This Bitcoin ETF institutional inflow trend analysis reveals a dramatic reversal on November 25 as $129 million flowed into Bitcoin ETFs after weeks of heavy outflows, with Fidelity leading at $170 million. The shift, accompanied by $78.6 million into Ethereum ETFs and strong debuts from new Solana and XRP products, signals institutional investors are adopting a more balanced multi-asset crypto allocation strategy as rate cut expectations boost risk appetite.

Key Insights

- Bitcoin ETFs recorded a strong return to inflows after weeks of withdrawals on 25 November

- New altcoin ETFs have also shown strong early traction and attracted strong institutional interest

- Market flows indicated a change a shift toward a more balanced multi-asset approach

The Bitcoin ETF institutional inflow trend analysis shows how the Bitcoin ETFs dramatically changed gears on November 25, marking a potential turning point for institutional confidence. Understanding the Bitcoin ETF institutional inflow trend is crucial for investors, as after weeks of heavy outflows, the major Bitcoin ETFs recorded a strong return to institutional buying with $128 million entering the market, while Ethereum ETFs added $78.6 million in a coordinated shift.

Bitcoin ETF Institutional Inflow Trend: Reclaiming Investor Attention

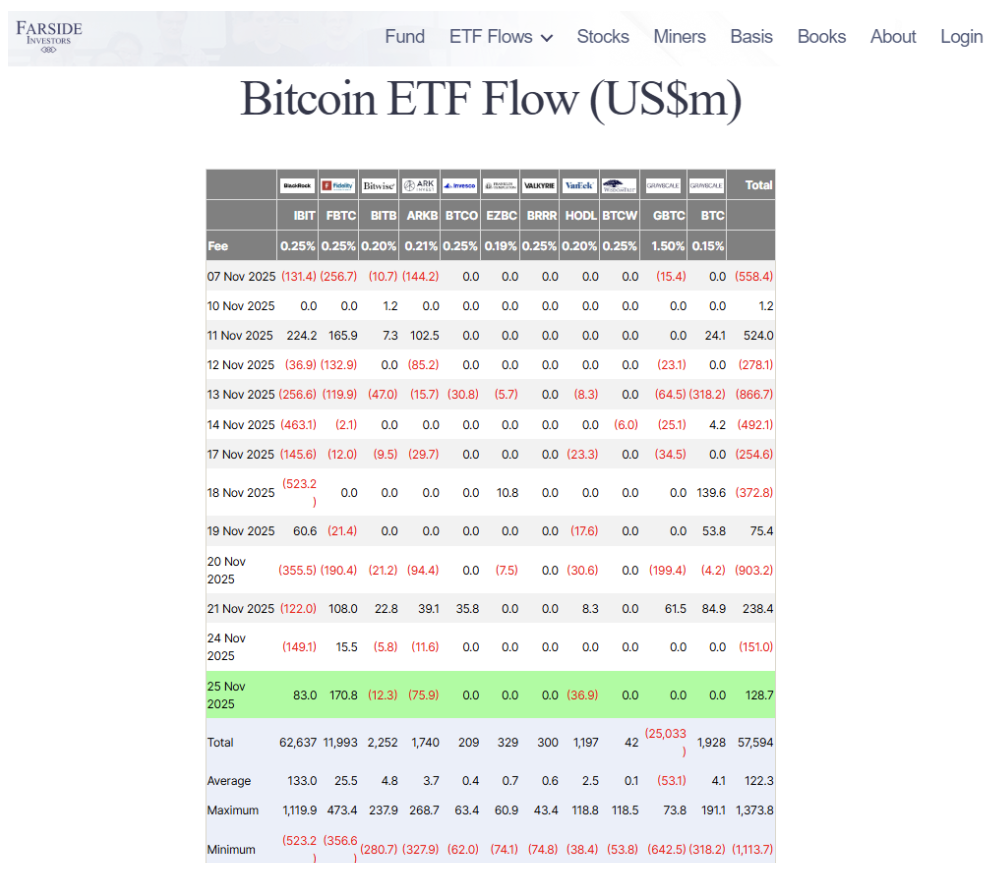

The Bitcoin ETF institutional inflow trend became clear when the Bitcoin ETF market reversed into a net inflow of about $129 million after billions in withdrawals earlier in the month, indicating more than a brief reaction but rather a deliberate move from investors who had cut exposure during the correction, as per Farside.

The fresh activity aligned with a rise in interest across traditional markets, on expectations of a possible rate cut in December.

One fund led the day. Fidelity’s flagship Bitcoin ETF saw most of the inflow with $170 million, followed by Blackrock’s IBIT with $83 million.

Others, like Bitwise, Ark Invest, and VanEck, saw outflows of $12.3, $75.9, and $36.9 million, respectively.

What Drove the Shift?

The Bitcoin ETF institutional inflow trend was driven by several factors, including price stability in the mid- to high-$80,000 range after setting a recent low, with large investors treating such corrections as strategic entry points when market conditions stabilize.

Investors also appear to have gained a stronger appetite for risk assets. Expectations of easier monetary policy in December also offered more confidence across markets.

That environment tends to benefit assets that do not produce income but act as long-term holdings.

Ethereum ETFs Continue to Trail Behind

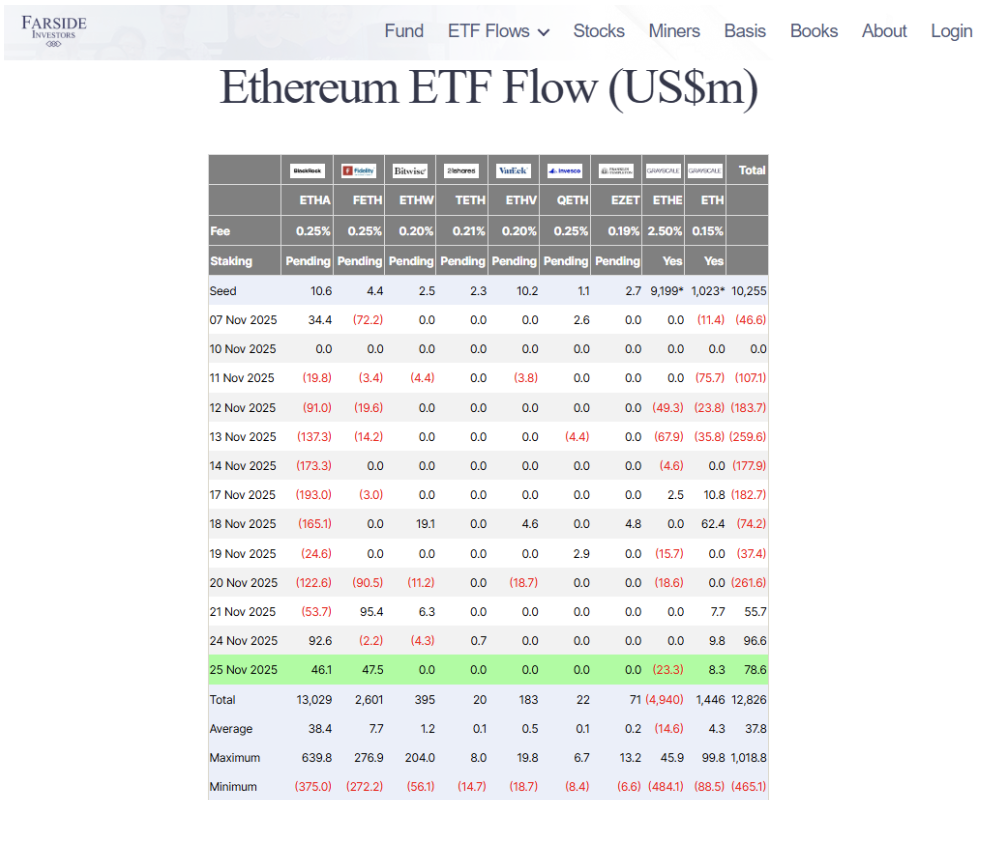

The Bitcoin ETF institutional inflow trend contrasted with Ethereum ETFs’ performance, which recorded total inflows of around $78.6 million while prices hovered below $3,000, suggesting Bitcoin remains the preferred first asset to accumulate when conditions improve.

Several reasons affected this slower recovery. For starters, Bitcoin is often seen as the first asset to accumulate when conditions improve. It is also treated as the more stable point of entry.

Ethereum, on the other hand, still faces more questions around its classification over the long term. This likely affected its performance against Bitcoin and led to a smaller recovery as the market rebounded.

New ETFs Create Fresh Competition

The Bitcoin ETF institutional inflow trend now exists within a broader context, as new ETFs tied to Solana, Dogecoin, and XRP from issuers like Grayscale and Franklin Templeton have drawn institutional attention, with several seeing early inflows that beat older products during their first weeks.

This growth indicated a change in how institutions view crypto allocation. They no longer focus on a single exposure point and are instead more interested in a mix of assets with different use cases and growth profiles.

Solana ETFs have stood out for their consistent streak of positive inflows. Major issuers like Bitwise and Grayscale saw strong demand for their products, and staking played a large role in this.

Particularly, Grayscale and Franklin Templeton’s new spot ETFs saw over $60 million in net inflows on their first day of trading.

A Market Moving Toward Balance

So far, the trading activity for 25 November shows a general stabilization across most of the market, after months of heavy price swings.

The wave of altcoin ETFs also shows strong institutional interest beyond the leading assets.

This period has already given investors a clearer signal that crypto allocation is becoming more balanced. This trend change indicates a move toward a more structured system that will likely affect market flows throughout the coming year.

The Bitcoin ETF institutional inflow trend observed on November 25 represents more than a single-day reversal…it signals a fundamental shift in how institutions approach crypto allocation, moving from concentrated Bitcoin exposure toward a balanced multi-asset strategy that includes Ethereum and emerging altcoin products, likely shaping market flows throughout 2026.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.