Key Insights

- Bitcoin (BTC), has dropped below $30,000 and is now struggling around the $29,000 zone in a -3% move.

- This week, a sell order for 16,000 bitcoins, valued at over $467 million may have started the massive drop Bitcoin is currently in.

- The decline sparked a sell-off in the larger cryptocurrency market.

- Bitcoin’s FireChart shows bids in the $28k – $29k range continuing to move up toward the active trading range and indicating another $31,000 rally

Within the cryptocurrency market, the last 24 hours have been an absolute bloodbath as the majority of coins have taken terrible beatings.

Bitcoin (BTC), has declined by more than 3% in the past 24 hours, dropping below $30,000 and now struggling around the $29,000 zone.

Bitcoin In the Charts

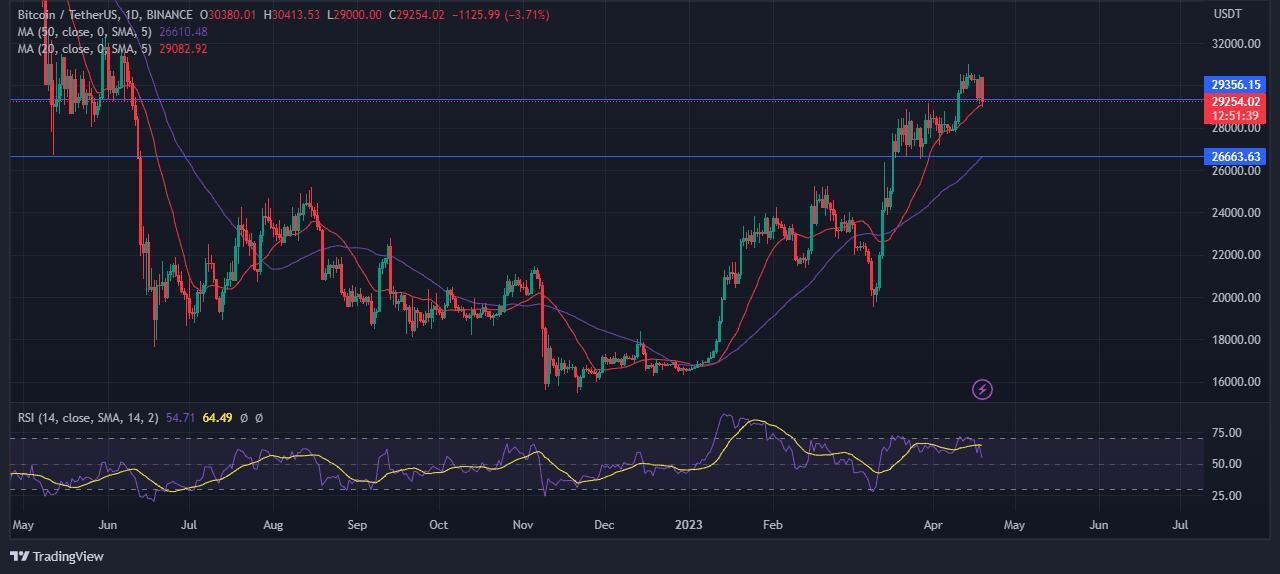

After consolidating in the latter half of March around the $26,600 and $28,800 zone, Bitcoin finally broke through and rallied straight up above the $30,000 zone around mid-April.

According to the chart above, after the golden cross that heralded Bitcoin’s rise from below $20,000 to $31,000, the cryptocurrency has risen by an impressive 58%, before a price reversal of around $31,000.

After getting rejected by the bears at around $31,000 on 14 April, the cryptocurrency has now reversed into a retest of its 20-day moving average as its RSI approaches the neutral zone.

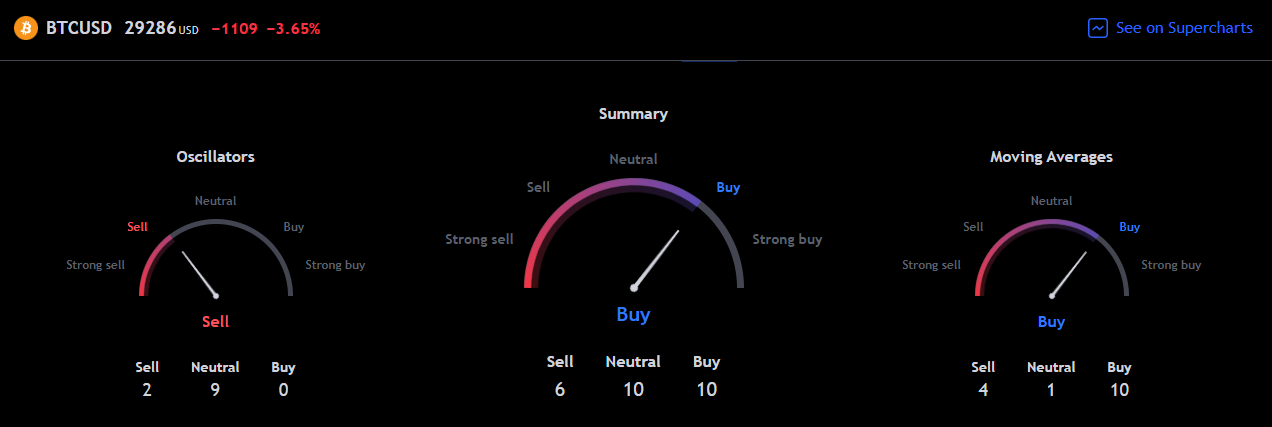

Overall, TradingView analytics also show that despite Bitcoin’s intra-day and weekly bearishness, the cryptocurrency is still fundamentally strong according to its moving averages.

While the Oscillators show neutral to sell verdicts, most of the Moving averages are strongly on buy verdicts.

In summary, TradingView’s metrics show a buy signal on the cryptocurrency, indicating Bitcoin’s strength in terms of technical analyses.

The Aftermath Of Bitcoin’s Bloodbath

Popular cryptocurrency trader on Twitter @52kskew noted this week, that a sell order for 16,000 bitcoins, valued at over $467 million at the time of writing, may have started the massive drop Bitcoin is currently in.

$BTC Spot CVDs

16K BTC sold at market from binance spot

Other spot exchanges had pretty typical size being soldInteresting selloff here pic.twitter.com/9SmirkSM7b

— Skew Δ (@52kskew) April 19, 2023

The decline sparked a sell-off in the larger cryptocurrency market, with Solana (SOL) losing close to 9% and plummeting about 5% in the last 24 hours, along with Dogecoin (DOGE), polygon (MATIC), and Ether (ETH).

Overall, this saw a staggering $160 million worth of leveraged long bets liquidated in less than one hour, with the majority of these holdings coming from ETH traders.

Just $4 million of these liquidations were from short sellers, with the majority (98%) coming from leveraged long holdings. At the same time, the majority of these liquidations came from ETH longs, which are worth about $36 million.

At around $27.6 million, Bitcoin was a close second, followed by DOGE and XRP.

Longs “squeezed” as Liquidations Mount

According to a tweet from crypto analyst, Michaël van de Poppe, the deep correction in the markets came because Bitcoin was unable to hold its footing at $29,700-29,800.

This caused a “cascade of liquidations†on the long traders when the cryptocurrency “shot downwardsâ€.

Deep correction on the markets, as #Bitcoin can't hold at $29,700-29,800 and shoots downwards through a cascade of liquidations. pic.twitter.com/B8EigaXHo7

— Michaël van de Poppe (@CryptoMichNL) April 19, 2023

Things may not be as bleak as they seem though.

According to another tweet from Material Indicators, another crypto market data and analytics provider, Bitcoin’s FireChart shows bids in the $28k – $29k range continuing to move up toward the active trading range.

Long day. Time to get some sleep and recharge for tomorrow. Going to leave you with one more #FireChart which shows bids in the $28k – $29k range continuing to move up toward the active trading range. Watching to see if bids replenish enough to take another shot at $31k or become… pic.twitter.com/ixwP1Affx9

— Material Indicators (@MI_Algos) April 19, 2023

And if bids replenish themselves, the bulls will have another shot at $31,000.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.