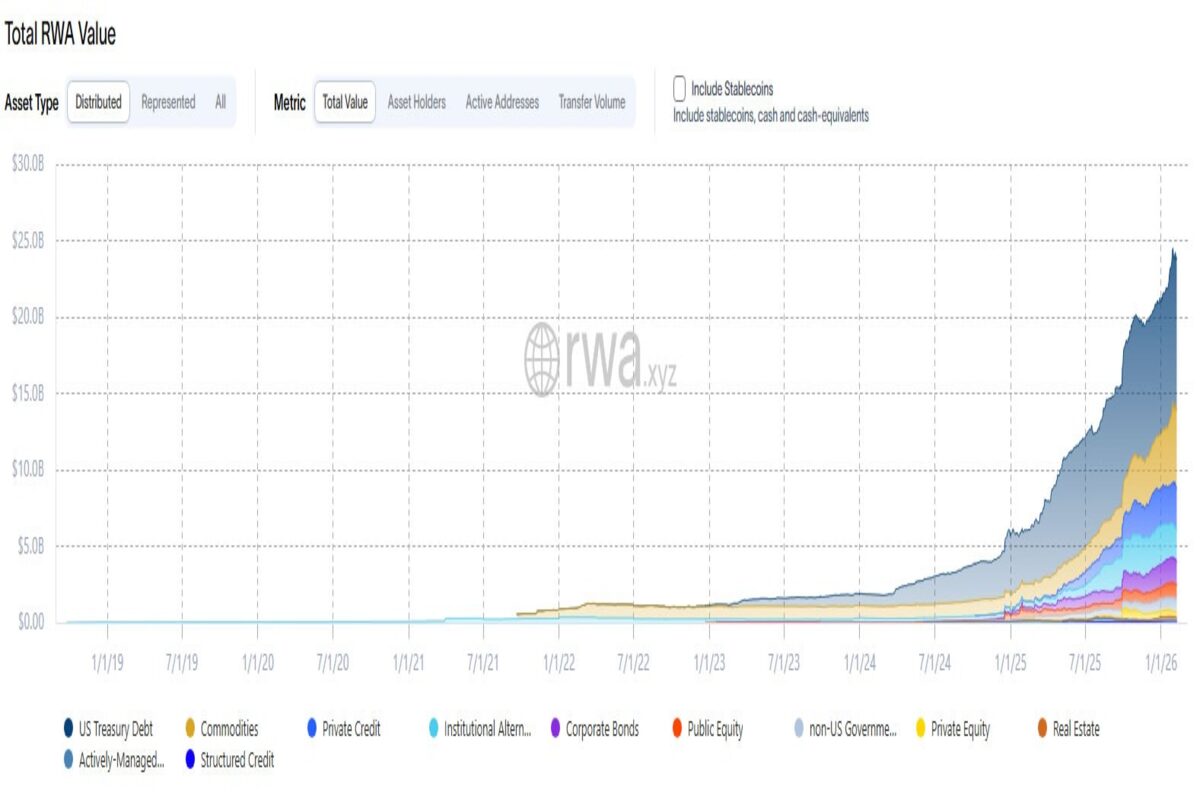

- The On-chain real-world assets have climbed roughly 300%, indicating that utility-led adoption is surging even during a bear market

- The exponential growth in tokenized assets and on-chain derivatives suggests value creation is no longer linked to broader market sentiment.

- If these trends continue, on-chain RWAs could eventually surpass cryptocurrencies in total value.

Sergey Nazarov, co-founder of Chainlink, believes that the current crypto market downturn is hinting at a structural maturity—a rarely seen phenomenon in past cycles.

Despite crypto markets entering a deep drawdown, Nazarov thinks this phase can be defined by resilience and continued infrastructure growth.

“Market cycles are inevitable,” Nazarov wrote in a recent post on X. “What matters is what they expose about how far the industry has come.”

A Crypto Bear Market Pullback—But No Signs of Structural Damage

Since peaking at a total market capitalization of $4.4 trillion in October, the crypto market has lost almost 44% of its value, wiping out close to $2 trillion in just four months. Historically, such declines have triggered major institutional failures.

But this time the picture is totally different.

As per Nazarov, unlike the 2022 bear cycle, where we saw many centralized exchanges and crypto lending firms collapse, the current downturn has not triggered any such major risk-management blowups yet.

“There have been no large institutional failures or cascading systemic risks,” he noted, suggesting that market infrastructure is now better equipped to absorb volatility.

Real-World Assets Continue to Excel

The second factor that sets this bear market apart is the rapid expansion of tokenized real-world assets (RWAs), a sector that is largely influenced by short-term price swings.

According to the RWA.xyz data, the on-chain value of tokenized RWAs has climbed by approximately 300% over the past year, despite the continued crypto market weakness.

Nazarov believed that this demonstrates that RWA tokenization delivers standalone utility irrespective of speculative trading cycles.

“Real-world assets on-chain are not tightly coupled to Bitcoin or crypto prices,” he explained. “They provide unique value that can grow on its own.”

Utility Is Advancing Faster Than Token Prices

Chainlink has been playing a major role in powering RWAs and on-chain data infrastructure, but its LINK token has not yet reflected any kind of this progress. LINK is down roughly 67% from its October highs and more than 80% below its 2021 all-time high, trading below $9 at the time of writing.

Still, Nazarov thinks that price underperformance is secondary to long-term structural shifts. He also argues that the steady adoption of on-chain perpetual contracts, tokenized commodities, and real-time settlement systems are pure signals that institutional interest is being driven by functionality and not hype.

Features such as 24/7 markets, transparent collateral, and real-time data are increasingly attracting traditional finance investors, he said.

A Structural Shift in What Crypto Represents

If these trends continue, the crypto industry may undergo a fundamental transformation, says Nazarov.

“For years, I’ve said that on-chain RWAs could eventually surpass cryptocurrencies in total value,” he stated. “If that happens, what this industry represents will fundamentally change.”

Analysts Echo the Sentiment

The idea that this downturn lacks existential risk is gaining traction from other market analysts.

Bernstein analyst Gautam Chhugani recently described the current phase as “the weakest Bitcoin bear case in history,” characterizing the sell-off as a confidence shock rather than a structural failure.

Likewise, Jeff Mei, COO at BTSE exchange, believes that much of the recent market pressure is coming from macroeconomic and non-crypto factors like concerns around the AI equity boom and expectations of tighter liquidity under a potential shift in U.S. Federal Reserve leadership.

“Nothing broke inside crypto itself,” Mei said. “This drawdown was driven externally.”

Not All Bear Markets Are the Same

While price declines remain painful, industry leaders are viewing this cycle as a stress test that the crypto ecosystem is passing smoothly.

As Nazarov affirms, the absence of systemic collapses and the continued rise of real-world utility clearly signal that this bear market is more about transition and not fragility.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.