Key Insights

- Crypto: Bitcoin is nearing its all-time high, with its realized cap reaching new highs.

- The average Bitcoin investor is in profit, with some analysts estimating profits of over 100% for the typical investor

- Technical analysis suggests a potential crypto bull run when Bitcoin starts to correct

- Analyst Gert van Lagen predicts Ethereum could reach $27,000 very soon or in the coming bull run

- Bloomberg analyst Eric Balchunas sees significant retail involvement in Bitcoin ETFs, indicating that smaller players are just as interested as larger ones.

The crypto market has been going haywire for more than a week now.

Bitcoin has been rallying every single day, with no end in sight, and is less than 10% from its ATH.

Some altcoins are following the flagship cryptocurrency’s lead, while others lag.

In total, the crypto market is behaving unpredictably, and nearly everyone is confused.

Will prices continue further upwards, or are we on the edge of a massive and brutal crash that catches everyone by surprise?

Will the altcoins rally while Bitcoin crashes? Will Bitcoin hit its all-time high BEFORE the halving?

Here are some of the biggest crypto tweets on the internet this week, to help you get a feel for what’s been going on and what might happen.

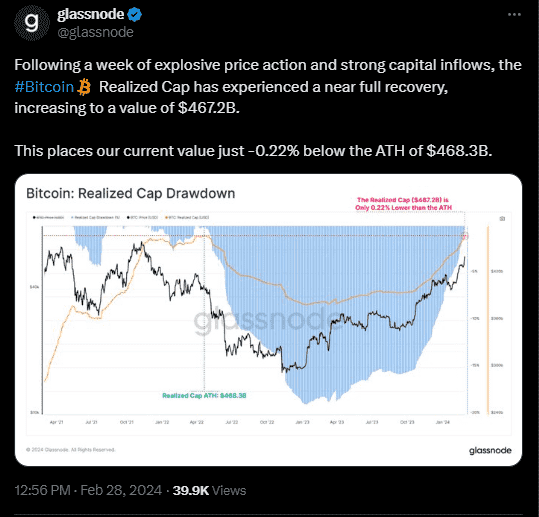

Bitcoin’s “Realized Cap” Is Now At a New Peak

First of all, you should know what “realized cap†means.

This metric, according to Glassnode, is used to measure the current price of Bitcoin, compared to the time at which each coin last moved.

In essence, it shows how much interest investors are showing in Bitcoin at any point in time.

In a new tweet from Glassnode, Bitcoin’s realized cap has reportedly rallied to around $467.2 billion, just $500 million (0.22%) away from its April 2022 high of $468.3 billion.

In essence, it means that the money invested, saved, and stored in Bitcoin is now at new highs, according to a supporting tweet from Glassnode’s lead analyst James Check.

The Average Bitcoin Investor Is In Profit

This isn’t all with the MVRV indicator.

According to Glassnode’s latest newsletter shared this week, Bitcoin’s current MVRV sits at around 2.14.

In essence, this means that the average investor now has unrealized profits of around 114%.

This means that each investor has made more than twice their initial investments.

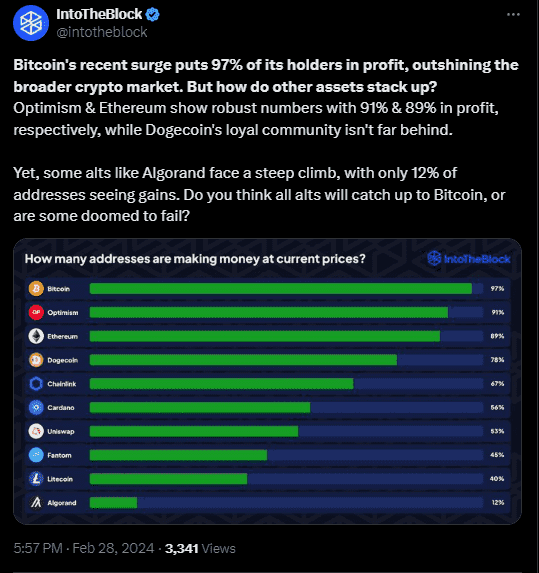

IntoTheBlock shared the same idea in a recent tweet, that showed that 97% of Bitcoin investors in some degree of profit.

These figures show that, in spite of the market’s volatility and corrections, Bitcoin investors are seeing huge returns on their capital.

As of this writing, Bitcoin is currently trading for $62,977, having surged to almost $63,500 on Wednesday.

The only instances in which Bitcoin’s price has increased by this much were in April 2021 and November 2021, when the cryptocurrency was at the peak of the last bull run.

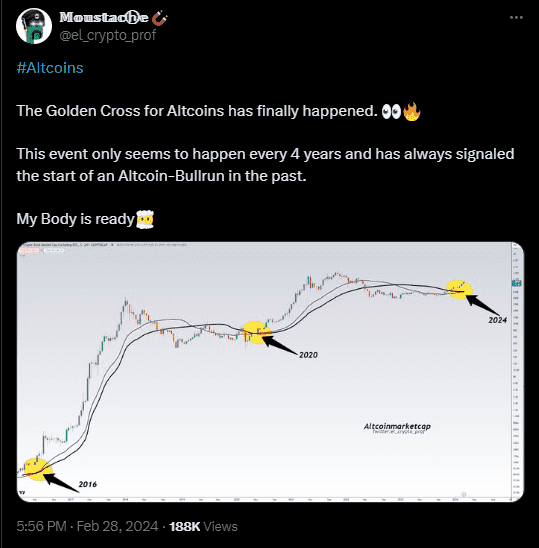

“The Golden Cross For Altcoins Has Happened” Expect A Crypto Explosion

Investors typically expect the prices of the altcoins to rally after Bitcoin does.

According to a recent tweet from analyst, Moustache, “The Golden Cross for Altcoins has finally happened”.

This, he explains, only happens every four years, and has always been a harbinger of altcoin bull runs in the past.

This outlook is corroborated in this tweet by analyst, Negentropic, who states that the altcoin index has increased by around 24% in February alone and that more is coming over the next few weeks/months.

Is ETH going to $27,000???

Everyone knows that Ethereum is set to outperform most other altcoins (and maybe even Bitcoin) in the coming bull run.

But how far up can the flagship altcoin go?

According to a recent tweet from analyst, Gert van Lagen, Ethereum might be adding a few more zeros very soon.

The analyst told all 88k of his followers on 28 February, that the price of Ethereum is ranging very close to completing a major Elliott Wave rally.

This, the analyst says, could push the cryptocurrency straight up to a retest of anywhere between $26,500 and $27,000.

Bloomberg’s Eric Balchunas Massive Retail Involvement In ETFs

However, according to Bloomberg ETF analyst Eric Balchunas, involvement from smaller traders in the recently introduced Bitcoin ETFs—which saw a lot of individual trades on Tuesday—may be heating up.

He stated in a post on Wednesday that, considering the number of trades, there is undoubtedly a significant retail component, even if they do not yet have options or are accessible on many advisory platforms.

This means that there is a significant uptick in the number of smaller investors when it comes to ETFs, compared to institutional investors.

Moreover, according to reports, this week, Bitcoin ETFs also broke through their trading volume record with a huge $7.69 billion figure on Thursday.

Overall, we can say that the ETF market is showing massive signs of interest and health, and could be a major catalyst that helps the price of Bitcoin hit new highs in the coming bull run.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.