Bitcoin’s winning streak extended to five consecutive days in early January with over 1% gains during Asian trading, supported by $471 million in spot ETF inflows, marking the highest single-day total since mid-November. BlackRock’s iShares Bitcoin Trust led institutional buying with $287.4 million as portfolio rebalancing followed year-end tax-loss selling, while geopolitical tensions, including the capture of Venezuelan President Maduro, reinforced Bitcoin’s emerging status as a flight-to-quality asset.

Key Insights

- Bitcoin rose over 1% on Monday, after extending its longest winning streak since October.

- Institutional interest has been on the rise, and spot Bitcoin ETFs are seeing their largest single-day inflows in months.

- Analysts say that the end of tax-loss selling and certain changes in geopolitics are driving this new trend.

Bitcoin has started the first week of the new year with a jump in its price. The asset rose over 1% during Monday’s Asian trading session, which means that Bitcoin is on a winning streak for its fifth consecutive day of gains. This development has been a welcome change for investors after a sluggish end to last year.

Bitcoin Streak Fueled by ETF Inflows

The current streak is not just about small retail trades.

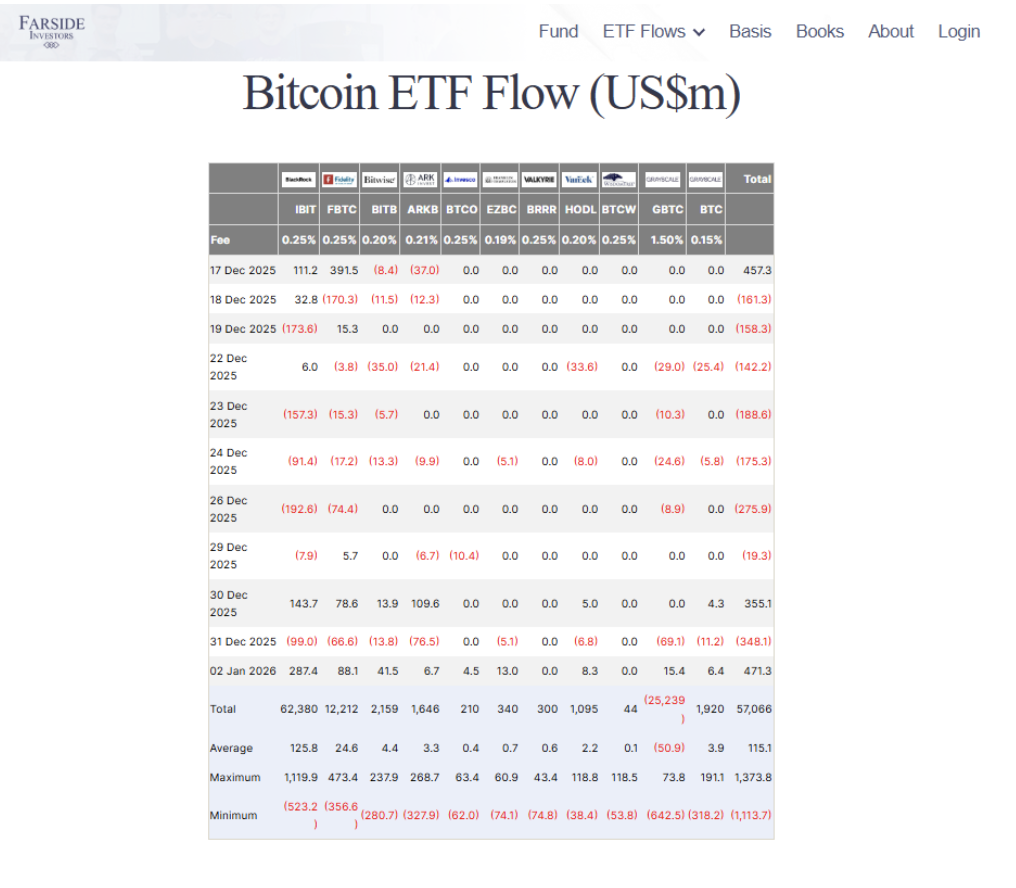

Large institutional investors are moving back into the market with capital, and Farside data shows that spot Bitcoin ETFs had a massive day on Friday. These funds brought in over $471 million in a single session. This was the highest total since mid-November.

BlackRock’s iShares Bitcoin Trust led the charge and recorded $287.4 million in new money. This was the fund’s biggest one-day haul since early October. Other major players like Fidelity and Bitwise also saw millions of dollars flow into their products.

Even Grayscale’s GBTC, which often sees money leaving, recorded a positive gain of $15.4 million.

Experts believe that this sudden interest comes from portfolio rebalancing. Many institutions sold off assets late last year, in a bid to harvest tax losses and lower their tax bills.

Now that the new year has started, these same investors are buying back in.

Markets React to Global Tensions and Safety

The Bitcoin winning streak also comes at a time of high geopolitical drama.

Over the weekend, US forces captured Venezuelan President Nicolás Maduro. This event shook global markets and sent oil prices to four-year lows. Traditionally, such events make investors nervous.

However, Bitcoin held steady and even gained during the chaos.

Some analysts now see Bitcoin as a “flight to quality” asset and much like gold or silver, people turn to it when traditional politics feel unstable.

The Trump administration’s “America First” policy is also a huge part of this. Some believe the government now views digital assets as “strategically important”. This development means that investors now have more confidence to hold through volatile times.

Technical Signals Point to More Gains

As the Bitcoin winning streak continues, technical experts are looking at major price levels. Bitcoin recently jumped from $91,480 to over $92,500.

At one point, it even moved past the $93,000 mark. This price action is happening alongside gains in other tokens as Ether, XRP and Solana all saw their prices rise by about 1%.

Overall, while the streak is a great start, the month is just beginning. Traders are watching to see if the ETF inflows stay consistent and if BlackRock and Fidelity continue to see hundreds of millions in new capital, the price could test new highs.

The capture of Maduro may continue to affect the market and if energy prices stay low and inflation remains contained, the Federal Reserve might adjust its stance on interest rates.

This would provide even more fuel for riskier assets like Bitcoin. As of writing, the market now shows that investors are betting that the worst of the last year’s slump is over.

Data from CoinGecko and TradingView now show a market that is waking up. After a 6% loss last year, Bitcoin now has a lot of ground to make up. However, the first few days of the year show that the gears have finally shifted.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.