Key Insights

- THORChain devs are proposing burning 60 million RUNE tokens ($300M) from the Standby Reserve to unlock more lending capacity.

- They argue that the burning will reduce the supply, potentially increasing the remaining RUNE’s value and attracting more collateral.

- Some support the move to burn these tokens, while others question its logic.

- RUNE recovered from the 2022 decline in late 2023 and is currently trading at $4.5

- This incoming burn could be the catalyst that launches RUNE further up to $7.2 or even higher

THORChain has one of the strongest fundamentals and use cases among L1 networks in the crypto ecosystem.

THORChain basically stands as a middleman, allowing users to exchange one cryptocurrency for another very seamlessly, and without the need for middlemen.

Users can securely exchange Bitcoin for Ethereum, Ethereum for BNB, BNB for Litecoin, etc.

The native cryptocurrency of this protocol is $RUNE, and very recently, the THORChain devs have proposed to burn a massive amount of this cryptocurrency.

Here are the details, what might happen if this proposal is approved, and what the future has in store for $RUNE

The THORChain Proposal

According to a recent proposal published on 30 January, THORChain developers are trying to burn a whopping 60 million RUNE tokens from the Standby Reserve fund.

This amount can be chalked up to roughly $300 million and has got the THORChain community talking.

The issues are that the Standby Reserve Fund currently holds 100 million tokens (about 20% of the total supply of RUNE), and the THORChain developers want to burn a whopping 60 million (which will be 12% of the total supply).

According to the proposal, the developers believe that by burning these tokens, THORChain will be able to pull in more collateral and offer more loans to its users. In detail, the proposal states that:

“By burning ~$300 million in RUNE from standby, it means THORChain can onboard another $100 million in Collateral (33% Lending Lever), which is a $50 million in market-buy on RUNE (200% collateralization ratio).â€

In essence, the developers aim to bring in about $100 more collateral, as well as give the remaining supply of $RUNE a chance to explode upwards, especially now that the next bull run is almost upon us.

This should be good news.

However, the THORChain community has grown divided over the latest developments, as we will soon see

How Has The Community Reacted?

Not everyone is impressed, or even pleased with the recent development.

While a large part of the community has praised the THORChain developers for this massive move, others have kicked against it with tooth and nail.

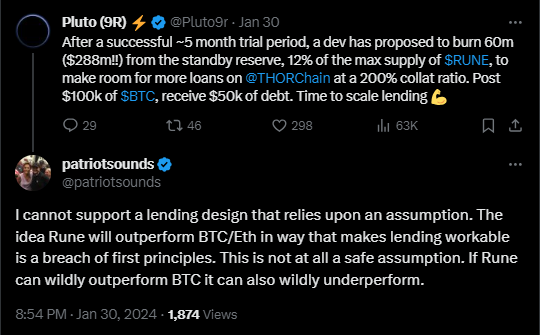

A good example is X user, @patriotsounds, who questions the logic behind burning a whopping 12% of RUNE’s total supply.

@patriotsounds wonders how this new development will affect the core functioning of THORChain, stating that:

“I cannot support a lending design that relies upon an assumption. The idea Rune will outperform BTC/Eth […] is a breach of first principles.

This is not at all a safe assumption. If Rune can wildly outperform BTC it can also wildly underperform.â€

In essence, @patriotsounds means that while the recent development might help the price of THORChain and even help it outperform Bitcoin, the reverse is also possible.

Further, @patriotsounds believes that the decision to burn $300 million $RUNE is based on assumptions alone, and does not have enough rationale backing it.

At the time of writing, the proposal is still under review, and may or may not be finalized.

In all, depending on what the THORChain community votes on, we are bound to see a massive spike in $RUNE if a whopping 12% of the cryptocurrency’s total supply indeed gets burned.

What To Expect From RUNE

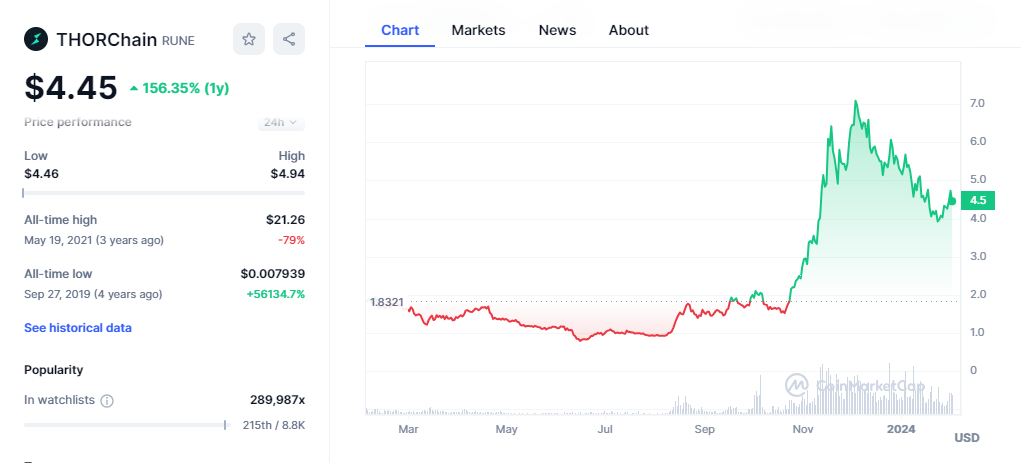

According to CoinMarketCap, RUNE used to trade at an all-time high of around $21.

However, the 2022 bear market hit, and the cryptocurrency declined heavily to around $1 between late 2022 and mid 2023.

RUNE recovered with the rest of the market in the final quarter of 2023 and now trades at around $4.5 at the time of writing.

This shows strength on the part of the bulls.

In the charts, we can see this comeback a lot more clearly, as shown below:

After spending more than a year trading under the $4.3 resistance, RUNE got back above in November 2023 and is now retesting this zone after being rejected from the $7.28 resistance.

So far, the bulls appear to be in control of the narrative, as shown by the zoomed-out chart below:

RUNE recently got rejected from the 50-day EMA shown above and is consolidating against its next move.

If a catalyst like the $300 million RUNE burn occurs, we just might see a full rebound on RUNE and a powerful rally towards $7.28 or even higher.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.