Key Insights

- Ethereum has lost more than 13% of its value since reaching a high of $2,118 on Tuesday last week

- According to Nansen, the total amount of ETH locked has hit an ATH since the Shapella upgrade, with an impressive 18,879,775 ETH locked so far.

- About 894,671 ETH and 27,809 validators are waiting for a full exit, and 86.4% of all validators have updated their withdrawal addresses so far

- Ethereum is facing support around $1840 and may trend lower

According to TradingView statistics, Bitcoin has declined by 0.5% during the last day and is now trading at $27,471.

Ether on the other hand, also experienced a decline of over 1.9% and is now well below the $2,000 mark.

On Friday afternoon, the price of Ether (ETH) dropped to $1,833, the lowest level since April 9. Because of this, all of the gains from the recent price increase that followed the successful deployment of the eagerly awaited Shanghai upgrade last week have been completely obliterated by this price decline.

The second-largest cryptocurrency by market capitalization has lost more than 13% of its value since reaching a high of $2,118 on Tuesday. It has decreased by 0.5% over the past day as investors continue to assess the macroeconomic and crypto-industry-specific uncertainties that have impacted the larger digital asset market.

However, several interesting statistics have popped up on the Ethereum network since the success of the Shapella upgrade, and some of them are worth sharing.

Total ETH Locked Hits New All-Time High

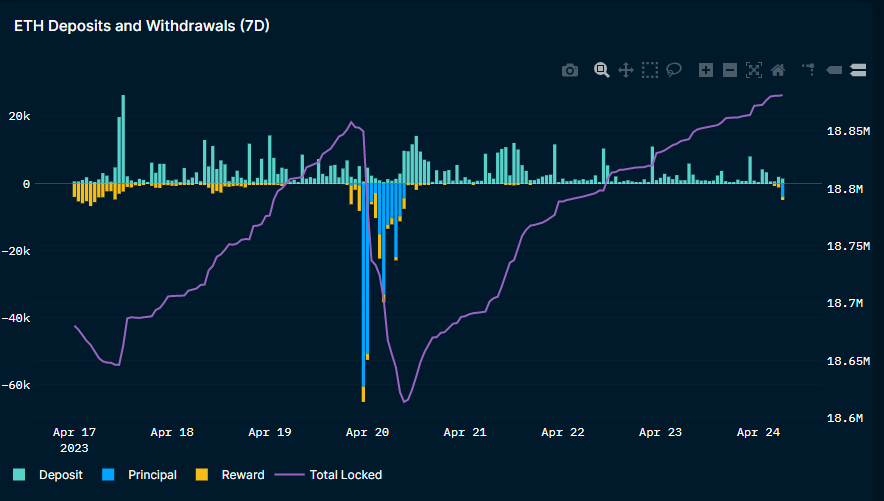

According to a new analytics tweet from the blockchain data and research platform, Nansen, the total amount of ETH locked has now hit a new all-time high since the Shapella upgrade, with an impressive 18,879,775 ETH locked so far.

🔥 Total ETH locked* hit a new all-time high since the Shapella upgrade

18,879,775 ETH locked pic.twitter.com/RVJgmy4znI

— Nansen 🧭 (@nansen_ai) April 24, 2023

According to Nansen, these locked tokens include all ETH that is “out of circulationâ€, like

- ETH staked on the Beacon chain

- ETH Deposited to the beacon contract but not validated yet

- Rewards on the Beacon contract

Nansen also mentioned that:

- About 894,671 ETH is currently waiting for full exit (about 4.7% of the total ETH on the Beacon chain including rewards)

- About 27,809 validators are waiting for a full exit, and

- 4% of validators have now updated to the new and eligible 0x01 withdrawal address

Nansen went further to say that a potential negative balance wave may be on the way, as full withdrawals are processed as the days go by.

A negative balance occurs when the number of withdrawals surpasses deposits as more withdrawals get processed.

As illustrated above, this is what the post-shapella 7-day withdrawals and deposits currently look like.

Ethereum’s Price Analysis

Chart analysis of Ethereum reveals a persistent negative trend.

As bearish sentiment increases, the ETH/USD pair has dropped considerably over the previous week, even falling as low as the $1,850 level.

Ethereum is currently in bear territory and is likely in for further selling pressure over the short term.

As soon as the ETH/USD pair dropped below the crucial $1,882 support, the bears intensified their efforts and the selling pressure increased.

At first, this level offered solid support, but the bulls were unable to hold it, and the price dropped massively below it.

Around $1,842, there is a sizable amount of support for the ETH/USD pair. However, If this support breaks, Ethereum is expected to continue falling and test its next support at $1,800.

In all, Ethereum is currently in bearish territory and stands a real chance of travelling lower if the bulls fail to step up.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.