Key Insights:

- Bitcoin is in the “early stage of a parabola”, following a 1.5-year correction, according to analyst TechDev

- Trader Tardigrade, another analyst says that BTC is in an interesting formation, which is a blatant indication of a bullish trend reversal.

- Michael Van de Poppe believes that $28,800 should be the next resistance level to keep an eye on.

- Meanwhile, the price of BTC has reacted positively to fears of a second bank failure after First Republic Bank (FRC) shares dropped by more than 50%.

The price of Bitcoin fell sharply last week, after creating a bearish candlestick and breaking through a short-term pattern to the bottomside in the process.

However, this week has brought some confirmation that the bear market may now be over, and it might be time to buy some Bitcoin.

According to opinion pieces by cryptocurrency experts like Trader Tardigrade and TechDev this week via Twitter, BTC has finally broken out of its bearish trend after managing to hold itself above the $27,000 level after days of bearish price action.

In this article, we examine the pieces of evidence that Bitcoin is now free from its bearish formations, and the possibility of parabolic rallies in its price over the coming weeks as pointed out by some of the most prominent analysts on Twitter.

Bitcoin May Be Free From Its Bearish Trend

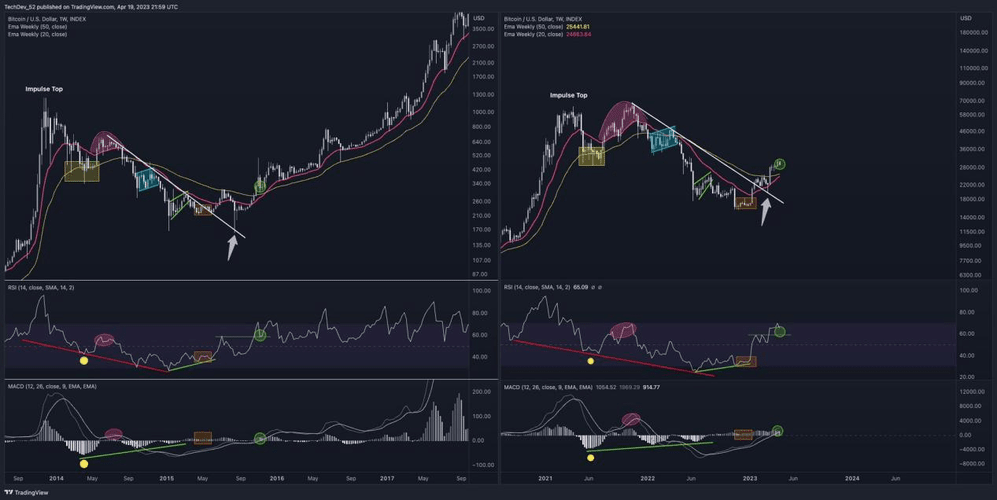

Taking the opinions of TechDev first, the analyst shared a few thoughts on the matter via a tweet. In his words, BTC is in the “early stage of a parabola”, following a 1.5-year correction.

The analyst shared side-by-side images of Bitcoin’s price action in 2015 and Bitcoin’s price action in 2023, highlighting similarities between both.

This, according to TechDev might be the start of an impending BTC bull run.

Trader Tardigrade is another analyst with insights into Bitcoin’s behaviour.

“After building up a consolidation above the upper trendline(green circle), to absorb all the remaining selling pressure,”, the analyst began in the tweet.

#Bitcoin bear market ends with a expanding triangle.

After building up a consolidation above the upper trendline(green circle), in order to absorb all the remaining selling pressure, $BTC will take off. #BTC #Crypto pic.twitter.com/2lZDS77OsZ— Trader Tardigrade (@TATrader_Alan) April 26, 2023

Trader Tardigrade went on to say that this resulted in an expanding triangular formation, which is a blatant indication of a bullish trend reversal.

“$BTC will take off”, the analyst concluded.

A positive trend has been spotted in the BTC charts by Michael van de Poppe, another well-known cryptocurrency expert.

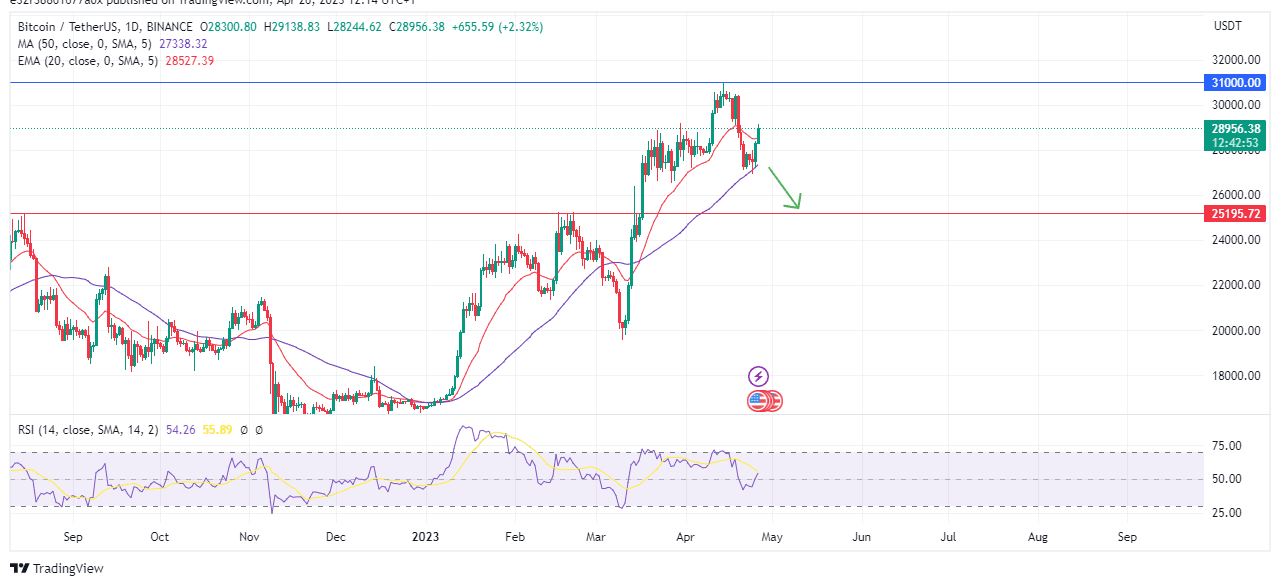

Van De Poppe’s insight piece indicates that because BTC has maintained its position above $27,000, breaking above the significant resistance of $28,800, will make it possible for the cryptocurrency to resume trading within its prior range.

Van de Poppe believes that $28,800 should be the next resistance level to keep an eye on.

He forecasts that BTC will likely continue its upward trajectory and hit $30,000 as it did less than a month ago, barring a temporary period of stabilization.

In essence, BTC, according to van de Poppe, may be in line for a significant rebound, which would be advantageous for investors seeking a potential investment opportunity.

Meanwhile, BTC Price Spikes As First Republic Reignites Banking Fears

Following fears of a second bank failure after First Republic Bank (FRC) shares dropped by more than 50% on April 25, the price of Bitcoin (BTC) has increased by +3% over the last 24 hours.

Recall that the market cap of the entire crypto market also soared, following the failure of Silicon Valley Bank (SIVB) in early March and amid worries about other mid-tier US institutions.

The head of research at Australian crypto education platform, Collective Shift said that BTC spiked the moment Fox News Business reporter Charles Gasperino broke the news that bankers at First Republic Bank were expecting the company to enter government receivership.

Bitcoin Price Action

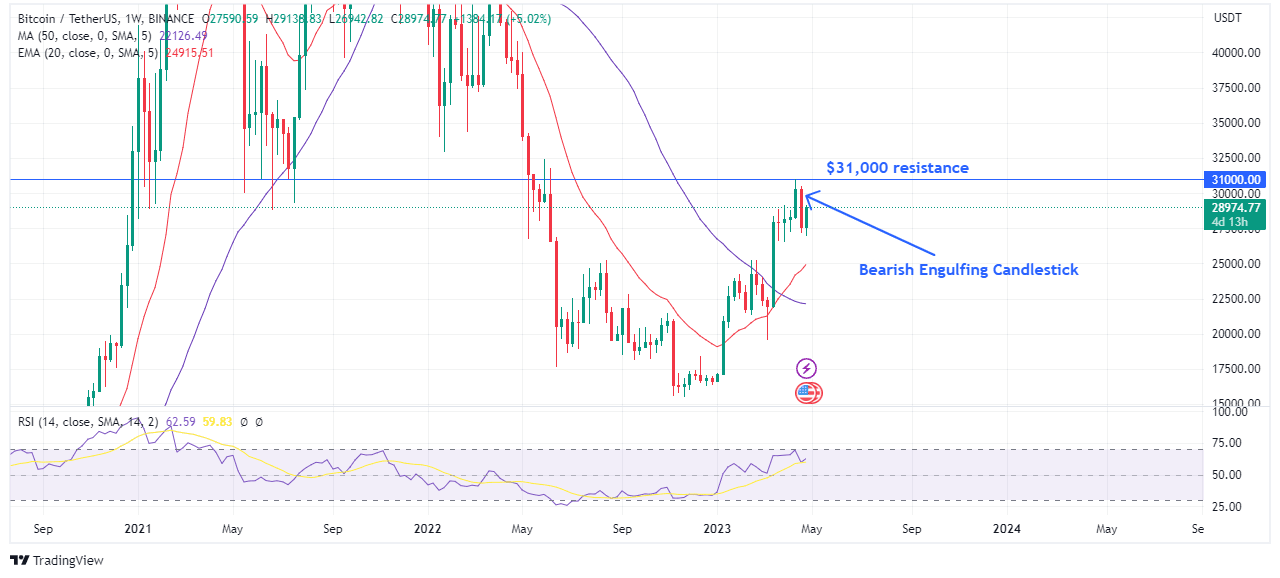

Last week, the price of Bitcoin dropped significantly, resulting in a bearish engulfing candlestick on the weekly timeframe as illustrated below.

The candlestick also confirmed $31,000 as a significant resistance, given that Bitcoin failed to break through in the previous week.

Because of this, Bitcoin has no chance of rallying to $35,000 or higher if this zone isn’t first broken. And in the event of a breakout from this resistance, it might serve as a significantly strong support level for the cryptocurrency’s price.

If Bitcoin continues to fail in its efforts to break through, however, the bears might take the opportunity to sink the cryptocurrency lower to the $25,000 zone as illustrated above.

The RSI, on the other hand, has gravitated to the bullish zone, indicating a shift in control and strength on the part of the bulls.

Meanwhile, because of the current banking crisis scares, the correlation between Bitcoin and the S&P 500 may be wearing off, according to data from crypto analytics company Santiment.

This is happening because the concept that Bitcoin is a haven during the banking crisis has once again gained traction and Bitcoin may enjoy further bullishness if traditional banking systems continue to fail.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.