The government shutdown’s impact on crypto market analysis reveals how the 40-day crisis ending could unleash $180-300 billion in frozen liquidity into financial markets. As federal back pay, stalled contracts, and suspended credit programs resume, crypto assets are positioned to capture significant capital flows as investors shift from extreme fear toward risk-on investments.

Key Points

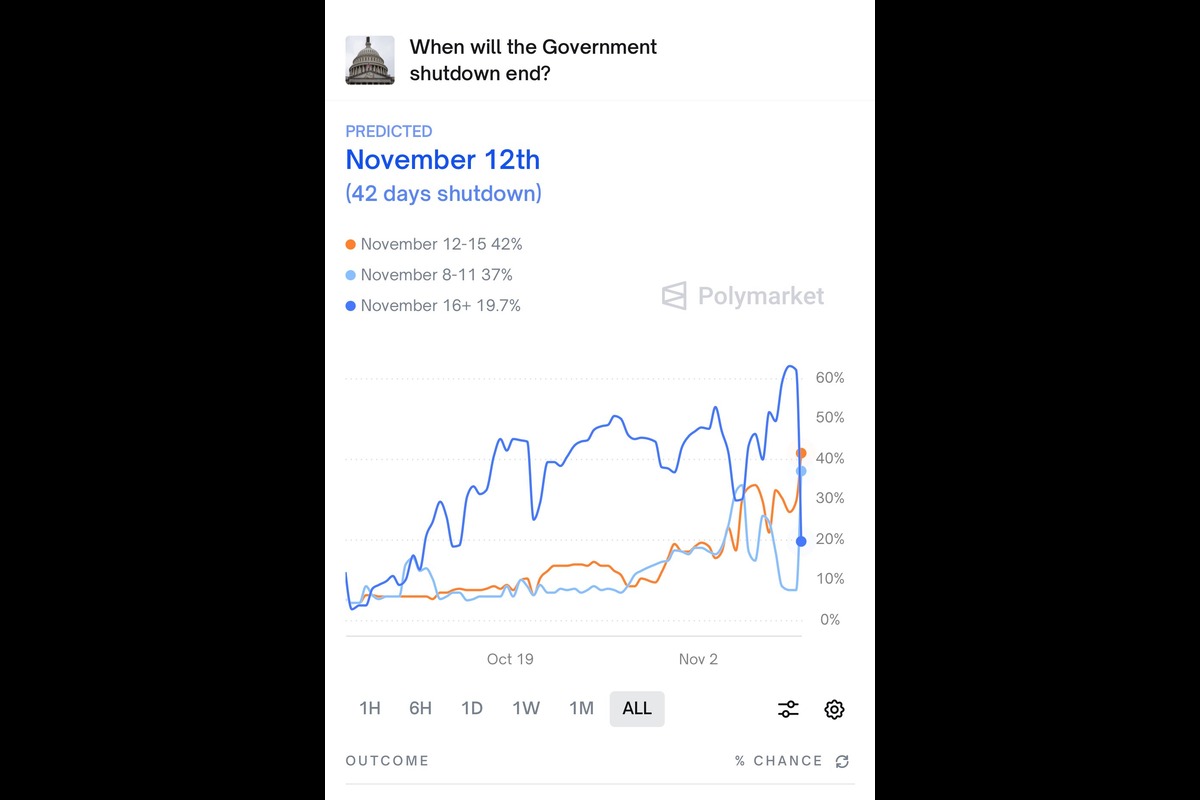

- The longest US government shutdown in history appears to be ending after 40 days.

- Analysts are predicting that $180-300 billion in liquidity will flow back into financial markets.

- The Crypto Fear & Greed Index jumped from 22 to 29 in a trend from extreme fear to cautious optimism.

As the government shutdown ends, understanding its impact on the crypto market becomes essential. The conclusion of America’s longest 40-day political standoff brings more than relief for federal workers — it signals the release of massive pent-up liquidity. Financial analysts anticipate that billions in delayed payments, contracts, and credit programs will soon circulate through the economy, potentially igniting renewed momentum across digital assets and risk-on markets.

The numbers are staggering. Between $180 billion and $300 billion in frozen spending will soon start moving through the economy, and crypto markets are already responding. This government shutdown’s crypto market impact could be unprecedented.

Government Shutdown Ends: What It Means for the Crypto Market

The shutdown started on October 1, when Congress failed to pass spending bills for the new fiscal year. Hundreds of thousands of federal workers went without pay. Government contracts sat frozen, and economic data stopped flowing.

Late Sunday, a group of moderate senators broke ranks and provided enough votes to advance a compromise spending bill.

The legislation combines short-term funding through January 2026 with longer-term appropriations. Additionally, House passage and Presidential approval are also expected this week.

The economic damage rose almost every day during those 40 days. Federal obligations piled up. Private sector companies couldn’t process government contracts, and small businesses lost access to loan guarantees.

Where Does the Money Come From?

The predicted liquidity surge isn’t new money created out of thin air. It stands as the delayed payments and spending that accumulated during the shutdown. This backlog falls into three main categories. Analyzing the government shutdown’s crypto market impact requires understanding.

Once the government shutdown ends,

Market is going to explode will bullish news$2000 stimulus checks

QT ending

Dec rate cut

QE starting

155 Altcoin ETFs

Crypto market structure billYou are not bullish enough.

— Ash Crypto (@AshCrypto) November 9, 2025

First, federal employee back pay tops the list. Hundreds of thousands of workers will receive paychecks covering the entire 40-day period. This is expected to create an immediate spike in consumer spending power. These funds will circulate quickly through the economy.

Second, stalled government contracts will restart. Defense contractors, technology firms and research institutions have billions in pending agreements and agencies will rush to clear the backlog once fully operational. This injects capital directly into multiple sectors.

Third, suspended credit programs will resume. Small Business Administration loans were on hold, and agricultural subsidies stopped flowing. These programs provide billions in credit market support, and their return will stabilize business confidence.

What Happens Next?

Traditional stock markets will absorb some of the returning capital. But crypto markets are set to grow, especially after the recent crash. This is likely to happen because of how investors behave when systemic risk disappears.

Crypto serves as the biggest risk-on asset class. When political crises end, capital seeks the highest potential returns, and the sheer volume of delayed spending will likely overwhelm the slower-moving traditional markets.

The Senate vote is regarded as major progress, but the shutdown isn’t officially over yet. The House must pass the bill before sending it to the President. Any unexpected delay could temporarily cool the market hype.

Political observers agree that things seem to be resolving fast. The prolonged shutdown created strong incentives for both parties to compromise, and lawmakers from both parties want this resolved.

For crypto markets, the timing couldn’t be better. The $180-300 billion liquidity event comes as technical indicators are starting to turn bullish. Trading volumes are increasing, and institutional interest is rising.

Bitcoin has already broken through several resistance levels, and Ethereum is showing similar strength. The altcoins are following the majors higher, and the pattern shows that demand is widespread, rather than being isolated speculation.

Final Verdict

The end of America’s longest government shutdown has been a major deal for the financial markets. The release of $180-300 billion in frozen capital could create encouraging conditions for cryptos to grow across the board.

Federal workers getting back pay will also boost consumer spending. Government contracts resuming will inject business capital, and credit programs restarting will support small enterprises.

All these flows eventually find their way to investment markets.

Crypto markets have moved past extreme fear. The data blackout is ending, and political risk is receding.

These factors are combined to create a favorable environment for prices to increase. In all, the next phase of the crypto market cycle may just be starting.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.