Key Insights

- Over $700 million in liquidations occurred last week, just as Bitcoin dropped below $98,000.

- Solana is testing critical support at $223 and could either rebound toward $300 if the bullish momentum holds or decline toward $187 if it fails.

- Ethereum is hovering near its psychological support of $3,000 and could rally to $3,500 or drop to $2,722.

- Litecoin is testing support around $92, with a rebound that could target $146 and $200 in the works.

- If critical support zones hold, XRP and Dogecoin could face steep corrections but rebound soon.

The Crypto market took a nosedive over the last week, with Bitcoin falling below the $98,000 price level for the first time in weeks.

This decline caused a cascade of liquidations across the market, totaling $700 million, according to Coinglass.

The market’s liquidation cascade

This said, the best time to buy into the market is now when cryptocurrencies are trading at a discount.

Here are some of the best tokens to keep an eye out for this week, especially as the market struggles to find its footing.

1. Solana (SOL)

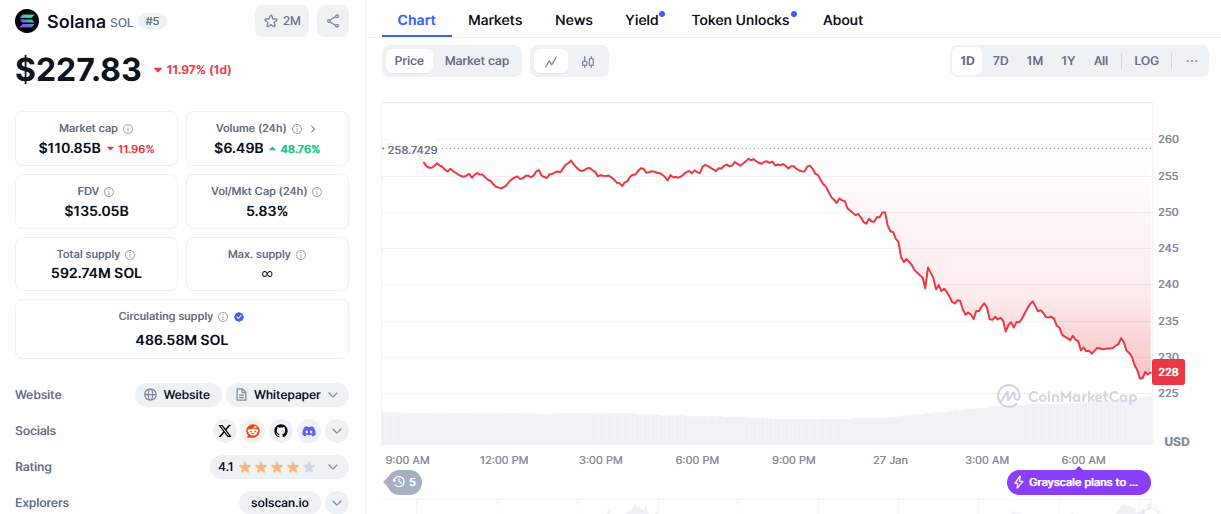

Solana has been one of the worst-affected cryptocurrencies in the ongoing market slump.

The cryptocurrency has been down by around 12% over the last 24 hours before writing, along with a slightly harsher 13% decline in the weekly timeframe.

Solana’s price performance

In the charts, Solana is displaying an interesting pattern.

The cryptocurrency has declined for a retest of the 200-period EMA around $223 on the 4-hour chart, which has historically served as a strong support.

Ongoing price performance of Solana

In contrast to the daily chart, if the bulls are unable to maintain Solana around this price level, the cryptocurrency could face a decline further down to its 200-day EMA around $187.

However, if the $223 price level holds up, Solana should see a rebound that takes it straight up to the $300 zone or higher.

2. Ethereum

According to CoinMarketCap, Ethereum has also been hit relatively hard, with a 9% decline over the last 24 hours.

Ethereum’s price performance

The cryptocurrency has also shown a 10% decline over the last week, with an ongoing retest of the psychological $3,000 zone.

According to the charts, Ethereum has just lost the 200-day EMA of around $3,125 but hasn’t entirely closed underneath yet.

Ethereum’s ongoing performance

That said, Ethereum’s medium—to long-term price outlook will depend on its performance between the $3,125 and $3,000 zone.

If Ethereum breaks further below $3,000 and closes with the bearish influence still intact, the cryptocurrency could continue to fall to the next major support zone around $2,722.

On the flip side, a break above $3,125 could salvage the situation and put Ethereum back on track to test the $3,500 mark again.

3. Litecoin

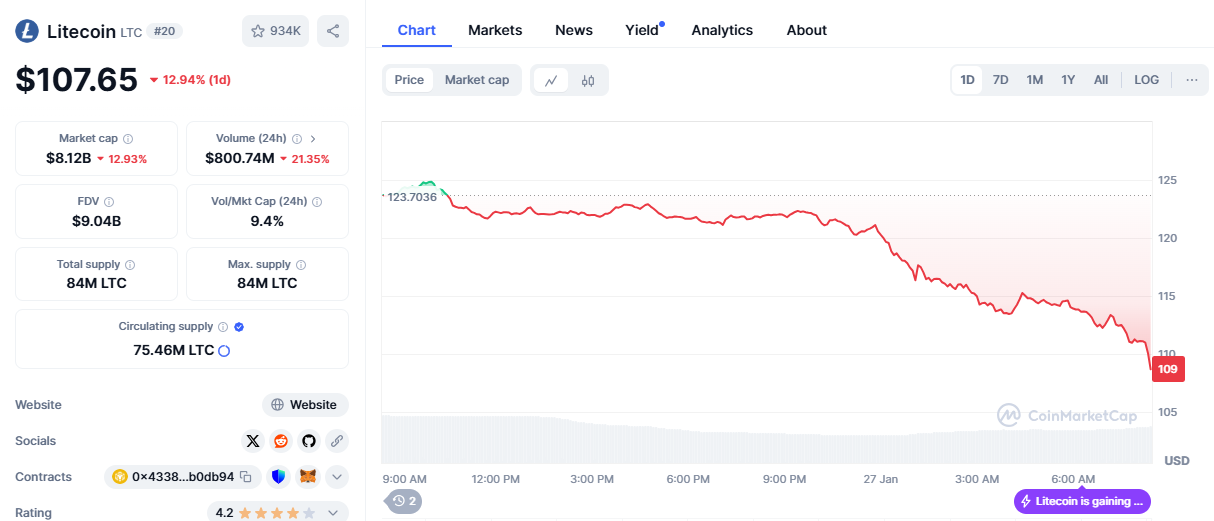

Litecoin is another badly hit cryptocurrency on all timeframes. The cryptocurrency and the rest of the market are facing a 13% decline in the daily timeframe.

Litecoin’s ongoing decline

The cryptocurrency is also down by around 13% on the weekly timeframe, indicating that the bearish momentum is fresh.

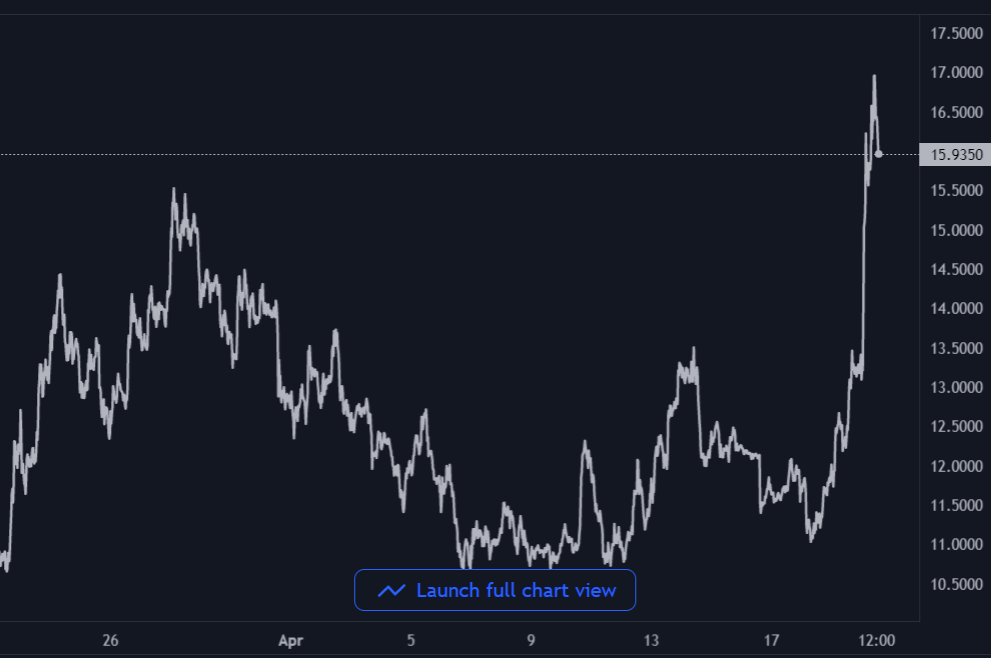

The cryptocurrency currently trades in an inverse head-and-shoulders pattern on the daily chart, indicating that a decline further to the 200-day EMA around $92 is still possible.

Litecoin’s price performance

Investors must wait for the price of Litecoin to stabilize somewhat and look out, especially for what happens around the $92 zone.

In the case of a rebound, Litecoin could be poised to break above its previous local high of $146 and even target $200.

4. XRP

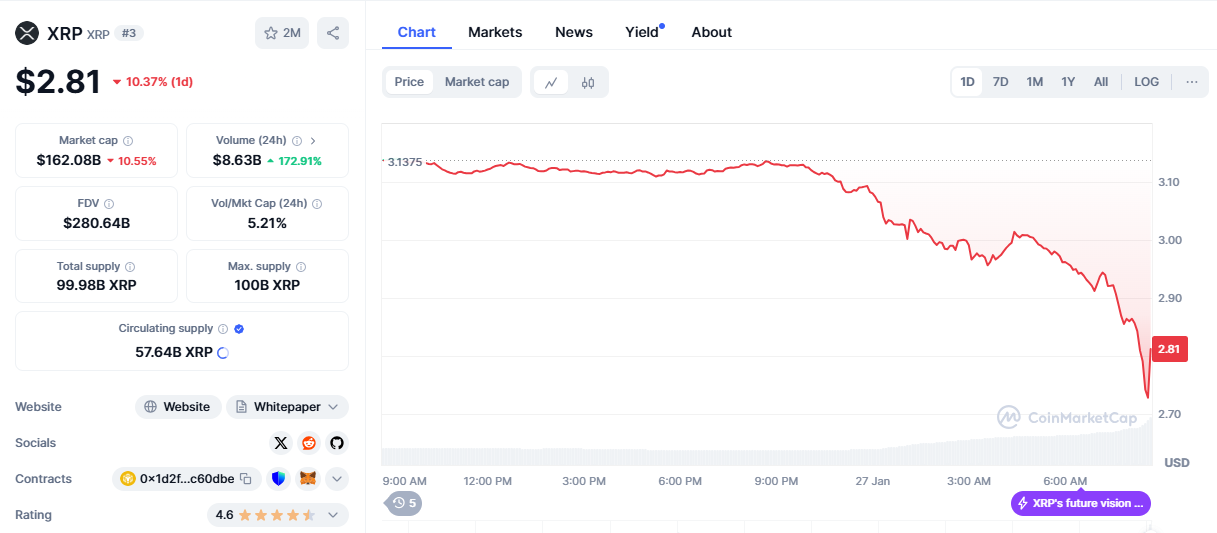

Despite being one of the best-performing cryptocurrencies over the last month, XRP has declined strongly with the rest of the market, with a 10% price decline, according to CoinMarketCap.

Price action on XRP

According to the charts, the bullish impulse on XRP came right after a breakout from the illustrated symmetric triangle.

The cryptocurrency rose and broke above the $3 price level for the first time since 2018 before hitting a high of $3.4.

Price action on XRP

According to the 4-hour chart, the bears attempted to drive XRP below the 200-period EMA around $2.7.

However, the bulls have stepped in and are attempting to save XRp from crashing further down to the $2.5 zone, as highlighted by the Fibonacci extension tool.

Investors must be aware that a retest of this $2.5 zone could still occur. However, if the bulls are able to prevent a further decline from this price level, a rebound to the upside could take XRP straight up to $5.

5. Dogecoin

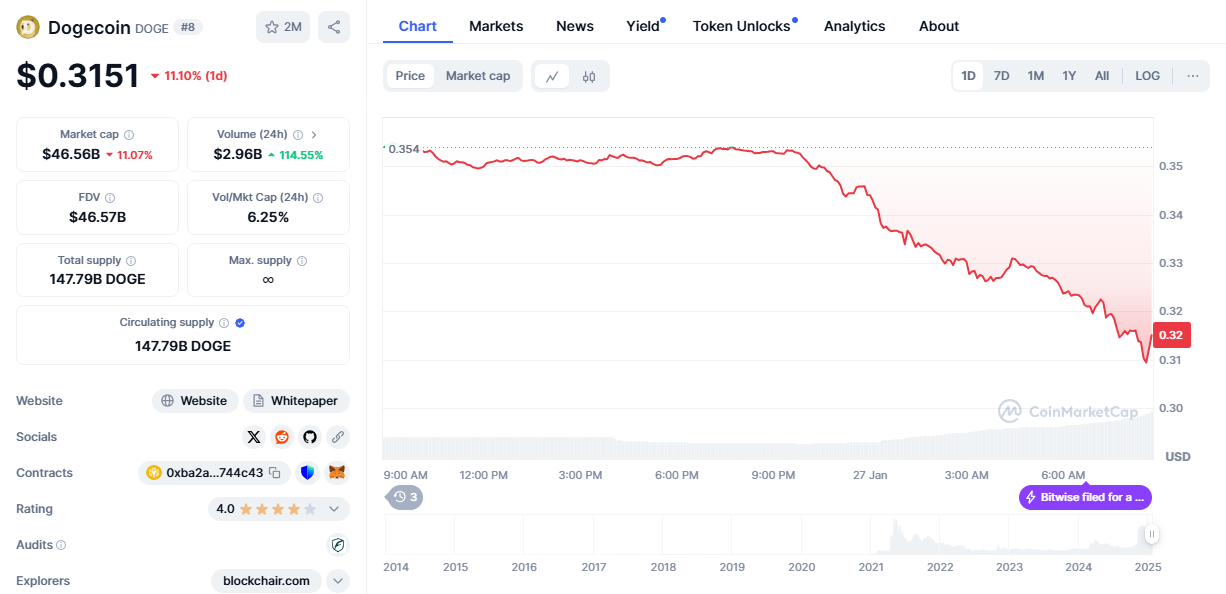

Dogecoin joined the rest of the market in the ongoing decline and is now down by around 10% over the last 24 hours.

Dogecoin’s price performance

The cryptocurrency has a current price of $0.3152 and is down by a harsher 16% over the weekly timeframe.

According to the charts, Dogecoin might be in for some more correction. However, depending on how quickly this correction comes, the cryptocurrency is set to rebound and continue towards its $1 target.

Dogecoin’s ongoing market decline

According to the charts, the cryptocurrency could continue further downwards and retest the $0.28 zone before starting this rebound.

However, a break below the $0.26 zone (which also happens to be the 200-day EMA) would invalidate this outlook and lead to an even steeper correction for Dogecoin.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.