This week’s US economic events could shape Bitcoin’s path to $110,000. From Thursday’s CPI inflation data to corporate earnings from Disney and Cisco, plus major Treasury bond auctions, these macroeconomic triggers will determine whether crypto sustains its risk-on momentum or faces near-term volatility.

Key Insights

- The incoming US CPI data could sway rate expectations and shape crypto sentiment.

- Corporate earnings may show consumer strength and tech spending trends.

- Bond auctions and shutdown risks may influence liquidity and risk appetite.

Understanding US economic events and crypto market connections is essential as major catalysts arrive each week that traders watch closely. These events affect expectations around inflation, interest rates and overall liquidity. In turn, these guide how investors position themselves.

Here are some of the most important economic updates this week that could affect trading behavior across Bitcoin and other assets.

Top 4 US Economic Events and its Impact on Crypto Market

1. CPI Report Leads

Thursday’s October CPI report is expected to stand out as the most important release this week. Markets want clear signs that inflation is cooling, and many analysts expect a December rate cut.

So far, traders are watching things like energy prices, housing costs and services inflation.

These areas often push price changes higher or lower, and any surprise in these categories can move markets quickly. A softer CPI reading may lift risk appetite and support crypto demand. A higher reading may create caution and trigger short-term selling.

The release comes just hours before the 30-year bond auction. This timing may increase volatility since inflation affects long-term yields.

2. Disney Earnings and What They Signal for Investors?

Disney’s earnings are expected on Thursday and may give traders a sense of consumer spending strength. Investors have been watching Disney+, theme parks, theatrical releases and advertising trends.

💵Most Anticipated Earnings Reports This Week💵

A slightly quieter week for earnings, but still notable names to watch! On deck this week is Rigetti Computing $RGTI, Oklo $OKLO, Disney $DIS and, Applied Materials $AMAT.

Which of these names do you expect to outperform? pic.twitter.com/Jwtb3HVGrT

— TipRanks (@TipRanks) November 9, 2025

These areas could determine how households spend on entertainment and travel during uncertain economic conditions.

Disney+ subscriber growth and pricing updates will also be worth watching, since streaming is now facing rising competition. Theme park attendance may show whether families continue to travel despite higher prices, and the company’s plans for the holiday period may also affect market reaction.

3. Cisco Results and Global Tech Trends

Cisco is expected to release its earnings on Wednesday. This update will help reveal how companies spend on technology.

Traders will focus on networking equipment demand, cloud migration and cybersecurity needs. Cisco’s comments on AI-related infrastructure may also affect market views on long-term tech investment.

Sea Limited, Nu Holdings and JD.com are expected to report this week too. In all, these companies will offer insight into Southeast Asian e-commerce, Latin American fintech growth, and Chinese online retail.

Their results may show whether consumer and tech adoption trends have been stable so far.

If these companies report healthy growth, investors may feel more confident about technology and digital finance trends. Weak results on the other hand, may raise issues about demand or regional economic stress.

4. Bond Auctions and Shutdown Questions

Two major Treasury auctions are expected to take place this week. The 10-Year Note auction arrives on Wednesday, and the 30-Year Bond auction follows on Thursday.

Investors want to see strong demand, since it shows confidence in US debt and long-term economic conditions.

🇺🇸US SETS QUARTERLY REFUNDING AT $125B, IN LINE WITH ESTIMATES

US TREASURY SETS 30-YEAR BOND AUCTION AT $25B ON NOV. 13

US TREASURY SETS 10-YEAR NOTE AUCTION AT $42B ON NOV. 12

US TREASURY SETS 3-YEAR NOTE AUCTION AT $58B ON NOV. 10https://t.co/0xxOPTelAi

— CN Wire (@Sino_Market) November 5, 2025

While weak demand may push yields higher and pressure risk assets. Strong demand may steady yields and support the market’s growth.

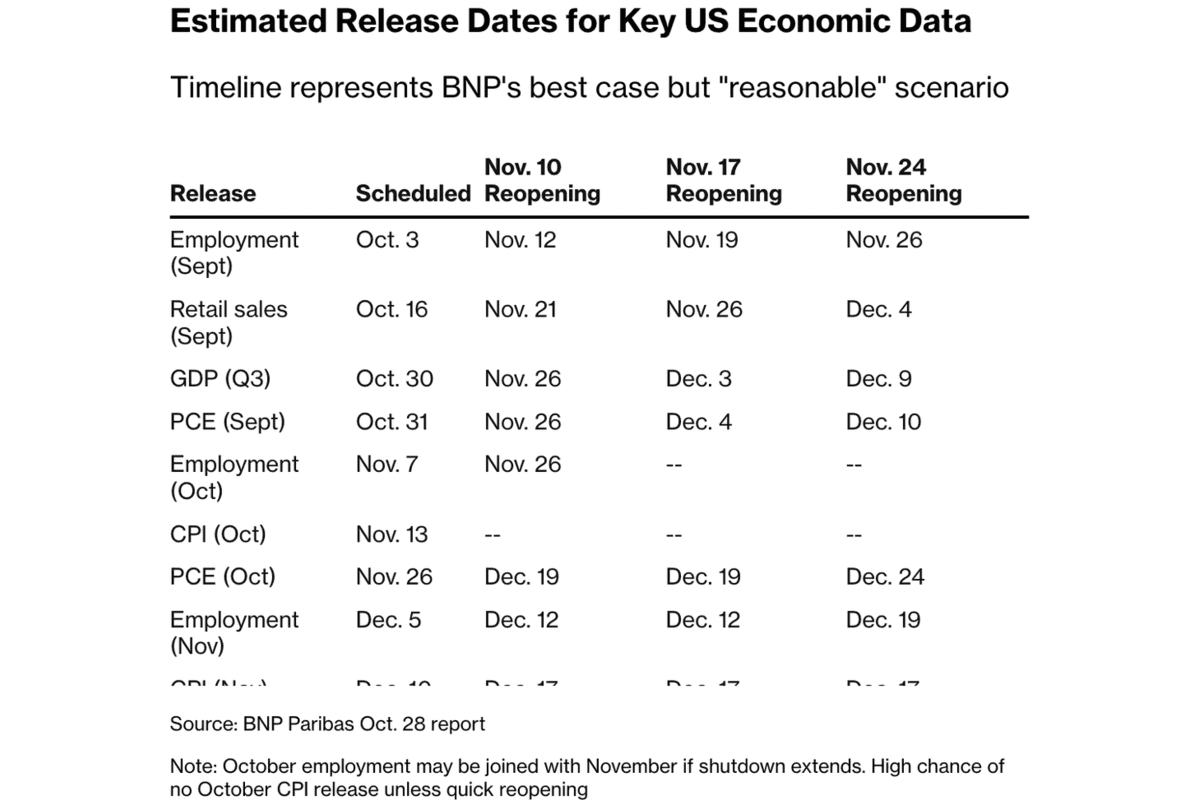

The ongoing government shutdown story is another major source of uncertainty. A shutdown can delay economic data, influence spending expectations and create political noise.

Traders are watching these factors because they affect how markets judge fiscal stability.

If the shutdown ends soon, markets may lean toward stability. If not, uncertainty may stay high.

How Do These US Economic Events Play Out?

Bitcoin now trades above 106,000 dollars at the moment, and traders want to see whether the asset can move toward $110,000. This week’s US events could either support that move or slow it down.

CPI is currently the most important event. A soft reading could support easier financial conditions, which often help crypto. A higher print on the other hand, may delay such expectations.

Fed speeches throughout the week may add more clues about what happens with future policy.

Corporate earnings, global tech updates and bond auctions will add more layers to market behaviour and traders often react accordingly to these signals.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.