Key Insights

- Bitcoin is on a bullish run, surpassing the $52,000 mark and marking a two-year record.

- Some believe BTC is already priced in, while others like CrediBULL Crypto predict a parabolic run to $100,000 by mid-2024.

- Bitcoin’s open interest for futures and options is at an all-time high, indicating strong demand and liquidity from institutional and retail investors

- Renowned personalities like Cathie Wood and Robert Kiyosaki see BTC as a potential substitute for gold

- Bitcoin might be outperforming the metal soon.

BTC has been on a tear lately and is showing no signs of slowing down.

The cryptocurrency has just spent the last week above $52,000, marking a new two-year record for the weekly close.

This is just as the next halving draws ever closer, less than 70 days away.

The next bullish market cycle is showing signs of arrival, and investors are pumped up with anticipation.

Here are some of the things to know about BTC this week.

Bitcoin To Hit $100k By Mid-Year

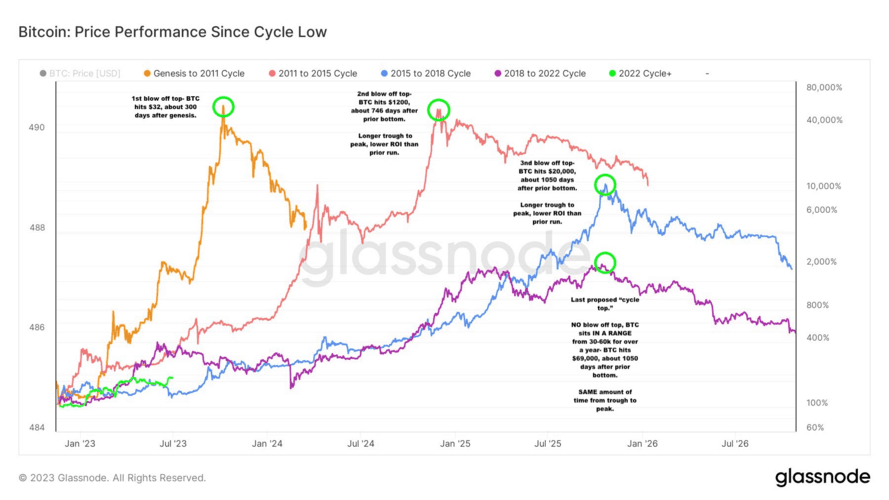

The BTC halving is believed by many, to be one of the biggest warning signs that a bull market is incoming.

However, not everyone is as optimistic.

Analysts have argued that the halving is already priced in and that the bull market still depends on macroeconomic and geopolitical factors.

One of these analysts is CrediBULL Crypto, who in a recent tweet, argued that it might be wrong to carry narratives like “first ever time we did X before the halving!â€.

CrediBULL Crypto implies that everyone thinks every halving is different because the market “erroneously” sees the halving as THE single event that determines BTC’s price.

CrediBULL Crypto says that in the coming months, we can expect further continuation upwards at a more aggressive pace than we have seen thus far.

At the end of this, the analyst expects BTC to break the $100,000 mark by the end of this parabolic run and hit a “top” sometime around mid-2024.

Bitcoin’s Open Interest Is At A Record High

Despite the uncertainty around the halving, other factors indicate market health in the long and short term.

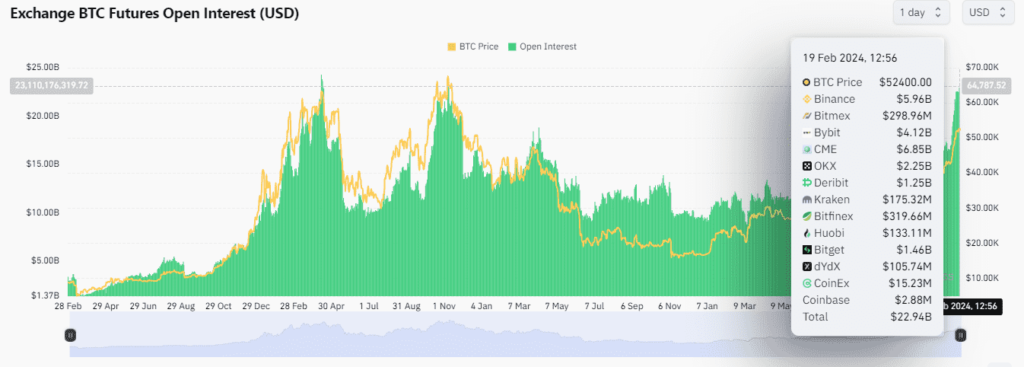

According to data from Coinglass, the open interest (OI) for BTC futures and options has reached new highs, indicating that the cryptocurrency is now experiencing strong demand and liquidity.

According to data from Coinglass, the total exchange OI for BTC hit around $22.8 billion on 19 February, and has even advanced to around $22.94 billion at the time of writing.

This figure puts Bitcoin’s current OI around the highest level since Bitcoin’s $69,000 all-time high in December 2021.

The OI for CME Group’s Bitcoin futures also reached a new record of $6.8 billion, after the launch of several Bitcoin ETFs in Canada and the US.

This indicates that Bitcoin is very healthy, and is receiving a huge amount of interest from both institutional and retail investors alike.

Bitcoin Will Beat Gold Soon, “Rich Dad, Poor Dad†Author Says

The Bitcoin versus gold narrative has been around for a while now.

These comparisons have become even more popular in 2024, when only two weeks ago, on ARK Invest’s “Big Ideas 2024” podcast, the company’s CEO, Cathie Wood pointed out that BTC might turn out to be a direct substitute for Gold.

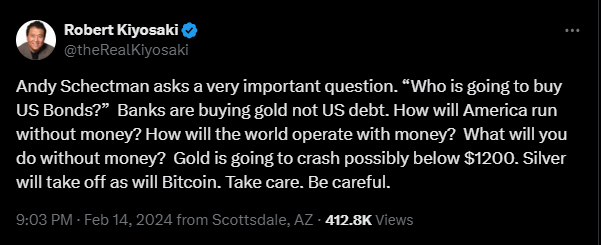

Recently in a tweet, the bestselling author of “Rich Dad, Poor Dadâ€, Robert Kiyosaki argued that some investors are looking for alternatives that present higher returns or lower risks.

Kiyosaki predicted in the tweet, that Silver and BTC will take off soon, as gold crashes below $1,200.

Kiyosaki, who is a vocal critic of the US economy and the Federal Reserve, believes that silver and Bitcoin are the best assets to protect one’s wealth from the impending “biggest crash in historyâ€.

If Wood and Kiyosaki turn out to be right, we might be seeing a major spike in BTC, regardless of what happens with gold.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.