Uniswap whales dumped $75 million worth of UNI tokens immediately after the UNIfication proposal announcement, raising insider trading concerns. Despite the controversial whale sales, the proposal introduces protocol fee activation and a 100 million token burn mechanism.

Key Insights

- A Uniswap whale dumped $75 million worth of UNI right after the “UNIfication” proposal announcement.

- The proposal was put in place to activate protocol fees and introduces a massive 100 million token burn.

- Analysts are warning that the timing of whale sales shows signs of insider exits rather than organic growth.

A Uniswap whale sold $75M worth during a 44% surge after Hayden Adams’ “UNIfication” proposal, sparking insider trading concerns.

The update promises to reshape how the protocol works introducing fee activation, token burns and a merger between Uniswap Labs and the Uniswap Foundation.

For many in the crypto space, it looked like a major turning point for one of DeFi’s biggest names. However, behind the excitement, a large investor moved to sell tens of millions in UNI at the height of the rally.

Uniswap Whales Dumped $75 Million During Surge

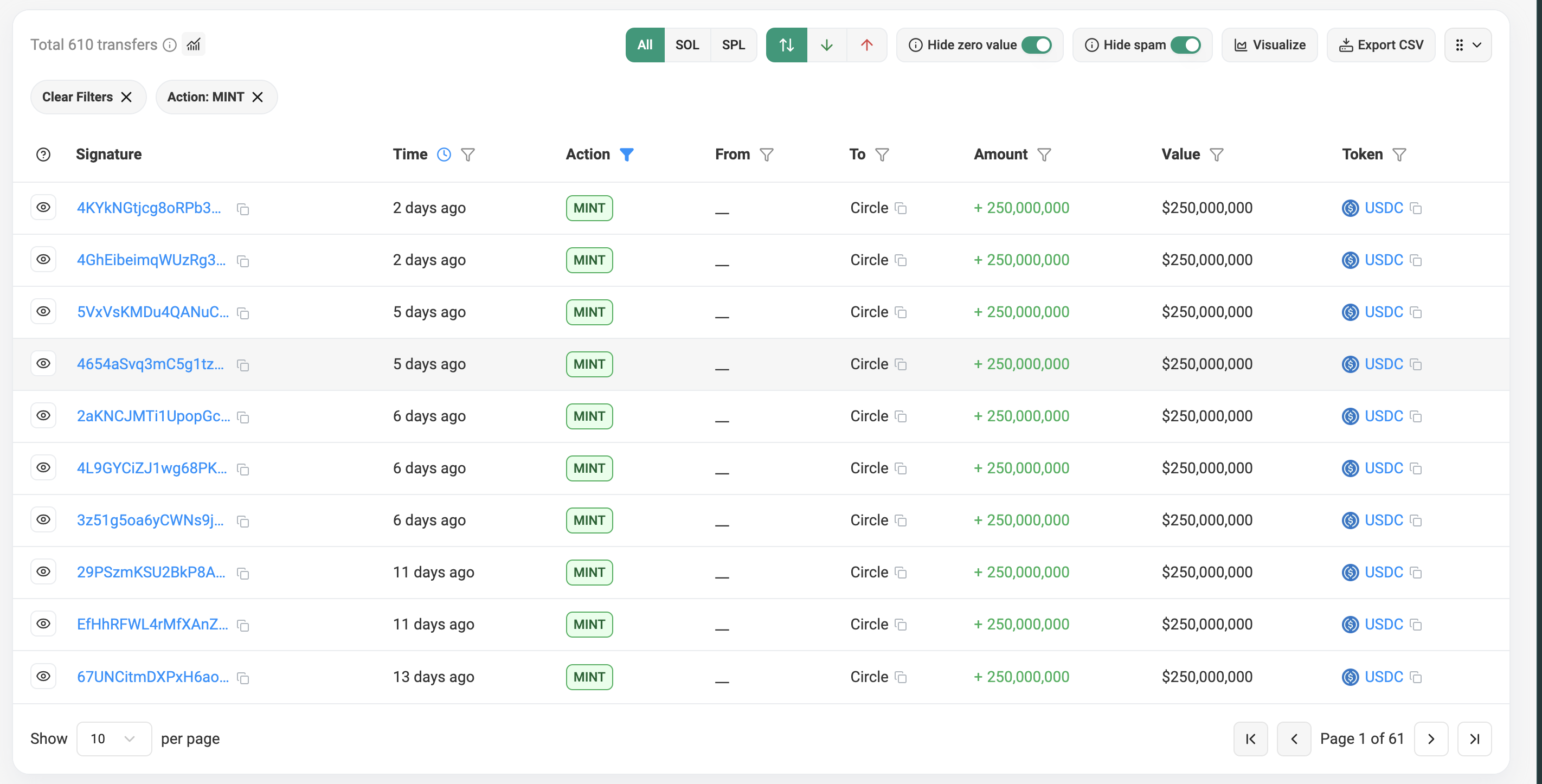

Blockchain data confirms that a Uniswap whale sells UNI tokens totaling $75 million right as the “UNIfication” proposal started to trend, using wallets seeded from 2020 investor contracts.

The wallets tied to this address were seeded from Uniswap’s original investor contracts and have made several large exchange deposits this year.

According to analytics firm Bubblemaps, the entity used four wallets to funnel around 36 million tokens through a single Coinbase deposit address. Altogether, this whale has moved over $200 million in UNI to exchanges in 2025 alone.

On May 14, the address sold 12 million tokens.

Then on November 10 (just hours before Hayden Adams made the announcement), it sent another 9 million UNI to the market. The final, perfectly timed sale happened as the token spiked and dumped $75 million into the rally’s peak liquidity.

That timing has led many analysts to suspect the whale may have known more than the public. The way this Uniswap whale sells UNI tokens with such precise timing has fueled speculation about potential insider knowledge of the proposal’s announcement.

More Whales Sell UNI Tokens After Initial Exit

Other large holders didn’t stay behind. Blockchain tracker Lookonchain reported that another whale wallet sent 2.8 million UNI to Coinbase Prime minutes after the announcement. When a major Uniswap whale sells UNI tokens at this scale, it often triggers a cascade effect where other large holders follow suit to lock in profits.

A separate long-term investor offloaded 1.7 million UNI (worth about $15 million) to Binance and even accepted a loss of over $1.4 million to exit while prices were high.

Social media reaction was sharp.

One X user commented, “Whales pump UNI and retail lines up to get dumped.” Another added, “This isn’t accumulation. It’s distribution disguised as a bull run.”

Why Uniswap Whale Sells UNI Despite UNIfication Upgrade

Despite the controversy, the UNIfication proposal is a major change in how Uniswap operates. For five years, the protocol generated billions in trading fees without sending any returns to token holders.

The new plan changes that.

Today, I’m incredibly excited to make my first proposal to Uniswap governance on behalf of @Uniswap alongside @devinawalsh and @nkennethk

This proposal turns on protocol fees and aligns incentives across the Uniswap ecosystem

Uniswap has been my passion and singular focus for… pic.twitter.com/Ee9bKDric5

— Hayden Adams 🦄 (@haydenzadams) November 10, 2025

Uniswap will now capture between 16.7% and 25% of liquidity provider fees on v3 pools along with 0.05% on v2 pools. It will then use all proceeds to burn UNI tokens. This means a portion of trading fees will permanently remove tokens from circulation and could even reduce supply over time.

The proposal also introduces a one-time burn of 100 million UNI from the project treasury. Based on current trading volumes, monthly burns could reach as high as $38 million worth of UNI.

On top of that, Uniswap v4 will launch with new “aggregator hooks” to generate external revenue and Protocol Fee Discount Auctions that let traders bid for temporary fee-free trading windows.

Fresh Whale Movements Hint at Accumulation

Hours after the sell-off, an on-chain analyst reported a new wallet withdrawal from Coinbase.

The address 0xA25…4Fd08 pulled 474,000 UNI (worth roughly $4 million) from the exchange within an hour.

Unlike the earlier event where a Uniswap whale sells UNI tokens for profit, such withdrawals to self-custody often signal accumulation rather than distribution. Traders interpret it as a sign that some large players might be moving tokens to self-custody wallets for long-term holding.

While one Uniswap whale sells UNI tokens worth millions during the rally, contrarian investors appear to be accumulating at these elevated price levels.

If this address belongs to an institutional buyer or fund, it could show that some investors still believe in Uniswap’s growth, even amid controversy over insider exits.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.