Key Insights:

- The total XRP sales by Ripple in the first quarter (Q1) of 2023, net of purchases, were $361.06M, compared to $226.31M in the previous quarter.

- XRP’s performance in Q1 of 2023 was promising, despite its macroeconomic crises, indicating that Q2 may be a profitable one as well.

- Considering the position of XRP between two important moving averages, it is important to DYOR before opening any trades

- Ripple in a recent report, stated that in the ongoing case, testimony from several of the SEC’s experts has been removed from the court record.

The $0.45 support level on XRP has been heavily protected by the Ripple Coin bulls, despite the current bearishness experienced by the cryptocurrency markets as a whole.

Over the past few weeks, XRP has maintained its footing above the $0.40 zone. So far, the whales and long-term investors appear to be getting ready for a huge price movement and have been actively buying the cryptocurrency’s dips.

Despite the series of bank runs and Ripple’s ongoing SEC lawsuit, long-term investors of XRP seem to be growing more optimistic about the cryptocurrency’s ability to surge even higher, and the Q1 report for the cryptocurrency also predicts a promising second quarter of 2023.

XRP In Q1 Of 2023

According to Ripple’s quarterly report for XRP, the total XRP sales by Ripple in the first quarter (Q1) of 2023, net of purchases, were $361.06M, compared to $226.31M in the previous quarter.

XRP’s Ledger on-chain activity remained strong as well, with decentralized exchange volumes increasing 34% to $115M in Q1 2023 versus Q4 2022.

At the same time, XRP’s Average Daily Volume (ADV) on centralized exchanges jumped 46% in Q1 to $1B from $698M.

Silvergate, Silicon Valley Bank (SVB), Signature, and Credit Suisse were among the organizations that suffered serious setbacks in March. March’s series of bank runs severely affected the crypto market, causing a massive dip in Bitcoin. XRP, however, held up comparatively well despite the turbulence.

The Fed’s denial of the crypto-focused bank Custodia’s application for membership and the Fed, FDIC, and OCC’s joint statement on the liquidity risks to banks servicing the fiat deposits of crypto clients were factors that contributed to the impression that regulators are trying to discourage banks from allowing legal operating entities within crypto to have bank accounts in the US.

Overall, it is clear that the macroeconomic woes that continue to plague traditional financial systems as well as the crypto markets might continue. However, XRP is expected to stand strong regardless.

XRP Price Analysis

XRP is performing well on a daily and weekly perspective, according to data from CoinMarketCap.

The cryptocurrency is up by 1.9% over the last day and by 5% over the last seven. XRP comes next, only to other examples of the top 30 cryptocurrencies like Solana, ICP and Cosmos in terms of bullishness.

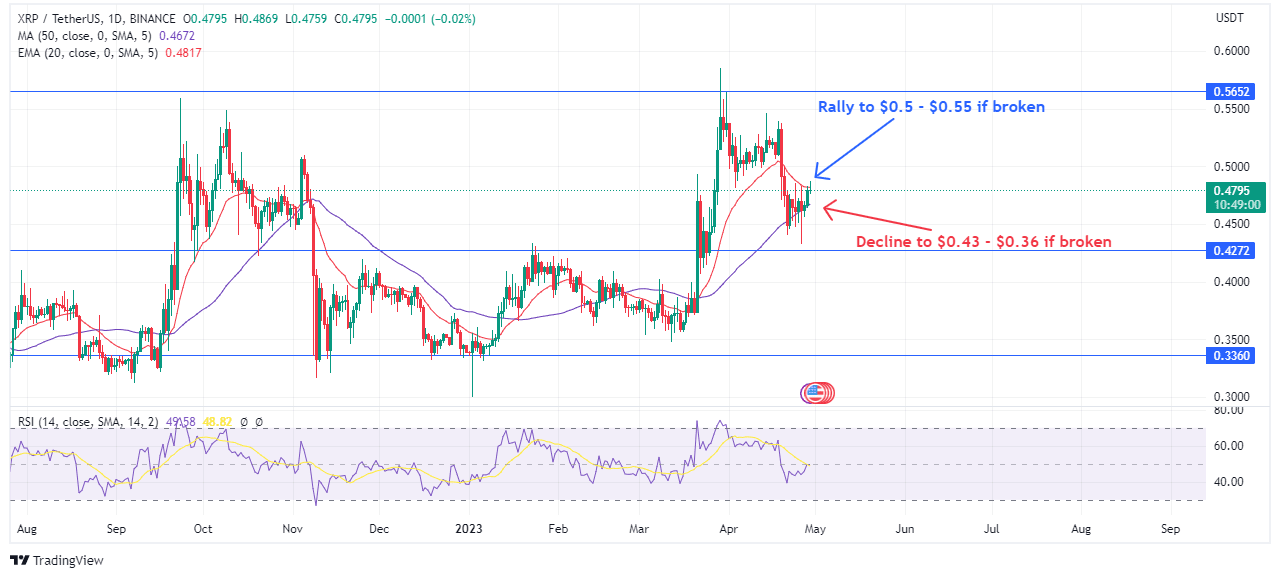

As mentioned earlier, on April 26, XRP rebounded off the support at $0.43, showing that the bulls are strongly holding this level.

As shown below, the price has increased and approached the 20-day EMA (red line below, around $0.48), which is a crucial mark for the bulls to attempt breaking.

However, if the bears are successful in rejecting XRP from this 20-day EMA, the price is expected to go below $0.43 and eventually reach $0.36 if the bulls do not step up to salvage the situation.

On the other hand, XRP might hit the $0.5 resistance level if the bulls are successful in driving the price over the 20-day EMA.

A break and closure above this level would show that the short-term bearishness on XRP is over, opening the door for a rebound to $0.54 and then to $0.58 if all goes well.

The RSI on the daily chart is at the neutral zone, indicating that the bulls and bears may be evenly matched at this point.

Considering the position of the cryptocurrency between two important moving averages, it might be a good idea to first watch the price action of the cryptocurrency for a while, before opening any trades.

Latest On The Ripple Vs SEC Case

Meanwhile, Ripple in a recent Q1 report it published, mentioned that the US Securities And Exchange Commission (SEC) just suffered a setback in the ongoing case in which the former was accused of selling XRP as an unregistered security.

In its XRP markets report for the first quarter of 2023, Ripple notes that in a ruling issued last month by the lawsuit’s presiding Judge, Analisa Torres, testimony from several of the SEC’s experts was removed from the court record.

Ripple stated in its report that the Court issued a 57-page order on March 6th, choosing which expert views from the SEC and Ripple might be taken into account on summary judgment (and, if necessary, during trial) and which opinions needed to be “struck out”.

In particular, the SEC’s expert’s evidence about the “reasonable expectations of an XRP purchaser” as well as their expert’s attempt to ascertain what “caused” the price of XRP to move was struck out from the record.

The article also stated that Ripple anticipates a summary judgment ruling in 2023. However, the Court ultimately decides when this will happen.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.