Key Insights

- The Launch of SpaceX’s Starship ended in a crash-and-burn, and Dogecoin appears to have followed suit

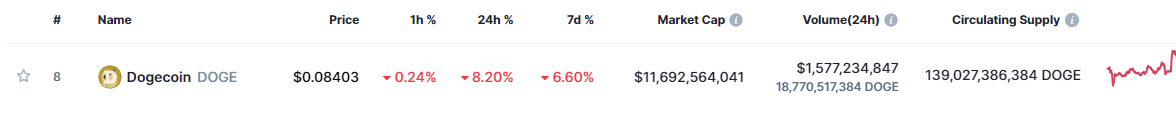

- Dogecoin has taken more than an 8% hit in the daily timeframe alone.

- The volume of whale transactions on the network has significantly decreased since April 4, when it hit a record high.

Dogecoin has been through a rough couple of weeks in April.

From massive rises in price when Elon Musk, one of its biggest promoters bought out X Corp and changed the logo of Twitter into the Dogecoin’s Shiba Inu dog, to a massive 8% dip on its daily timeframe according to CoinMarketCap.

In recent news, Dogecoin’s price crashed alongside SpaceX’s Starship rocket, when it exploded roughly four minutes into its flight after a successful launch.

Dogecoin Crashes Hand-In-Hand With Starship Rocket

The expected launch of SpaceX’s Starship, the most powerful space rocket ever constructed, went off without a hitch.

Any observer, though, may have been perplexed by what took place. The launch was successful, and there were cheers and shouts.

However, there was also an explosion.

ABC News reported via a tweet, that the boosters of the SpaceX Starship rocket failed to detach from the rocket after launch, causing the rocket to explode in midair.

BREAKING: SpaceX Starship rocket explodes in midair after launching as the boosters failed to separate from the rocket. https://t.co/8ENh7lSbSv pic.twitter.com/wTqBgYtYMo

— ABC News (@ABC) April 20, 2023

According to SpaceX, during the test flight, their test spacecraft “had multiple engine failures, lost altitude, and began to fall.”

The Starship’s first launch schedule was unsuccessful due to technical difficulties, pushing back the launch date to Thursday.

Dogecoin and the SpaceX service Musk planned to create with the launch are connected, considering how Musk is actively involved in both.

Therefore, it seems that SpaceX’s woes have rubbed odd on the memecoin.

Dogecoin Investors and Whales React

Crypto whales haven’t bet much on DOGE in the last two weeks. The volume of whale transactions on the network has significantly decreased since April 4, when it hit a record high.

The average daily number of DOGE transactions has also decreased from 1,062 on April 4 to about 273, according to the most recent statistics.

This is happening in the middle of a $258 billion lawsuit filed against Musk by DOGE investors, who claim that he touted the memecoin before intentionally allowing it to crash.

Dogecoin Price Analysis

Things do not look pretty for the memecoin at the time of writing.

CoinMarketCap data shows that Dogecoin has taken more than an 8% hit on the daily timeframe alone.

Things are just as bad on the weekly timeframe as well, with DOGE’s 6.6% slump over the last seven days.

After hitting the $0.1 zone sometime in early February, DOGE began to sink until it hit the $0.62 zone in early March.

However, DOGE recovers almost immediately, creating an ascending trendline and following it straight up to a retest of the $0.1 zone.

However, DOGE’s history has been another failed attempt at reaching the $0.1 zone again.

After a rejection from the $0.095 zone, DOGE declined for a retest of the trendline again and is struggling to rebound.

A close look at the charts shows that DOGE may have broken through this trendline to the underside.

The RSI being neutral also means that the bulls and bears may be evenly matched. DOGE is at a crucial zone at this point and is stuck in a range between its 20 and 50-day moving averages.

The memecoin may either bounce off this trendline and attempt another retest of the $0.095 zone or trend lower and retest its 50-day moving average around $0.078.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.