Key Insights

- JPMorgan reports that Bitcoin now holds a larger allocation in investor portfolios compared to gold, even after adjusting for volatility.

- The approval of spot Bitcoin ETFs in January is seen as a major driver of BTC’s price surge, attracting $10 billion in investment.

- JPMorgan predicts the BTC ETF market could reach $62 billion, with some reports suggesting it might even hit $220 billion in the next few years.

- Bitcoin’s price and net inflows into ETFs have both grown significantly in February and March.

- Overall, CryptoQuant’s CEO expects a demand surge and a potential supply crisis for BTC due to the upcoming halving event.

It turns out that Bitcoin is winning in the BTC versus gold debate.

In a groundbreaking shift in investor preferences, BTC now seems to have beaten gold in terms of portfolio allocation.

This remarkable development is far from only being related to portfolio allocation and is also true in terms of volatility-adjusted allocation.

According to insights from JPMorgan, preference for Bitcoin in investor portfolios has now flipped gold by about 3.7 times, when adjusted for this volatility factor.

The Rise of Bitcoin ETFs

Insights from JP Morgan show that the approval of the 11 spot BTC ETFs has been a game-changer for the crypto market.

Since their approval on 11 January this year, about $10 billion has been pulled into the Bitcoin ecosystem, explaining why BTC has rallied by so much in so little time—and before the halving, no less.

According to reported insights from JPMorgan’s managing director Nikolaos Panigirtzoglou, even, the market size for Bitcoin ETFs could potentially rally straight up to around $62 billion, considering its relation to the gold market.

JP Morgan’s insights from another report also show that the market for spot BTC ETFs might shoot further up, and even hit around $220 billion within the next two to three years.

The Bears Can’t Win Until The ETFs Let Up, CryptoQuant CEO Says

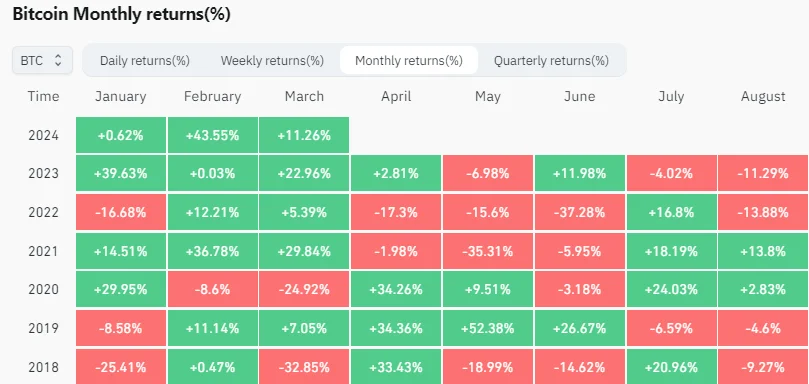

Throughout February, BTC’s price and market cap increased by around 45%, according to data from Coinglass.

This growth was also reflected in the net inflows for the BTC ETFs, which climbed to $6.1 billion, from around $1.5 billion in January.

Moreover, the daily inflows into these ETFs hit a peak of around $1 billion on 12 March, showing that the growth of the Bitcoin spot ETF market is not stopping.

Considering how the halving is only about a month away, Ki Young Ju, CEO of CryptoQuant recently stated in a tweet, that we might be seeing a surge in demand and a subsequent supply crisis within the next six months.

In all, the spot Bitcoin ETFs have done much for the price of BTC, pushing it up into a first-ever break above an all-time high, before a halving.

Moreover, this growth has also paved the way for increased institutional adoption, leading to investors choosing cryptocurrency over gold at an increasing rate.

The shifting tides in investor portfolio allocation show that Bitcoin is truly entering a new chapter, and the ETFs might only be the first of many more BTC investment vehicles to come.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.