Key Insights

- Bitcoin dropped from $64,000 after large outflows from Grayscale Bitcoin Trust, suggesting that investors are losing confidence in GBTC.

- Bitcoin miners did not sell their holdings despite the price increase.

- Overall, analysts warn of potential Bitcoin corrections due to supply and demand shifts and profit-taking by whales.

Bitcoin started to rally sometime last week, and surpassed all expectations when it broke above $55,000, then $60,000—before stopping at $64,000.

However, on 29 February, the cryptocurrency started to decline from here, falling more than 3% from $64,000 to $62,000 where it now sits.

Interestingly enough, the cryptocurrency’s drop coincides with massive selloffs across the market.

Who is responsible? The miners? The whales?

Let’s find out:

Bitcoin’s Drop From $64,000

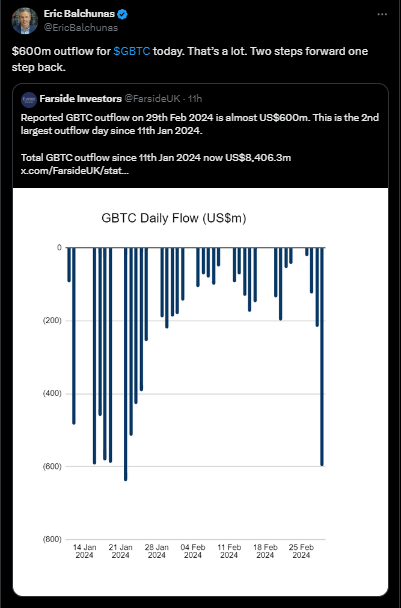

According to data from Farside Investor, this decline In Bitcoin from $64,000 came right at the same time as a massive tranche of outflows from the Grayscale Bitcoin Trust (GBTC).

The snapshot above shows outflows of around $598.9 million from the GBTC on 29 February, beating the second largest February outflows from the day before, more than twice over.

The only day that surpassed this figure was from 22 January, when investors withdrew $640.5 million.

Interestingly, data from TradingView also shows that Bitcoin also declined by around 6% on the same day, falling from $41,689 to around $39,431.

The outflow suggests that investors are losing confidence in GBTC, which has also been trading at a discount to its net asset value for several weeks, meaning that the ETF shares themselves are worth less than Bitcoin they hold.

Even Senior ETF analyst at Bloomberg Eric Balchunas commented on this, stating that the Grayscale Bitcoin ETF was going “Two steps forward one step backâ€.

The Miners May Be Innocent

Meanwhile, Bitcoin miners held onto their crypto while investors in GBTC were selling off their holdings.

Data from CryptoQuant shows that despite $40 billion flowing from mining pools into crypto exchanges in February, miners’ holdings remained steady.

This data shows that miners’ wallet reserves were at 1.828 million Bitcoin on 28 February, a marginal rise from 1.827 million on February 1st.

This suggests that, even though the price of Bitcoin soared above $52,000 on February 26, miners refused to sell even the Bitcoin they were given as block rewards.

However, CryptoQuant data also revealed that miners sold at least 40,000 BTC on 26 February, taking advantage of the high prices.

Overall, data shows that Bitcoin’s decline from $64,000 had nothing to do with the miners because most of their sales happened in January.

What’s Next for Bitcoin?

The difference between the behaviour of the GBTC investors and the miners shows how unstable and unpredictable the Bitcoin market is at the moment.

While some investors are taking their winnings and cashing out, others are sticking on for the long haul.

Recall that analysts at JPMorgan also warned recently, that when supply and demand shifts before and after the halving, Bitcoin may experience more market corrections.

They argue that while institutional investors’ demand could still be strong, the halving is set to reduce the number of new coins coming onto the market. This may lead to a liquidity crisis, which would raise the possibility of a sudden price drop but potentially drive it higher.

Moreover, analyst, Ali notes that there is a massive ongoing wave of profit-taking, among the Bitcoin whales.

With all of this being said, be prepared for possible Bitcoin corrections from here.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.