Key Insights

- OpenAI CEO is currently seeking $7 trillion for an AI chip project

- According to Token Metrics, five specific tokens (QI, XCN, ZEPH, Banana Gun, GHX) could see price boosts if the project gets funded.

OpenAI’s current CEO, Sam Altman was in the news a few days ago, for something interesting.

According to reports, the visionary behind ChatGPTÂ is seeking to raise a staggering 7 Trillion dollars for a new project that is set to revolutionize the Artificial intelligence niche.

For context, this figure is larger than the GDPs of Mexico, India and South Korea combined.

Altman is looking to develop Artificial intelligence chips that could power advanced LLMs like ChatGPT with several new and improved features.

According to Token Metrics, several Artificial intelligence niche tokens could be on their way to price explosions if this $7 trillion somehow materializes.

Altman’s $7 Trillion Bid

According to a recent publication from the Wall Street Journal, Sam Altman is currently speaking to the United Arab Emirates for funding, anywhere between $5 trillion and $7 trillion for the AI chip project, which aside from the lack of funding, still faces several technical and regulatory hurdles.

These chips will be built to perform complex operations at high speed, making training and running LLMs like ChatGPT much faster and much more efficient.

According to this publication, Open AI currently spends about $12 million on cloud computing services to run ChatGPT and other Artificial intelligence tools, every single month.

This figure is also expected to continue rising, as GPT becomes larger and more advanced.

Hence, the need to create these chips that can run things, without relying much on cloud service providers as Artificial intelligence becomes more powerful and efficient

In fact, the Wall Street Journal even states that these chips might make it 10 times faster and cheaper to run these mentioned AI tools.

These AI Tokens Are Set To Benefit

According to a recent tweet from Token Metrics, five AI crypto tokens are set to explode upwards this week and beyond, if Altman gets his $7 trillion.

These AI crypto tokens are:

1. BENQIÂ (QI)

Benqi is a Defi protocol that leverages Artificial intelligence to scale up lending and borrowing rates on the Avalanche network.

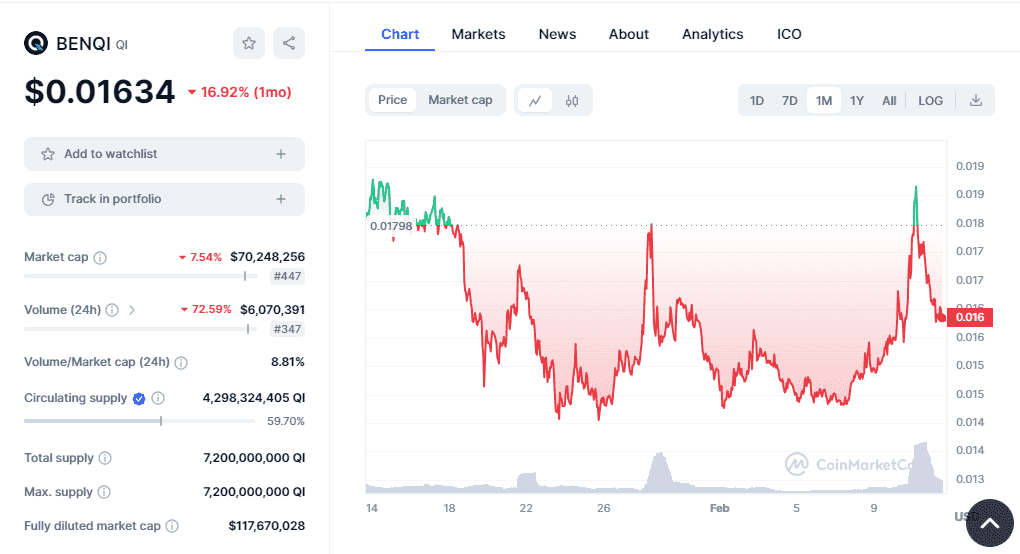

According to CoinMarketCap, Benqi trades at around $0.01634 and is under some bearish waters at the time of writing.

However, if Token Metrics is right by any means, we might see all of this change, and the ongoing bearishness might be a massive “buy the dip†opportunity.

2. Onyx (XCN)

Onyx, on the other hand, is a decentralized AI network that allows anyone to create, share, and make money out of AI services and models.

At the time of writing, the cryptocurrency trades at around $0.00158 and is bearish on lower timeframes.

However, over the last month, the cryptocurrency has gained around 19% and could be on its way to turning parabolic.

3. Zephyr Protocol (ZEPH)

The Zephyr protocol simply connects AI developers and users, giving them incentives for improving the quality of AI solutions.

Unlike the others on the list, Zephyr isn’t very bearish on its lower timeframes and is up by $4.62 on its monthly chart.

4. Banana Gun

Banana Gun takes an alternate approach and is a gaming platform that uses Artificial intelligence to generate unique and personalized game worlds and avatars.

According to CoinMarketCap, Banana Gun trades at around $20, and is incredibly bullish over all timeframes at the time of writing.

The cryptocurrency is up by more than 80% over the last month and is even up by around 17% over the last 24 hours at the time of writing.

5. GamerCoin (GHX)

Just like Banana Gun, Gamercoin is a gaming token.

The token is used to reward gamers for playing, creating, and sharing games on the GamerHash platform, which uses Artificial intelligence to optimize the use of idle computing power.

If we thought Banana Gun was bullish, GamerCoin is more so.

The cryptocurrency is up by 134%, 25% and 1.2% over the last month, week and day at the time of writing, indicating strong momentum and strength on the part of the bulls and price action.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.