Crypto markets have once again started to show early signs of stabilization, but investors are still deeply fearful. As per Santiment, panic remains dominant despite recent price recovery attempts.

Key Insights

- Bearish sentiment rules social platforms despite prices’ attempt to stabilize.

- Historically, extreme fear levels have aligned with late-stage corrections

- Oversold conditions across major assets signal that selling pressure may be weakening

- This can also create favourable conditions for long-term accumulation

Is the market flashing a signal traders are ignoring?

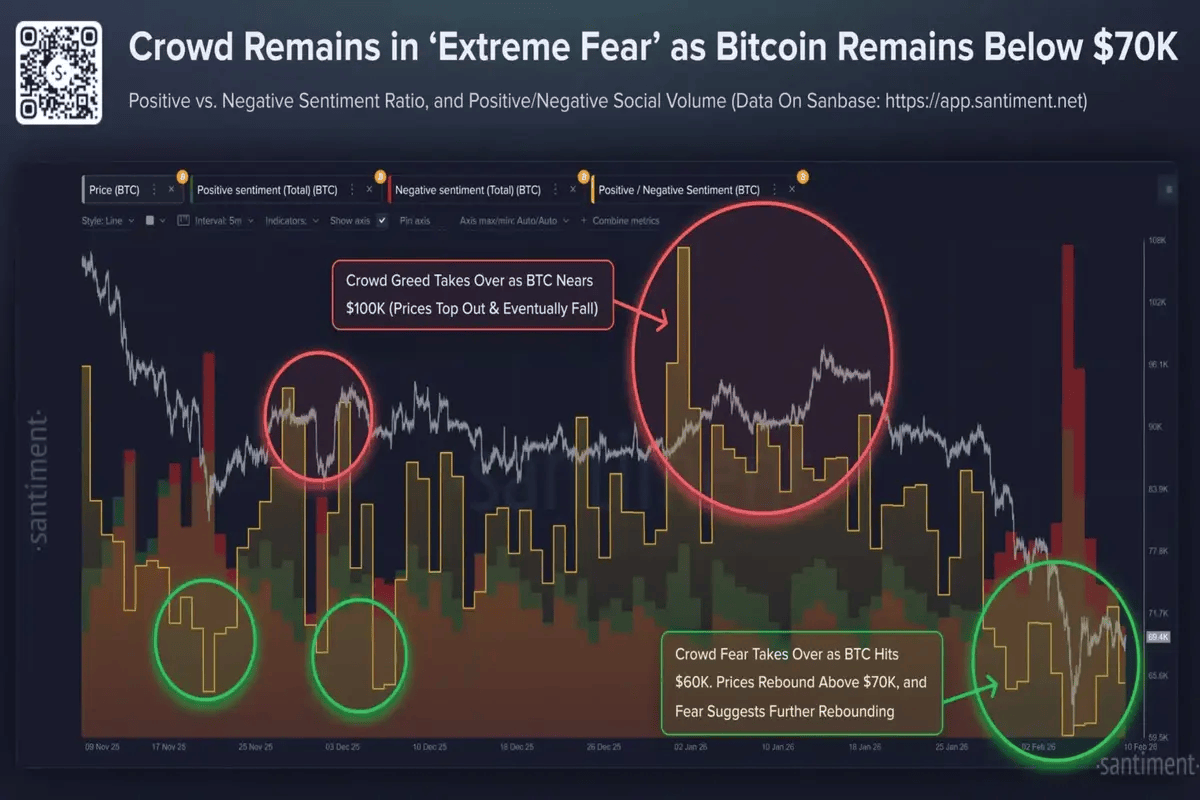

Crypto prices have moderately rebounded after Bitcoin’s recent slide, yet the broader sentiment across various social platforms remains extremely negative.

Fearful comments continue to dominate timelines, despite prices stabilizing and volatility cooling. This divergence between market sentiment and price behavior is clearly hinting at a pattern we have seen in the past.

Crypto Market Sentiment Deeply Bearish

According to social activity and crowd positioning, pessimistic narratives outweigh optimistic ones. Meaning that traders are more focused on downside risks rather than on recovery scenarios. Such conditions typically emerge when uncertainty is high and confidence is fragile.

Historically, such conditions have painted a more nuanced picture. Intense market fears have frequently coincided with late-stage corrections rather than the beginning of prolonged collapses. When retail participation contracts and risk appetite fades, larger players often gain room to reposition without triggering dramatic price reactions.

Fear vs. Market Structure

Behavioral dynamics in the crypto market are always cyclical. Excessive optimism commonly clusters near local highs, while extreme pessimism often aligns with sharp drawdowns.

The current market scenario reflects the latter: participants are cautious despite price stabilization, which clearly suggests that emotional momentum has not yet aligned with market action.

This imbalance matters a lot for the further direction of the market. When selling pressure is driven completely by sentiment and not structural deterioration, markets sometimes enter accumulation phases. Reduced enthusiasm mainly creates favorable conditions for longer-term positioning.

‘Extreme Fear’ Returns

The Crypto Fear and Greed Index recently dipped into deeply fearful territory; levels have been extremely defensive in the past. At the same time, momentum gauges across major assets have been hovering near oversold zones.

While oversold readings do not guarantee reversals, they do reflect exhaustion in aggressive selling. In such conditions, markets frequently shift from impulsive declines to consolidation, where price discovery becomes more balanced and volatility gradually compresses.

What Could Shift the Narrative?

For market confidence to strengthen, capital flows and spot demand will have to play a decisive role. Sustained buying interest, particularly during low-enthusiasm conditions, often serves as the foundation for durable recoveries.

Currently, the crypto market is at a familiar crossroads—fear is dominating, technical signals remain cautious, and structural panic is notably absent. This phase might represent quiet accumulation, or simply temporary stabilization, and will be completely driven by how liquidity, investor participation, and risk appetite evolve in the weeks ahead.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.