Bitcoin veterans deposited 13,000 BTC ($1.48B) to exchanges since October 1, 2025, amid $400M in 24-hour liquidations on November 3 (mostly longs, $97M), as BTC dipped to $108,000 from $115,000 highs post-Fed’s 0.25% rate cut.

Key Insights:

- Bitcoin veterans have deposited 13,000 BTC worth $1.48 billion to exchanges since October 1.

- This happened amid nearly 400 million dollars in liquidations on 3 November alone.

- The market currently holds near $110K as traders debate whether whale movements are good or bad.

$400 million in Bitcoin liquidations rocked the crypto markets this week. Bitcoin veterans are making waves again, and some of these long-term holders have moved massive amounts of BTC to exchanges over the past month.

$400 Million in Bitcoin Liquidations Trigger Whale Movements

Since October 1, long-time Bitcoin holders have deposited nearly 13,000 BTC worth approximately $1.48 billion to major exchanges.

These movements come as Bitcoin trades near $108,000 after a rocky October. The timing has been a source of speculation about whether veterans are cashing out or preparing for leveraged trades.

One of the most active whales (1011short), who reportedly earned nearly $197 million in profits by shorting before the last FED rate decision was also involved.

Bitcoin OGs are dumping $BTC!

BitcoinOG(1011short) has deposited ~13K $BTC($1.48B) to Kraken, Binance, Coinbase, and Hyperliquid since Oct 1.

Owen Gunden has deposited 3,265 $BTC($364.5M) to Kraken since Oct 21.https://t.co/qyZllJWfFShttps://t.co/u3b8zn5iYe pic.twitter.com/qQe3dYlnfp

— Lookonchain (@lookonchain) November 3, 2025

According to reports, the wallet cluster linked to “1011short” has been sending BTC to exchanges throughout October and early November.

Some of the recent transfers include 500 BTC worth $55 million to Kraken on November 2 and several smaller deposits between 70 and 150 BTC to Hyperliquid.

Market Stabilises as Bitcoin Holds $110K

Bitcoin is trading above $110,000 as Hong Kong begins its business week, while Ether sits at $3,880.

Both digital assets are down by a great deal over the last 30 days, and while BTC has fallen 10%, ETH dropped 14% as traders continue to consolidate positions.

Meanwhile, around $400 million in crypto derivatives were liquidated over the past 24 hours.

About $97 million in long positions and $58 million in shorts were wiped out, and the pattern indicates that there is an ongoing flush of overleveraged longs.

Federal Reserve Dampens Rate Cut Expectations

The Federal Open Market Committee slashed rates for the second consecutive time in late October. The federal funds rate now sits in a target range of 3.75% to 4.00%. But Fed Chair Jerome Powell’s recent comments have cooled expectations for further cuts.

Powell said another cut in December isn’t “a foregone conclusion.” This statement has boosted the US dollar and driven investors away from risk assets like crypto. Treasury Secretary Scott Bessent warned that tight policies have already slowed parts of the economy.

“A further reduction at the policy rate at the December meeting is not a foregone conclusion,” Fed Chair Powell says. pic.twitter.com/d9BYcpzyWX

— Yahoo Finance (@YahooFinance) October 29, 2025

The FedWatch Tool now shows the probability of another rate cut has fallen to 69.3%. This reflects growing doubts about further policy easing.

The Fed also announced it will end quantitative tightening effective December 1. This means it will stop reducing its balance sheet after over three years of QT.

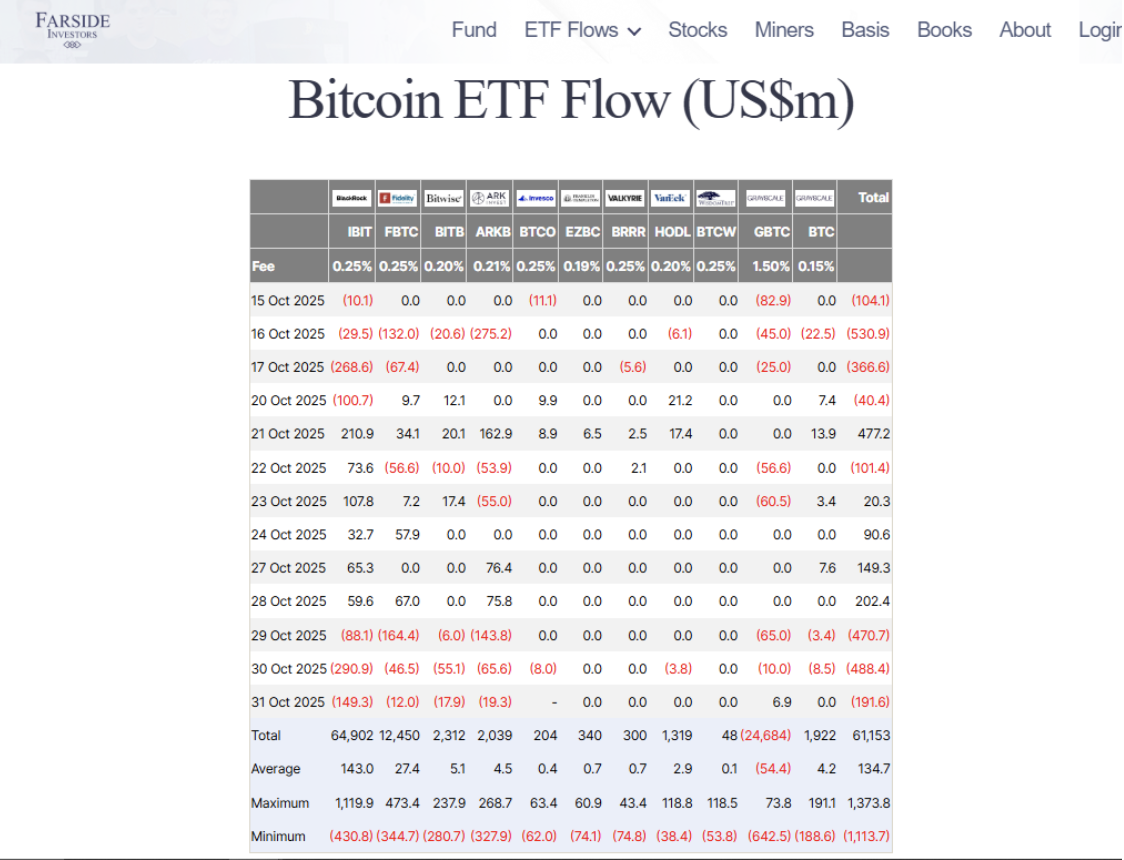

Bitcoin ETFs See Heavy Outflows

Meanwhile, Bitcoin ETFs continue to see heavy withdrawals. Recent data shows that US spot Bitcoin ETFs recorded $1.15 billion in outflows last week alone. The largest withdrawals came from funds managed by BlackRock, ARK Invest and Fidelity.

These outflows indicate that investors are pulling back from Bitcoin-linked financial products. On Wednesday alone, Bitcoin ETFs registered $470 million in withdrawals and marked one of the most significant exits in October.

Spot Bitcoin ETFs saw $388 million in net outflows in a single day and this represents the largest exodus since August

What’s Next for the Market?

Overall, the crypto markets have begun the week in a wait-and-see mode. Traders are looking for a catalyst that has yet to materialize, and the market needs a clear signal before making its next major move.

Presidents Xi and Trump are hinting at a possible truce regarding rare earth materials, and Germany could be working to introduce its own strategic Bitcoin reserve.

Overall, the market is waiting to see whether these veteran Bitcoin holders will follow through with sales.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.