Key Insights:

- Major Economies facing recession.

- Crypto-friendly laws could help boost economic activity.

- Governments could have reaped dual benefits with crypto regulations.

- Nicaragua as a successful model of crypto regulations.

Crypto markets have the potential to provide better employment, high taxes to the government, and jobs that could have aided in economic growth. However, the lack of clear crypto regulations even in major economies and the indecisiveness of governments continue to hurt global economies.

In this article, we try to bring an overview of how the lack of better crypto regulations has indeed hurt economies and how governments could use them to boost their growth.

Major Economies in Recession

In the last quarter of 2024, several countries have already slipped into recession. A few of them are the UK, Japan, Ireland, and Finland. What is more scary is that 18 more countries are on the brink of recession.

A common aspect in all these countries is that almost all of them fail to provide supportive crypto regulations. A few of them are noted below.

USA

As per reports from the OECD, the GDP growth in the USA is expected to slow down from 2.4% in 2023 to 1.5% in 2024. Estimates for 2025 are marginally better at 1.7%.

The US authorities have been fighting a bitter war against crypto companies. Due to the lack of clear crypto regulations, authorities have been overstepping their boundaries which drives away technical innovation and hence limits growth.

UK

The UK has already slipped into recession. GDP contracted by 0.3% in the last quarter (Oct-Dec) of 2023. This was after the economy already contracted by 0.1% in the quarter of July-Sept 2023.

Despite its aim of becoming a crypto hub, the UK does little to provide better crypto regulations.

Japan

Japan too witnessed recession as its economy contracted by 0.8% in the quarter of July-Sept 2023 and again by 0.1% in the quarter of Oct-Dec 2023.

Despite being one of the crypto-friendly countries, Japan lacks well-defined crypto regulations for foreign entities. Even for local companies, a stringent Financial Bureau standard is set which demands complex compliances even for the smallest companies.

European Union

The European Union is barely dragging its feet to avoid a recession. The GDP growth in the last quarter (Oct-Dec, 2023) was at zero growth, and in the preceding quarter, the economy contracted by 0.1%.

The EU brought MiCA, a law for crypto regulations. However, the law only makes clear regulations for stablecoins. It failed to form clear laws on other assets such as DeFi and NFTs.

What Can Governments Do?

The main reason for any recession, be it in the USA or Europe is typically due to the lack of funds to sustain economic growth. Traditionally governments printed money to stimulate growth or were dependent on banks to issue more loans.

However, both these methods run into several issues. Printing money causes super-high inflation. Sanctioning more loans in the past had failed in several banks in the past as well as in 2023.

A safer alternative would have been crypto markets which provide alternate ways of funding through decentralized finance. Since the risk is decentralized, it would have created far more resilient economies.

Also, the tax revenue generated through these markets would have aided in increasing government spending.

A mature crypto market would have been only possible if there were regulations and laws to support it. Mature markets would have presented new ways of financing the economic growth of several of the above countries.

Several blockchain-based businesses had mass potential but met failure due to funding gaps. A prime example was Metaverse, a concept that would have revolutionized the way people meet. Virtual businesses would have been so easier to set up which in turn would have generated employment.

Besides jobs, crypto markets would have been a source of emergency funds for governments too. Well-developed ICO markets would have complemented the traditional markets as a source of funds.

How Crypto Markets Can Help Restore Economic Growth

Crypto regulations would provide a clear direction to companies working in this sector. Being one of the hottest asset classes in the world, they could have been a good source of capital for old and new businesses.

Additionally, governments could have benefitted from an increased and diversified tax revenue.

The quantum of benefits from the crypto industry can be understood from the fact that after only six weeks of regulatory approval, Bitcoin ETFs have already amassed $8 billion in net inflows. The total market cap for just ETF stands at $51 billion globally.

Additionally, if we consider the combined market cap of all cryptocurrencies, we find that it exceeds $2.25 trillion. This amount is much greater than the GDP of several countries.

With favorable crypto regulations, the total market cap could have been much higher.

If we see India as a case study, we find that without the 1% Tax Deducted at Source, the Indian government could have got an annual revenue of approx. $1.2 billion. This revenue could be even higher if the 30% flat tax had been in line with the capital gains tax (10%-20%).

How Nicaragua Leveraged Crypto Regulations for Better Growth

When Europe, the USA, and other developed countries have been facing recession, Nicaragua has witnessed a GDP growth rate of 8.1% in the quarter of July-Sept 2023. Nicaraguan GDP growth has been higher than its Central American neighbors in the past.

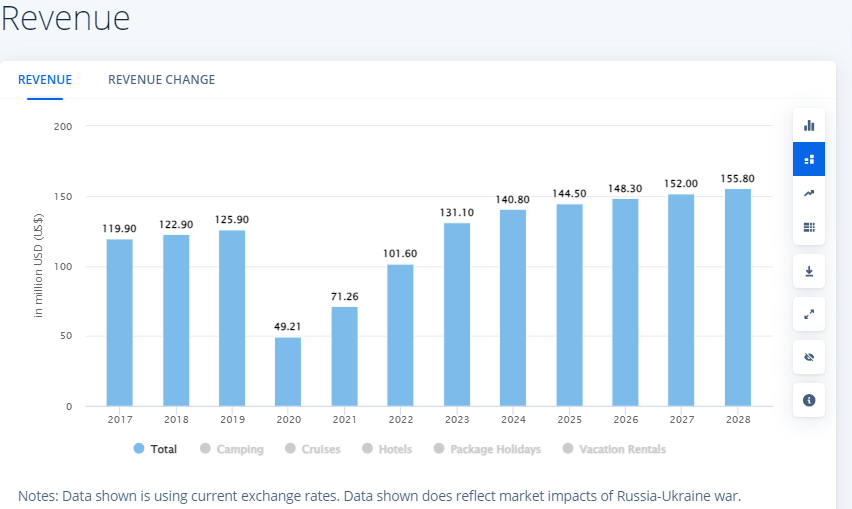

The country recently re-elected its crypto-friendly President Nayib Bukele once again. His crypto-friendly policies are one of the prime reasons why the country’s tourism sector grew in the past.

Despite hitting rock bottom in 2020 due to COVID, tourism in the country quickly bounced back and is expected to increase further in the near future.

Further, local educational institutions also play a crucial role in fostering a crypto-friendly education.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.