Key Insights

- Standard Chartered Bank now sees Binance’s BNB coin reaching a staggering $2,775 by the end of 2028.

- This bullish prediction came from Geoff Kendrick, the head of digital asset research at Standard Chartered.

- Another major development fueling this bullish sentiment is VanEck’s recent filing with the U.S. Securities and Exchange Commission (SEC).

- Growth on the part of the cryptocurrency will depend on more than just price charts.

The crypto market continues to surprise both retail and institutional investors.

Among the latest predictions comes from Standard Chartered Bank, which now sees Binance’s BNB coin reaching a staggering $2,775 by the end of 2028.

If this price level is reached, it will stand as more than a 360% increase from the cryptocurrency’s current price of around $600.

The prediction comes from BNB’s growing correlation to major cryptos like Bitcoin and Ethereum, as well as Binance’s dominance in the CEX space.

Here are the full details of this prediction.

BNB’s Journey from ICO to Market Giant

BNB was launched in 2017 as part of Binance’s Initial Coin Offering (ICO) and was initially used to offer trading fee discounts on the platform.

Fast forward to present times, and BNB has become one of the most valuable digital assets in the world.

It currently has a market cap of around $84 billion and is sitting strongly among the top 5 cryptocurrencies like Bitcoin, Ethereum, USDT and XRP.

Performance of BNB

Despite criticism about the cryptocurrency’s centralization, transaction fees and limited developer activity, BNB has weathered all odds.

Its close integration with Binance (which processes billions in daily volume) has given it a strong user base and is likely to play a major role in its success over the long term.

Why Standard Chartered Is Bullish on BNB

This bullish prediction came from Geoff Kendrick, the head of digital asset research at Standard Chartered.

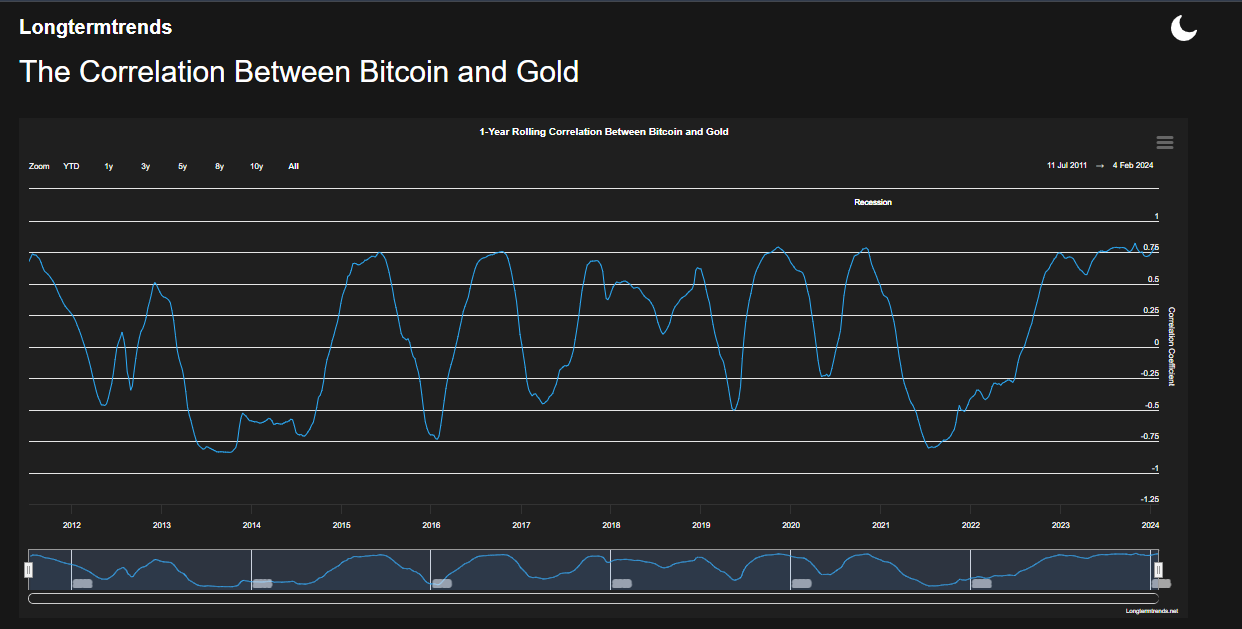

Kendrick believes that BNB’s price action has been consistent with that of Bitcoin and Ethereum since May 2021.

This similarity in returns (and volatility) sets the cryptocurrency up as a proxy of sorts for the general crypto market.

Kendrick notes that as long as Binance holds on to its market leadership, BNB is likely to benefit.

“BNB’s value drivers are unlikely to change anytime soon,” he noted in the bank’s recent report.

He added that the token’s fate mirrors the relevance and strength of the Binance platform.

ETFs Could Play A Part

Another major development fueling this bullish sentiment is VanEck’s recent filing with the U.S. Securities and Exchange Commission (SEC).

VanEck is looking to launch its first spot-based BNB ETF sometime soon, and if approved, this would stand as the first U.S.-domiciled ETF that holds actual BNB tokens.

Vaneck Files With SEC to Launch BNB-Backed ETFhttps://t.co/UYB6uGhWPU

— John Morgan (@johnmorganFL) May 5, 2025

The ETF will provide a regulated way of accessing BNB’s price movements to a n even bigger class of investors.

Staking capabilities might even be included as a way to generate passive income for fund investors.

If the ETF ends up approved, it would further push BNB as a legitimate investment and even spark increased demand from both institutional and retail investors.

Market Outlook for BNB

At the time of Standard Chartered’s report, BNB was trading at around $613. The asset is currently recovering from a relatively weak weekend and is still seen as one of the most bullish cryptocurrencies.

However, analysts continue to warn that growth on the part of the cryptocurrency will depend on more than just price charts.

Some of the major factors to watch include an SEC approval or rejection of the VanEck BNB ETF, how well Binance succeeds in its current regulatory battles and expansion efforts, as well as the ability of the BNB chain to attract developers and more use cases.

Regardless of most other factors, BNB’s future is largely dependent on Binance’s continued success.

Standard Chartered’s $2,775 prediction is an ambitious one but is not entirely ridiculous, considering the market’s general direction.

Prediction or no, investors should consider proceeding with caution and diversify their investments while watching industry trends.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.