The NFT markets saw decent growth in 2023 after almost a year-long recession in the markets. However, this growth was stunted by the SVB collapse, which affected about 10% of the USDC reserves.

NFT Sales Trends in 2023

Non-Fungible Tokens Markets have seen an upward trend since the beginning of 2023. Blue-chip Non-Fungible Tokens like Bored Ape and Mutant Ape saw price increases of more than 200%. Till February 15, primary NFT sales grew from $1.7 million to $1.9 million, while secondary sales grew from $16.8 Million to $19.1 million.

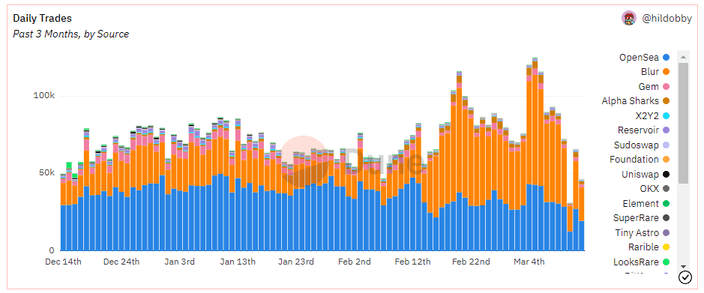

Further, most of the blue-chip NFTs were not much affected due to farming by Ethereum Whales. Here is a snapshot from Dune Analytics on daily Ethereym NFT volumes. Blur and Opensea continue to dominate the market.

The trend in sales was halted by the devaluation or de-pegging of the USDC, which is a stablecoin integral to NFT sales in the Ethereum blockchain.

You can see the sharp downward turn at the right portion of the graph. The sharp turn indicates the market trajectory in Ethereum NFTS just plunged below $500k daily volume. The date when this sharp turn occurred was March 10, 2023. This was the same date as the collapse of the Silicon Valley Bank.

How SVB Affected Non-Fungible Token Sales?

Silicon Valley Bank was a major bank in the technology sector. It has assets above $175 billion. On March 10, 2023, it was forced to cease operations following the California Department of Financial Protection and Innovation directive. All its assets were frozen, including about $3.3 billion worth of USDC reserves. This led to a major liquidity crunch in the crypto markets since USDC is one of the two major ERC-20 stablecoins.

Since most of the volumes of the Non-Fungible Token world exist on the Ethereum blockchain, thus people who were about to buy NFTs using USDC(an ERC-20 coin) saw their funds plummet in value. Further, massive selling of USDC took place, skyrocketing on March 11, akin to the UST collapse. However, withdrawals were soon assured. This was a tweet from Jeremy Allaire, CEO of Circle.

Will NFT Sales Resume?

We expect Non-Fungible Tokens sales to resume in some time as most of the money was lost. However, after the First Citizen Bank comes to the rescue, there might be a way out for users of the SVB collapse. Further, the US Federal Reserve might also inject $2 Trillion, as per JP Morgan. If this comes to be true, then there would be an even stronger trend than before.

Disclaimer: Voice of crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.