Dogecoin price support level analysis reveals the memecoin is struggling near $0.1487 after breaking down from a descending triangle pattern, despite network activity reaching 71,589 active addresses, the highest since September. While ETF filings from 21Shares and Grayscale generated optimism with $2.85 million in total flows, heavy selling pressure and the $0.2028-$0.2044 resistance cluster containing 11.72 billion tokens create significant headwinds for recovery.

Key Insights

- According to the charts, Dogecoin is showing signs of heavy selling near recent highs.

- So far, network activity has risen, yet price action continues to be weak.

- ETF progress has grown lately, even though demand from large traders continues to be soft.

Dogecoin has been a source of trader attraction over the last few weeks, as investors watch how its price reacts to important support levels. The token saw more users on the network and more talk around new ETFs. However, its price still slipped as large sellers took control.

Dogecoin Struggles After Fresh Breakdown

Dogecoin lost ground after sellers pushed the price under an important floor near $0.1487. This move followed three failed attempts to move past $0.1522. Each try saw a shrinking buy volume, and that showed growing doubt from buyers.

Once the price fell under $0.1487, trading volume jumped, and hourly candles crossed 400 million tokens. Large traders also offloaded positions, which means that retail traders did not drive this move. While this happened, a clean descending triangle formed on the charts. Lower highs pressed the price into a tight zone, and this pattern pointed to further weakness.

So far, trader focus now seems to be on whether Dogecoin can recover the $0.1487 to $0.1510 area.

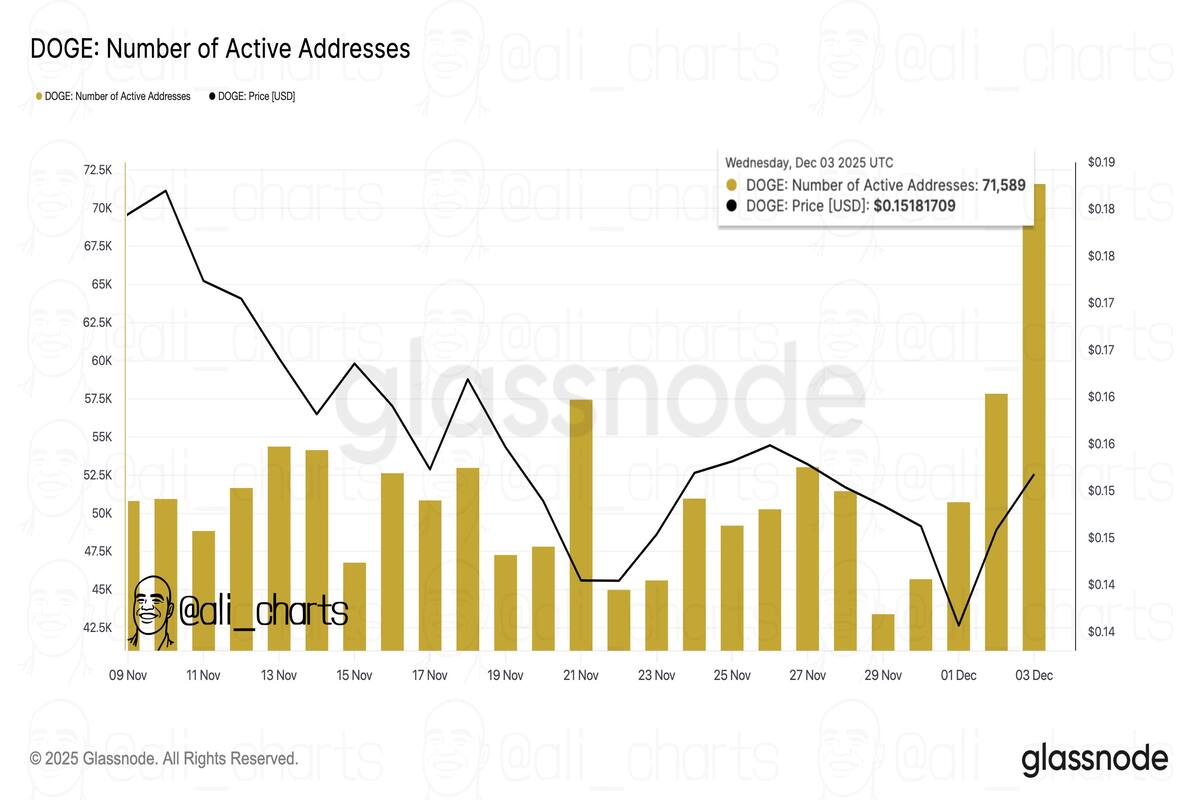

Rising Network Usage Fails To Lift Dogecoin

Dogecoin price saw 71,589 active addresses, the highest level since September. Users showed more on-chain activity while the price slipped. This created a gap between network strength and market action. ETF news also grew louder. Both 21Shares and Grayscale moved filings forward for spot Dogecoin ETFs and many traders hoped this would draw new buyers.

Large wallet activity also stayed quiet while ETF flows slowed. These factors reduced support on the chart. Wider crypto sentiment also leaned risk-off and this left Dogecoin unable to use its rising network interest for price gains.

Dogecoin Price Tests More Support

Dogecoin price now trades around $0.1445 after a drop from $0.1522. That fall has measured about 5%. The session also had 719.7 million tokens traded, and that was far above the daily average. In all, attempts to move back toward $0.1483 have been fading fast as sellers step in on each bounce.

Short candles near the low band are now showing weak demand at current levels, and considering how the price has slid underneath $0.1470, traders may have to watch the $0.1425 area next.

This being said, buyers must retake $0.1487 to stop the slide. A break past $0.1510 would show early signs of strength. But until then, sellers hold the edge.

Dogecoin Meets Heavy Supply Near $0.2

As of writing, the Dogecoin price remains capped by a long descending trendline on the weekly chart. A large cluster of 11.72 billion tokens sits between $0.2028 and $0.2044, which means that many holders in that zone are waiting for a breakeven exit.

Once the price pushes toward $0.2, traders expect slower progress, and supply in that band makes movement harder. Analysts still view Dogecoin as one of the most-watched meme tokens.

$0.20 is the key resistance for Dogecoin. That’s where 11.72 billion $DOGE were accumulated. pic.twitter.com/HZEsZSkf0Y

— Ali (@ali_charts) December 5, 2025

Long-term views vary, and many traders are watching higher targets, though current price action does not confirm strength yet. Analyst Ali Martinez reaffirmed that $0.2 is the major resistance zone for Dogecoin price, and a break above would lead to a move further upwards.

Strong User Activity And Early ETF Flows

Notably, active addresses have reached the highest point since September, as per Glassnode. That showed strong user involvement, and on-chain data supports this.

ETF inflows also grew.

Grayscale’s GDOG and Bitwise’s BWOW saw a combined $177,250 in net inflows on December 3, with this figure turning into a $972,000 outflow the following day on Friday, December 4.

So far, total inflows now sit at around $1.88 million since launch as of 5 December.

Even so, traders continue to watch new filings from firms like 21Shares, and many expect more attention on Dogecoin as new products reach exchanges.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.