Key Insights

- Bitcoin is up by 6% over the last week, and the Bureau of Labor Statistics’ most recent U.S. inflation data was a major catalyst.

- Ethereum, fueled  by the success of the Shapella upgrade, is sitting at a weekly gain of about 13%

- Solana, with the April 13 launch of Saga is up by 23.48%

- Cardano and polygon have fairly strong “buy†verdicts according to technical aggregates.

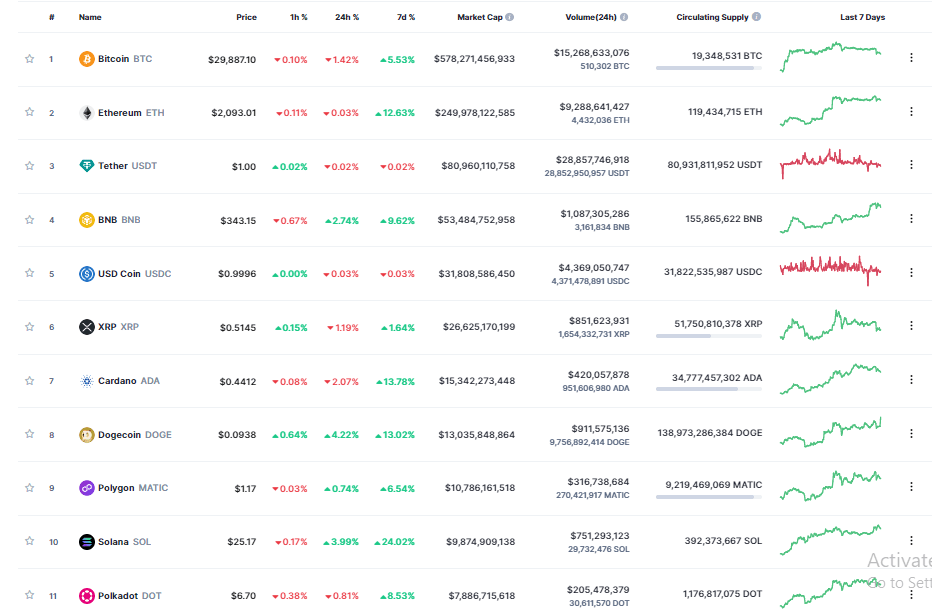

The crypto market has been bullish overall in the last few weeks, with Bitcoin and Ethereum performing fairly well over weekly perspectives.

According to data from CoinMarketCap, Bitcoin is up by 6% over the last week in its journey to and from the $30,000 zone. The cryptocurrency, after hitting the $31,000 zone, has now retreaded its steps and is trading at $29,900 at the time of writing.

Ethereum, fueled by the success of the Shapella upgrade, is sitting at a weekly gain of about 13%. Unlike Bitcoin, Ethereum’s break above the $2,000 zone (although weakened), is still going strong. The cryptocurrency now sits at $2,090 at the time of writing and is only a hair’s length from going under again

Other popular cryptocurrencies like BNB, Cardano and Polygon are up by 9.58%, 13.8%, and 13% respectively, and are all near significant support/resistance zones.

From this, it is clear that the crypto market’s direction may not be perfect, but all may be well for now.

The global crypto market cap is going strong as well, sitting at $1.26 trillion with a 24-hour trading volume of $42.6 billion.

The Crypto Market’s Price-Driving News

The Bureau of Labor Statistics publication of the most recent U.S. inflation data served as a major catalyst for Bitcoin’s price action over the last few days.

According to the Consumer Price Index for March, inflation turned out to be less than expected.

This most recent inflation figure is a clear indication that the FED may reconsider its strategy of rising interest rates, which it pursued throughout 2022.

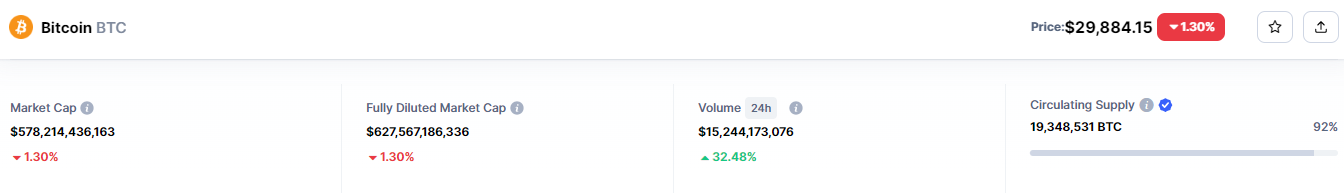

Bitcoin, over the last 24 hours, is bearish and has declined by 1.3%.

The cryptocurrency now has a market cap of $578 billion, taking a 45.7% share of the global crypto market cap (compared to last week’s 46.5%).

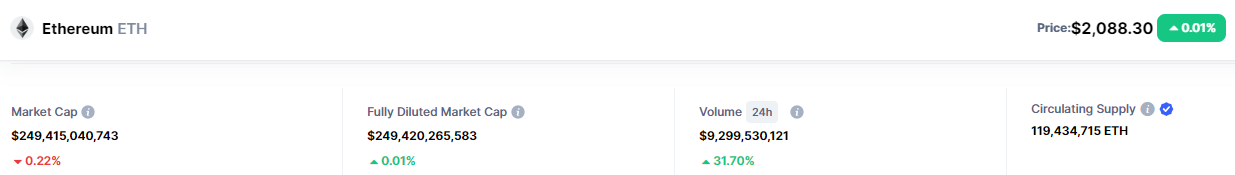

Ethereum on the other hand, temporarily crossed the $2,100 mark on Friday for the first time in the previous eleven months.

The long-awaited “Shapella” update on the Ethereum network, which went live on Wednesday, was the focus of most of the ETH buzz.

“Shapella” refers to two upgrades, Shanghai and Capella, which have now made it possible to withdraw ETH staked on the network at the execution layer and the consensus layer, respectively.

This upgrade has now made it possible for stakers to withdraw about $34 billion worth of staked ETH.

Ethereum’s transactions are executed and recorded in real time by the execution layer, while they are verified by the consensus layer.

To activate their software, each validator has had to invest 32 ETH, and are now getting paid ETH for validating transactions.

Because of this, Ethereum has a current market cap of $249.3 billion, with a 19.7% stake in the global crypto market cap (an upgrade, compared to last week’s 19.6%).

Another cryptocurrency whose price action was largely influenced by news events is Solana, with the April 13 launch of Saga, an Android phone powered by the Solana blockchain. With this Android phone, users can reportedly access Solana’s vast ecosystem of apps and projects more quicker and easier.

Basic Crypto Predictions For The Week

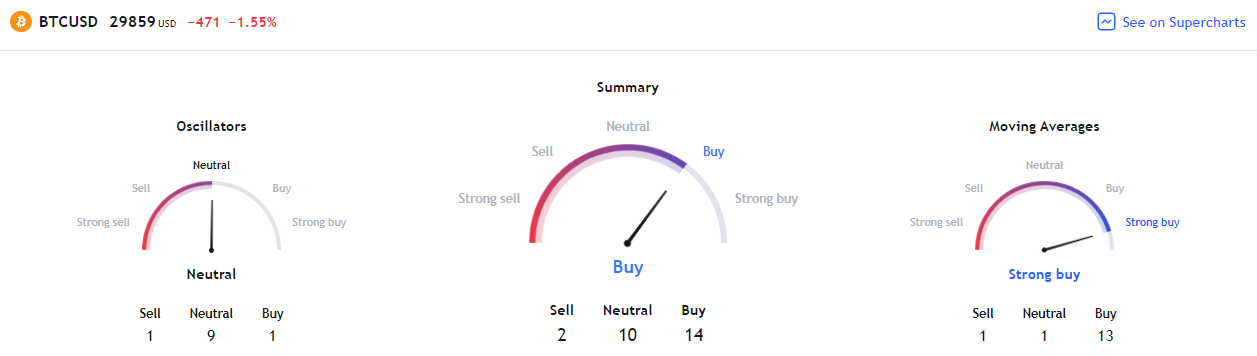

Bitcoin, the king of cryptocurrencies, has a fairly strong “buy†verdict, according to TradingView’s technical analysis pane.

Of all the indicators used, 9 oscillators and 1 moving average showed neutral positions, 1 oscillator and 1 moving average showed a “sell†position, while 1 oscillator and a whopping 13 moving averages showed “buy†perspectives on the cryptocurrency.

Judging by this, the verdict on Bitcoin turned out to be a fairly strong “buyâ€.

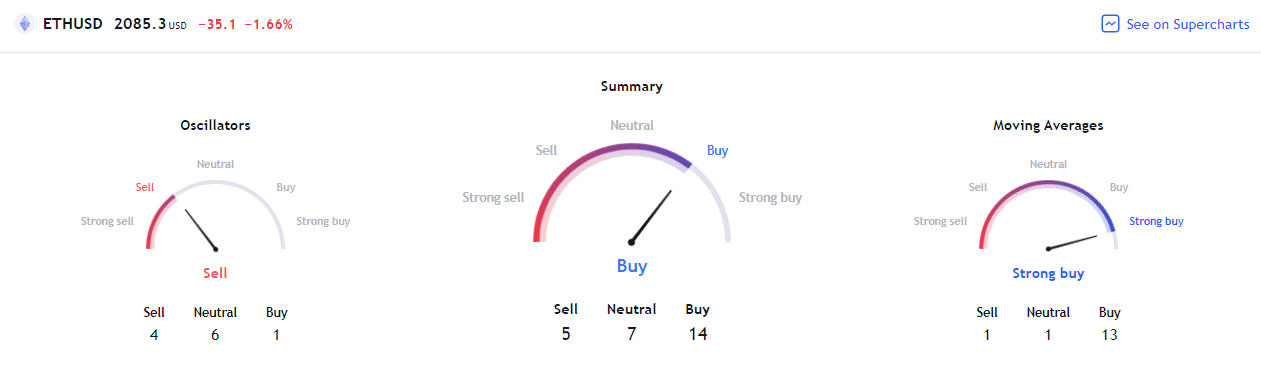

Ethereum

Ethereum, like Bitcoin, has a fairly strong “buy†verdict.

On Ethereum, the oscillators showed a “sell†verdict in total, and the moving averages show a very strong buy signal.

Overall, the verdict is a fairly strong “buy†on Ethereum.

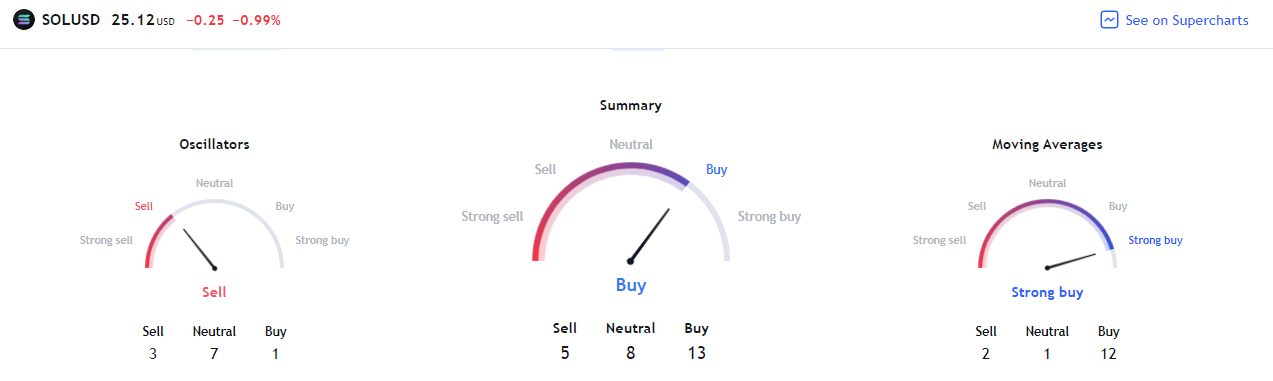

Solana

Solana, similarly, has a fairly strong buy, with the moving averages taking the lead on the “buy†signal.

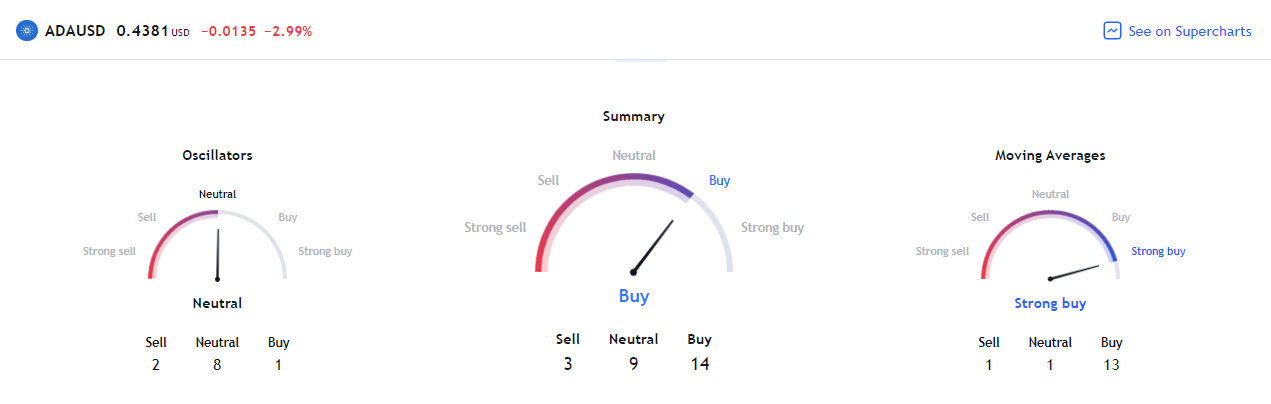

Cardano

The same goes for Cardano, with its “buy†signal.

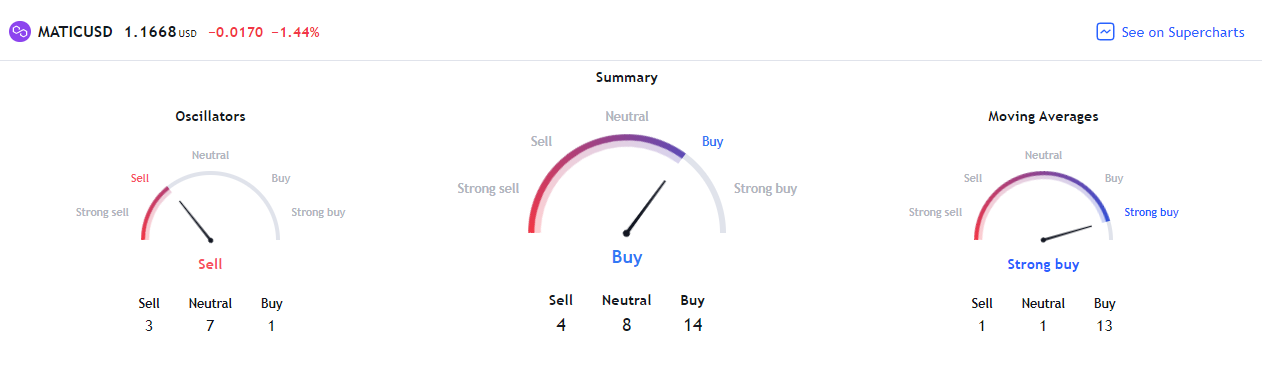

Polygon (MATIC)

Overall, it appears that the technical analysis of the entire crypto market is in agreement, and most of the cryptocurrencies in it are fairly strong buys.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.