Key Insights

- Analyst PlanB sees Bitcoin surging to $300,000 – $500,000 after April halving, based on the Stock-to-Flow model.

- PlanB also believes Bitcoin will become scarcer than gold, potentially surpassing its $13.8 trillion market cap.

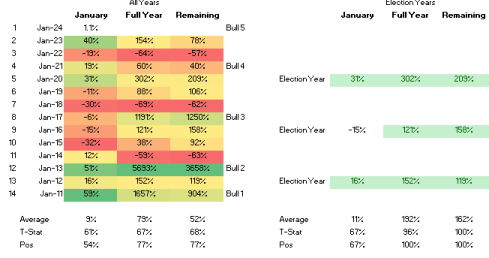

- In other news, analyst, Markus Thielen foresees BTC ending 2024 at $70,000 based on historical election year trends and price cycles.

- Historically, BTC has been down one year, followed by three up years, suggesting potential for further gains in 2024.

Bitcoin is poised for an explosive rally this year and further into the incoming bull run.

We all know that.

The only difference is that while some people expect BTC to post modest gains from now until the end of the coming bull cycle, other people have slightly more ambitious predictions for how the flagship cryptocurrency will perform.

For example, analyst and creator of the Bitcoin Stock to Flow (S2F) model has predicted a massive rally on BTC after the incoming BTC halving in April this year.

This analyst says that Bitcoin will become a direct competitor to gold.

Bitcoin Follows the Stock-To-Flow Model

The S2F model is one of the most popular and most controversial models for predicting the future price of BTC.

The model takes Bitcoin’s value into account, based on its scarcity.

PlanB believes that BTC has followed this model with uncanny accuracy since he created it.

In August 2023, the analyst dropped a prediction piece on YouTube, in which he claimed that Bitcoin’s relative strength index (RSI) is repeating a pattern that previously signaled parabolic rallies.

He supplemented this piece with his Stock to Flow model and concluded that BTC could hit $60,000 before or slightly after the April 2024 halving event, before booming upwards to between $300,000 and $500,000.

Specifically, he said:

“And then the bull market really goes on, the second stage of the bull market with FOMO (fear of missing out) and greed, and then in this scenario, it’s a rather conservative bull market that bottoms out or flattens out just below the stock-to-flow value of $500,000. So this averages at $300,000, which is still pretty okay, I would guess. It’s 10x from here.”

This prediction by the analyst indicates more than a 1000% rally from where Bitcoin currently sits under $45,000.

Bitcoin To Compete With Gold

If the $500,000 prediction was shocking, here’s another.

Over the weekend, the analyst predicted that after the halving, BTC will be scarcer than Gold and even real estate.

Specifically, PlanB says that it would “surprise him” if Bitcoin’s market cap stays under the market cap of Gold.

Now, keep in mind that the current market cap of BTC is about $840 billion, while the market cap of gold is about $13.8 trillion.

This, he says, means that Bitcoin is set to rise to more than $500,000 per token after the coming halving in 2024.

Year-End Prediction On Bitcoin, According to Markus Thielen

BTC could end the year at around $70,000, 10x Research’s Markus Thielen has said in a recent publication.

The expert who accurately predicted the latest decline in bitcoin (BTC) to $38,000 now believes that values over $43,000 are suitable for placing new positive bets on the cryptocurrency.

Late last year on 8 December, when BTC had almost reached 45,000, Thielen predicted that the price of Bitcoin would consolidate for three weeks, and start January strong, before a corrective move to 36,000 or 38,000.

All of this has happened in detail, by the way.

After that, BTC recovered from its crash to $38,500 and hit $40,100, to which Thielen called for a new rally.

Today, the price of Bitcoin sits somewhere around 43,000, and Thielen has come out with some new predictions as to how BTC will perform at the end of the year.

Thielen says that the macro and political circumstances around the crypto market show that BTC is set to rally further up from $42,000.

Moreover, he mentions that stocks often rise during the four-year US election cycle, which also happens to be the year in which the halvings come in.

In these years, he says that Bitcoin returns, on average, +192% annually, with +152% from 2012, +121% from 2016, and +302% from 2020 as constant performance.

In its 13-year history, Thielen says that Bitcoin has only seen three down years (2014, 2018, and 2022). However, these down years have been followed by three straight-up years.

This indicates that the cryptocurrency has a four-year cycle pattern. Given that 2023 was an upward year, if the tendency continues, we could we can expect Bitcoin to end the year at around $70,000.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.