Is crypto in trouble? It has been two weeks since the US Federal Reserve (FED) imposed a hike on its interest rates.

After this decision by the FED, the dollar strengthened significantly, equalizing against the euro, the British pound, and other global fiat currencies. This strengthening of the dollar also had adverse effects on several other financial assets like stocks, indices, and cryptocurrencies.

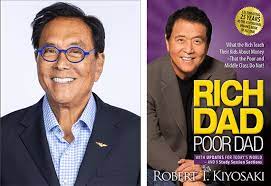

September was a beautiful month for the US dollar. However Robert Kiyosaki, author of the New York Times best-seller, Rich Dad Poor Dad believes the rise of the dollar at the expense of other assets and currencies will be short-lived.

Via a tweet on Sunday (1st of October), Kiyosaki states that he believes the dollar will follow the English pound sterling’s footsteps and inevitably crash by January 2023 after the FED pivots.

Prior to this, Kiyosaki had also tweeted that the United States and England share a historical bond in finances. He also states that crashes like these only make the rich richer and that he had bought many more US Silver Buffalo rounds.

Kiyosaki On Crypto

Long before Kiyosaki’s latest tweets, he had also mentioned that investors should venture into cryptocurrencies before the dollar gets usurped.

According to Kiyosaki, the global markets will likely experience a devastating crash very soon. He termed the dollar as ‘fake money’ and advised investors to opt for silver, a commodity he believes will likely surge in price to about $500.

The FED-rate hike from the perspective of the rest of the world was a catastrophic development. The central banks of countries in the rest of the world are currently struggling to keep up with the skyrocketing inflation brought on by this rate hike.

However, It is important to understand that the FED plans to continue increasing its interest rates. This may cause further drops in value for other global fiat currencies. Investors are beginning to turn to bitcoin and other options to hedge against the resulting inflation and escape its effects.

Investors from the European Union and the United Kingdom have even been observed to be selling their fiat money at record levels to buy bitcoin.

Bitcoin’s Reaction To This

After the FED-rate hike, the price of bitcoin started to trend downward, hitting a low of about $18,200.

However, the trading volume of the crypto was the opposite. The figure has hit a three-month high, despite the price drop and the current consolidation below the $20,000 level.

The idea of investors dumping fiat and jumping on bitcoin’s bandwagon only demonstrates Bitcoin’s ability to serve as a hedge, and fulfill the purpose it was created for.

Overall, bitcoin is starting to equalize against the stock markets and is competing against the dollar to emerge as the best-performing asset in the second half of 2022.

Disclaimer: The author’s comments and recommendations are solely for educational and informative purposes. They do not represent any financial or investment advice. Always DYOR (do your own research)