Stablecoins are now being used as practical financial tools like payments, payroll, and savings in addition to trading mediums. The study suggests that adoption trends are strongest in regions where currency volatility and cross-border friction are challenging.

Key Insights

- 54% of users reported holding stablecoins within the past 1 year, while 56% intend to acquire more over the upcoming year.

- Over 35% of annual earnings in stablecoins were reported among freelancers, gig workers, and marketplace sellers receiving payments in digital assets.

- Users reported saving roughly 40% in transaction costs compared to traditional payment systems.

- Africa is recording the strongest adoption and growth trends.

Stablecoins aim to provide stability within volatile crypto markets. Assets like USDT and USDC allow traders to move value without being exposed to rapid price swings in the crypto market.

However, a recent survey indicates that stablecoin utility is expanding beyond this.

As per the Stablecoin Utility Report 2026—based on a YouGov survey of 4,658 respondents across 15 countries—stablecoins are increasingly used for payments, savings, and income settlement rather than just trading.

Over 54% confirmed they had held stablecoins within the last year. In addition, 56% plan to increase their stablecoin exposure, while over 13% of non-holders intend to enter the market.

This growth profile suggests sustained demand rather than short-term speculative interest.

Stablecoins Become a Meaningful Savings Component

The study also highlighted a visible shift in how users treat stablecoins for finance decisions.

On average, holders reported allocating approx. one-third of their total savings to crypto assets and stablecoins combined. This behavior indicates that users consider stablecoins not just transactional bridges but also a part of core saving strategies.

The trend is most commonly seen in lower- and middle-income economies, where local currency volatility and banking limitations persist. In such conditions, dollar-pegged digital assets play a vital role in providing both stability and accessibility.

Spending Patterns Signal Monetary Utility

The survey also suggested that stablecoin balances are not remaining idle. Over 27% of holders spend stablecoins directly on goods and services, whereas 45% convert stablecoins into local currency for personal expenditures. More than a quarter of users convert or spend within days.

Most users either convert or spend stablecoins within months, reinforcing their role as active liquidity rather than passive holdings

Additionally, merchants have also started accepting stablecoin payments. Over half of participants indicated they completed purchases specifically because the stablecoin payment option was available.

Stablecoins For Cross-Border Payments

Stablecoin usage has accelerated in cross-border work and digital commerce. Almost three-quarters of users reported that stablecoins have improved their ability to transact with international clients in contrast to digital dollar payments.

This is because of lower transaction costs, faster settlement times and reduced cross-border friction. Stablecoin usage for remittances or payments has also reduced the average fee by 40%.

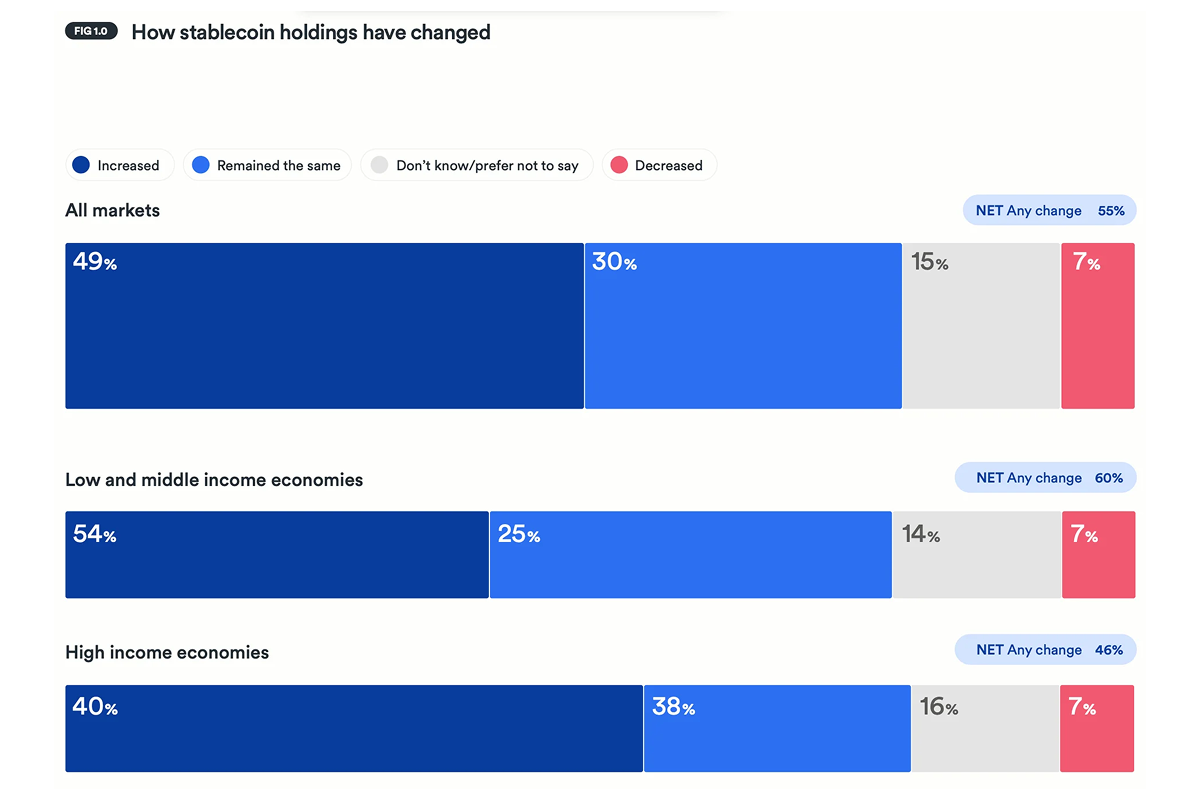

Stablecoin Adoption Remains Uneven Across Regions

The survey also revealed that stablecoin ownership is not evenly distributed.

Stablecoin usage is mainly higher in emerging markets as compared to high-income economies. Africa recorded the highest ownership levels. This clearly specifies that stablecoins are solving real financial inefficiencies, particularly in regions where traditional banking infrastructure remains limited.

Key Obstacles to Mainstream Adoption

Despite rapid growth, users still report structural frictions for complete stablecoin adoption.

Key concerns included:

- Wallet and blockchain selection complexity

- Multi-step transaction processes

- Irreversible transfers risks

- Need for clearer consumer protection frameworks

Users consistently also expressed a preference for stablecoin payment experiences similar to financial applications like fee structures, intuitive interfaces, and global acceptance.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.