Key Insights

- Jeff “Jihoz” Zirlin, an Axie Infinity co-founder lost $9.7 million in ETH due to a Ronin Bridge exploit.

- 2024 has seen a rise in hackers targeting crypto founders, CEOs and whales, draining millions worth of assets.

- The attacker bypassed security measures, stole the funds and mixed them through Tornado Cash, making them untraceable.

- There was a similar attack last month, when Ripple co-founder, Chris Larsen lost $112.5 million in XRP to a similar hack.

- Axie could rally if it breaks above $8.24 and reaches $11.15.

The hackers got their game on again in 2024, and have drained several defi protocols for hundreds of millions so far.

However, malicious actors have added a new class of targets to the menu this year.

These targets are crypto founders, CEOs and whales.

According to reports, this week, one of them managed to steal nearly $10 million worth of ETH from a prominent crypto co-founder.

Here are all the details of the hack, as well as what it means for the price of a certain cryptocurrency.

$9.7 Million ETH Drained

On Thursday, a hacker managed to break into two of the personal wallets of Jeff “Jihoz†Zirlin, one of the co-founders of Axie Infinity and Ronin Network.

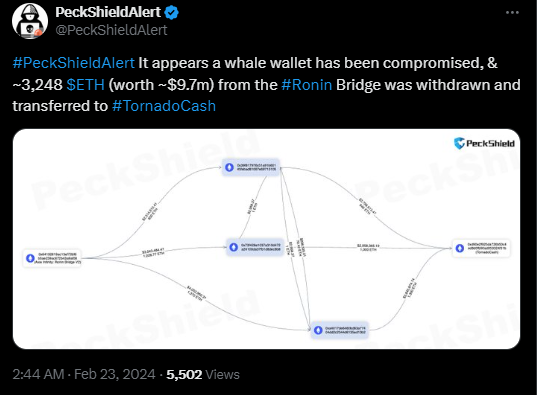

This hacker (or group of hackers) stole a total of 3,248 ETH (worth about $9.7 million at the time) from these wallets, as highlighted in a new tweet from PeckShield Alerts.

Peckshield notes that the hacker was able to manipulate a chink in the Ronin Bridge.

Whether by luck or by the hacker’s skill, the malicious actor was able to bypass a security feature in the Ronin Bridge, that detects particularly large transactions and pauses the bridge to prevent thefts.

PeckShield highlighted that the hacker was able to transfer these funds from the Axie co-founder’s wallet to three different addresses Ethereum mainnet.

From here, the hacker sent these funds to Tornado Cash, mixed them and rendered the funds untraceable.

Hackers Are Now Targetting Co-founders

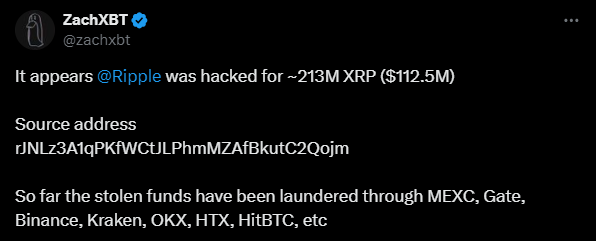

Something similar happened last month with the co-founder and executive chairman of Ripple, Chris Larsen.

On 31 January 2024, a hacker targeted and broke into four of Larsen’s personal wallets, before stealing over 200 million XRP tokens (which were worth about $112.5 million at the time of the attack).

Just like the recent hacker did on the Ronin bridge, the Ripple hacker used a vulnerability in the XRP Ledge to break past multiple security checks and loot Larsen’s wallets.

The hacker then used several exchanges, including Binance, Kraken, and OKX, to spread the funds out, making them untraceable.

Overall, the recent spate of attacks against co-founders in the crypto space serves as a wake-up call for the community to improve their security and awareness, especially as the next bull cycle approaches.

What Will Happen To Axie Infinity Token (AXS)?

According to the charts, Axie currently trades at around $7.75.

The chart above shows that the cryptocurrency is currently making lower lows, after its initial rejection from $11.15 on 25 December, 2023.

However, what is also true is that the cryptocurrency is supported strongly by the $6.8 resistance.

What does this mean?

It means that Axie has a chance to break above its $8.24 and challenge the $11.15 high from December 2023, as long as the bears do not pull the cryptocurrency down below the $6.8 block shown above.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.