Key Insights:

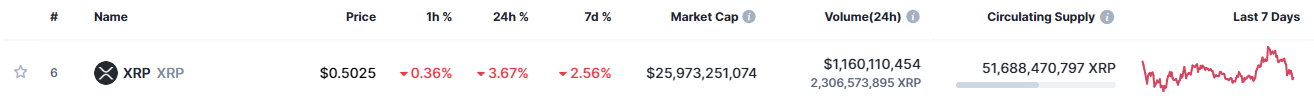

- XRP is down by 2.6% over the last seven days, is especially bearish this week, and is down by 3.7% today

- Defence attorney, James K. Filan, on Tuesday, shared a document via a tweet.

- In detail, the SEC has filed a “Letter of Supplemental Authority†to further support its motion for summary judgment in the ongoing lawsuit.

- XRP is reacting slightly on the bearish side this week.

Tuesday saw a 0.08% decline in XRP, partially undoing the previous day’s gain of 2.39%. Despite the bearishness, however, Ripple Coin avoided the sub-$0.51 region for the first time since late March on Tuesday and concluded the day at $0.51756.

Some of that bearishness, unfortunately, has found its way into Wednesday, and according to CoinMarketCap, the cryptocurrency is barely hanging on to $0.5.

CoinMarketCap data shows that the cryptocurrency is down by 2.6% over the last seven days, and is especially bearish today, with a 3.7% decline.

Why is Ripple Coin so bearish this week? And might the cryptocurrency’s bearish price action be due to external factors?

Let’s find out.

XRP Cracks Under Latest Filing in the SEC v Ripple Case

Updates on the ongoing SEC v. Ripple lawsuit generated attention on Tuesday after a protracted period of silence.

Defence attorney, James K. Filan, on Tuesday, shared a document via a tweet, captioned “SEC files Letter of Supplemental Authority in Further Support of its Motion for Summary Judgment.”

In essence, the SEC has filed a Letter of Supplemental Authority to further support its motion for summary judgment in the ongoing lawsuit.

In the lawsuit against Commonwealth Equity Services LLC, a District of Massachusetts court published a ruling on April 7, 2023, allowing the SEC’s petition for summary judgment and refusing the defendant’s cross-motion for summary judgment.

Because of this, the SEC claims that this ruling validates its allegations against Ripple.

Interestingly, this has had adverse effects on the price action of XRP. Recall that the cryptocurrency’s bearishness started on Tuesday, with a decline that completely annulled Monday’s 2.4% rise.

In essence, Investor mood will continue to be affected by developments in the current SEC v. Ripple case, leading to more bearishness if Ripple Labs takes more hits.

XRP Price Analysis

The price of Ripple is now consolidating beneath a key resistance area. It’s possible that it will try to emerge once more shortly.

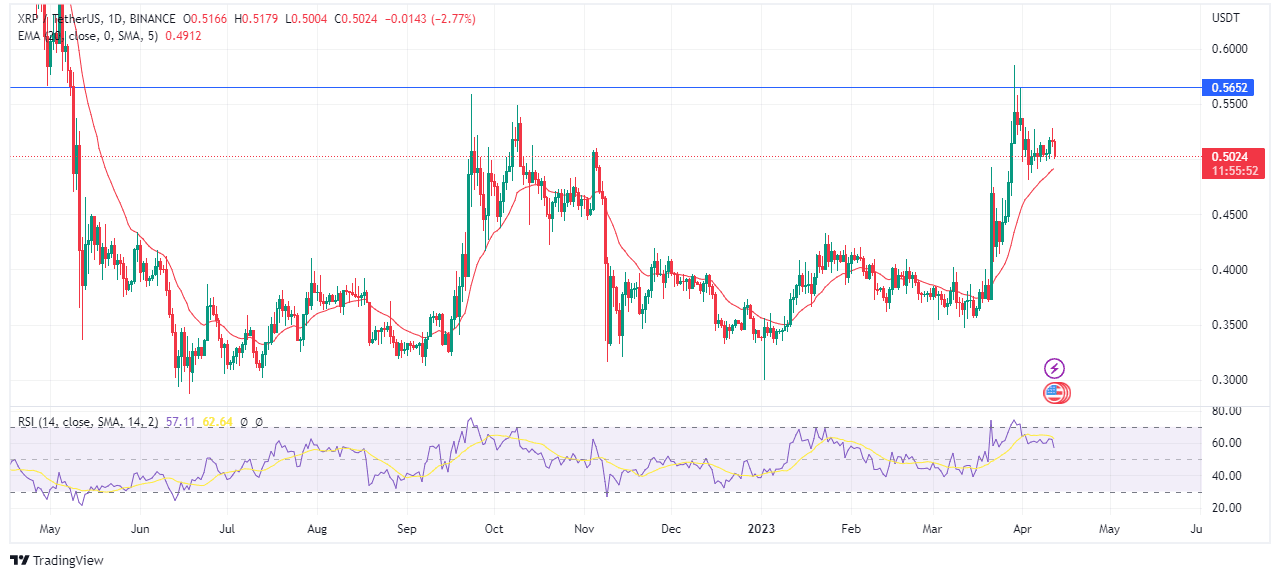

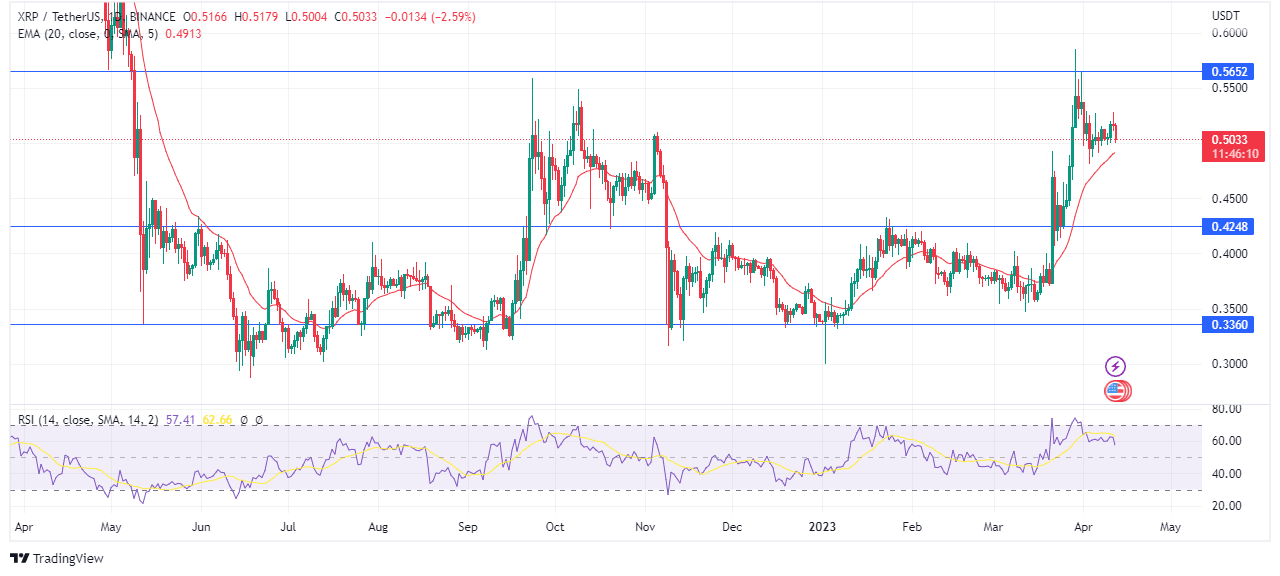

A good look at the daily charts shows that since reaching its highest point this year ($0.55 around March 29), the price of XRP has been rejected, and is now consolidating beneath this zone as the bears continue trying to push it lower, towards its 20-day Moving average (around $0.5).

On the daily chart, the RSI signal line continues to inch towards the neutral zone, further confirming that this bearishness may only be a consolidation phase.

Conversely, if the bears take full control and manage to push the price of XRP lower than its 20-day moving average, the resulting dip would be drastic and might bring the cryptocurrency to its knees around the $0.425 zone.

Further decline may bring XRP to the $0.336 zone.

Bullish Price Targets

If XRP bounces off its 20-day moving average and makes a rebound, a retest of the $0.5 zone is assured and if a breakout at this point happens, the price targets for XRP are

- $0.624

- $0.685 – $0.7

- $0.75

Bearish Price Targets

If XRP hits its 20-day moving average ($0.5) and breaks below, a decline to these zones is possible:

- $0.47

- $0.425

- $0.336

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.