Bitcoin rebounds 3% from extreme oversold conditions after weekend liquidations cleared over $200 million in positions, with the RSI reaching levels seen only six times in Bitcoin’s history. Altcoins, including XRP (+7%) and Zcash (+14%), rallied during the recovery as short sellers faced $66 million in liquidations amid the price stabilization near $86,000.

Key Insights

- Bitcoin has bounced after deep oversold readings as most weekend sellers fade.

- XRP and ZEC are leading strong altcoin moves during the general recovery.

- Liquidation data shows heavy losses for shorts as traders reassess their risk.

The Bitcoin market rebounded from extreme oversold conditions after a harsh stretch of selling pressure that pushed the cryptocurrency into territory seen only six times in its history, triggering a 3% recovery rally. The rebound started as weekend liquidations cleared more than $200 million in positions, easing pressure on buyers and opening space for a short-term recovery from the $84,000 lows.

These liquidations eased pressure on buyers and opened space for a short-term recovery.

Bitcoin Rebounds From Extreme Oversold Levels

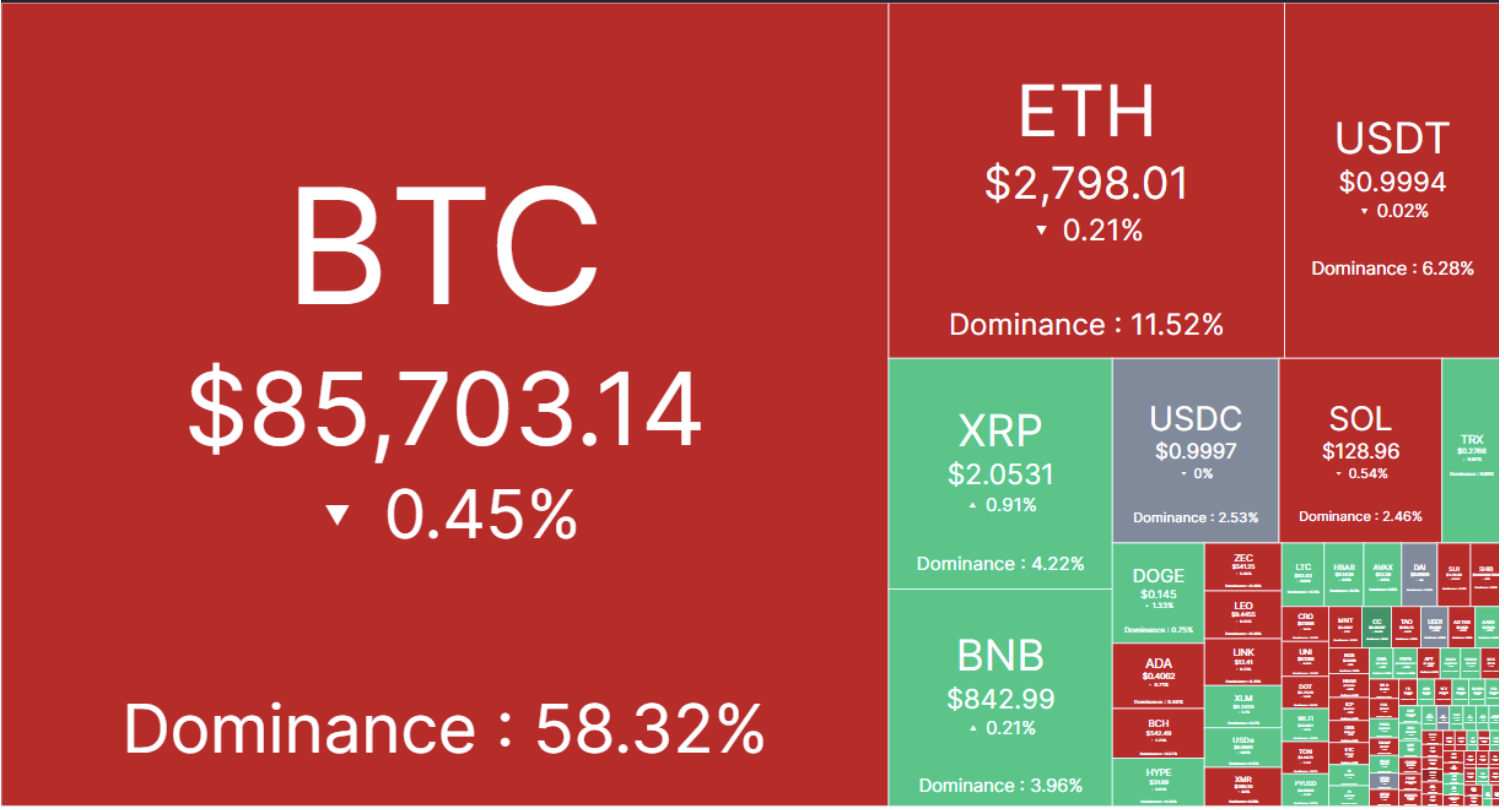

Bitcoin traded near $86,466 on Sunday afternoon and gained almost 3% from earlier lows.

Analyst Ali Martinez noted that the relative strength index dropped into a zone that rarely appears. Two dips into this zone in recent years each came before a rebound.

Bitcoin $BTC has hit extreme oversold territory on the RSI.

In the past two cases, the market bounced soon after. pic.twitter.com/nDICqyjJkQ

— Ali (@ali_charts) November 23, 2025

Traders reacted fast once the latest reading flashed, which helped fuel the lift from $84,000.

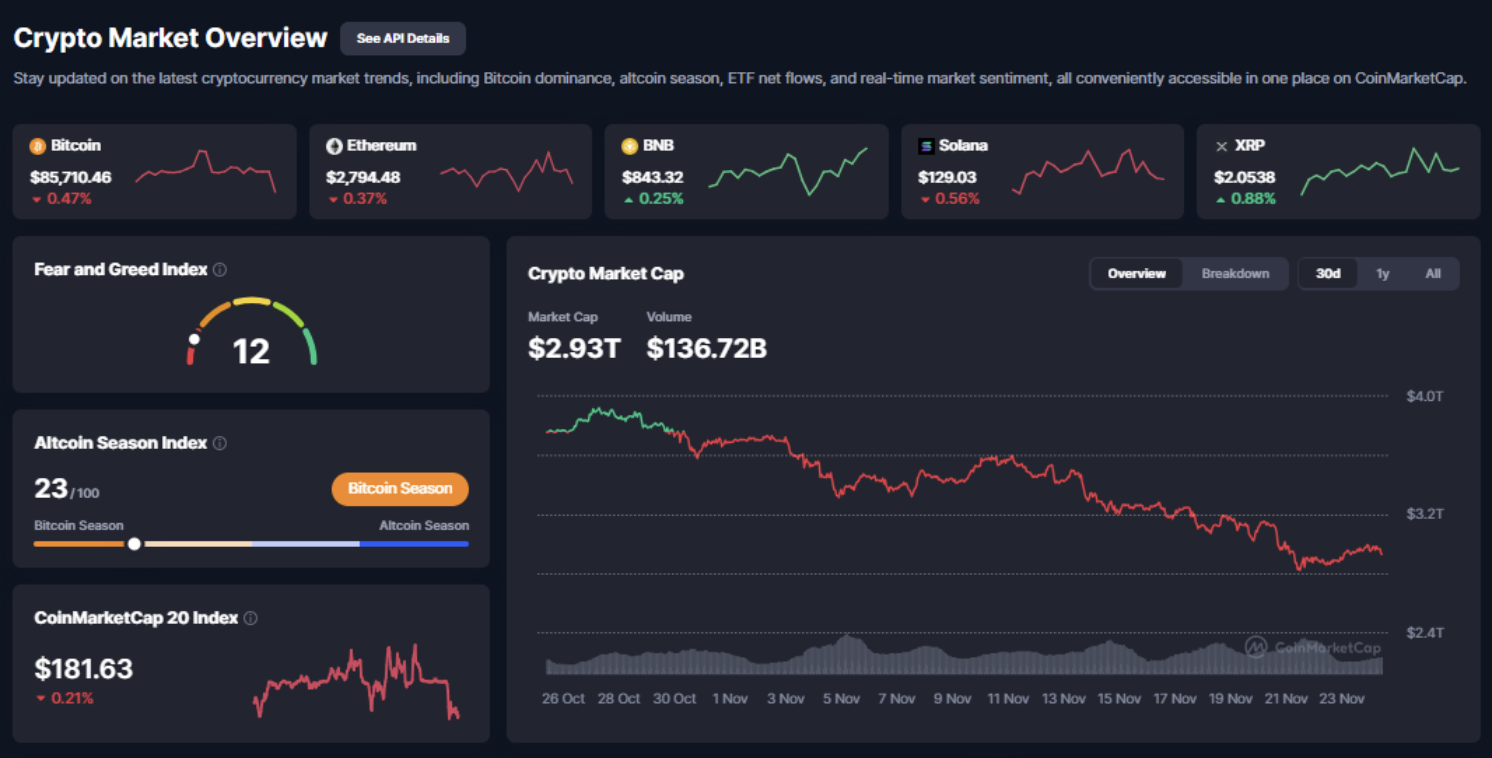

The overall market rose during the move, and CoinMarketCap data showed the total crypto market cap gaining more than 3% in 24 hours. Many top assets joined the rebound as traders stepped back from aggressive selling.

Bitcoin Rebound Strengthens After Weekend Breakdown

Bitcoin spent much of the past week sliding through several support zones. Thin weekend liquidity added to the drop and magnified each push down.

Once sellers lost fuel, prices began to stabilize near the mid-$80,000 range.

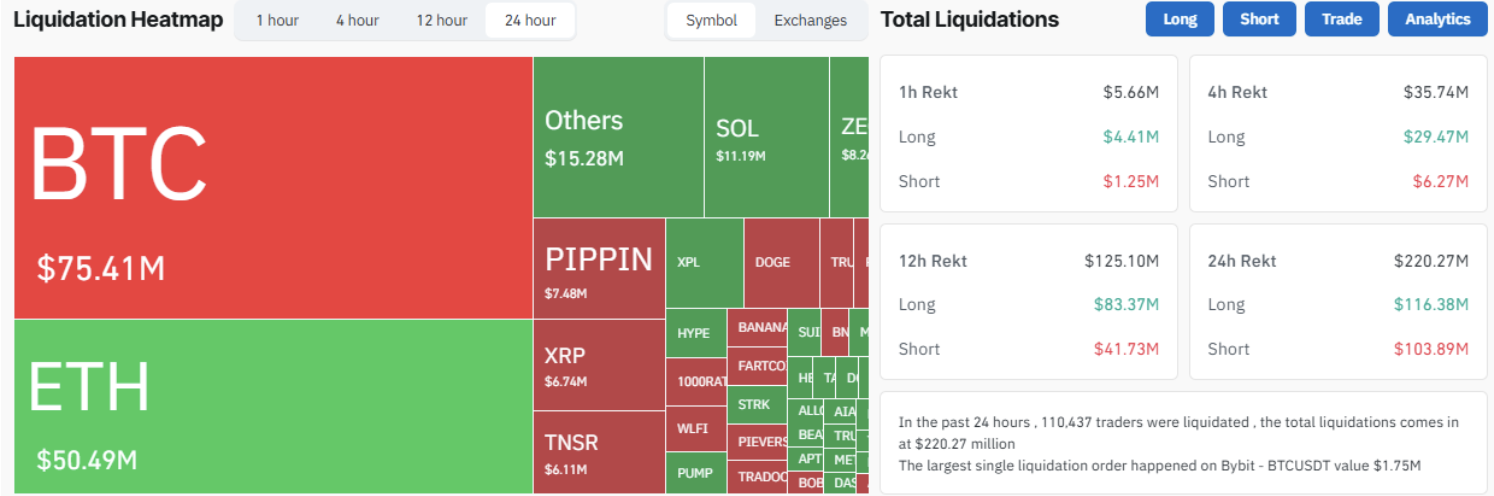

Fresh derivatives data revealed more pressure on short positions. More than $66 million in Bitcoin liquidations hit the market, and shorts took most of the losses. These figures showed how some traders bet on a deeper decline during the final stretch of the sell-off, as per Coinglass.

Buyers returned once Bitcoin found a floor near $80,000. Price then moved back toward $87,000 as the next session began. The RSI started to climb from extreme lows, and this pattern happened only six times in Bitcoin’s history, according to one analyst who reviewed long-term data.

Some indicators remain bearish despite the lift.

The MACD on the monthly chart has crossed into negative territory. Notably, past cycles that showed the same setup eventually fell much deeper, often by more than half. This leaves traders uncertain about the next large move.

Altcoins Rally As Bitcoin Rebounds, Triggering Recovery

Altcoins jumped once Bitcoin found support and Ether rose more than 4%. Solana, BNB, DOGE, ADA and TRX also gained.

Many others still sit far below their monthly highs, but the strong Sunday session showed a change in tone. Sellers slowed once Bitcoin showed signs of relief.

Zcash delivered one of the biggest moves. It climbed more than 14% to reach $574. So far, the token has gained over 900% this year after steady demand from traders who watch privacy-focused assets.

XRP added more than 7% and traded near $2. The asset saw strong volume as buyers returned after several weeks of pressure. These moves helped lift sentiment for the day, even though the market still shows signs of stress.

Thin liquidity during weekends has often produced exaggerated swings.

The same pattern appeared this time as large liquidations cleared more than 117,000 positions in 24 hours.

CoinGlass reported a single liquidation worth more than $3 million on Hyperliquid and these events helped wipe out leverage and set the stage for a faster rebound once demand returned.

Market Sentiment Remains Fragile Despite Rising Prices

Crypto traders also track several sentiment gauges to measure confidence. The Crypto Fear and Greed Index sat at 10 during the Sunday session, and this reading shows extreme caution.

All of this means that the market wants proof that the rebound has strength beyond short-term bounces.

Meanwhile, some analysts are seeing signs that the worst may be near an end. They are pointing to rare oversold readings and steady buying interest during the recovery. Others argue that the monthly MACD could be warning of more pain ahead.

On the other hand, daily volume offers a mixed signal. Bitcoin 24-hour volume rose above $64 billion, and market cap figures also climbed by 1.6% to $2.97 trillion.

Overall, these numbers show steady participation despite the recent market fears.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.