Key Insights

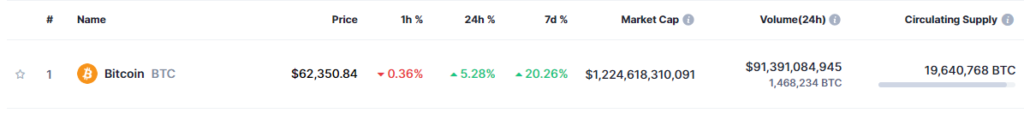

- Bitcoin price has surged over 20% in the last week, reaching over $62,000.

- Analysts predict a market correction for Bitcoin, with a potential drop of -15% by April

- The correction is set to happen due to factors like the upcoming Fed meeting, Bitcoin halving, and Ethereum upgrade.

- The recent surge is partly attributed to the approval of several Bitcoin ETFs.

- If a correction occurs, though, altcoins may benefit and see significant price increases.

Bitcoin has beaten analyst expectations many times over this week, when it rallied from around $51,000 to more than $60,000 in less than 10 days.

The cryptocurrency first broke above the $60,000 zone on 28 February 2024 and has been at the forefront of growing demand and optimism.

The snapshot above even shows that the cryptocurrency is trading at more than $62,000, and is up by around 20% in the last week alone.

However, it might be sensible to be cautious at this point.

The crypto market “always†crashes almost as hard as it pumps eventually, and several analysts are starting to predict a market decline anywhere from here.

One of these is an executive from Matrixport, who predicts that Bitcoin will crash soon, the altcoins will take its place, and that short-term traders should be cautious, come March/April.

Matrixport’s Co-Founder Predicts a 15% Drop By April

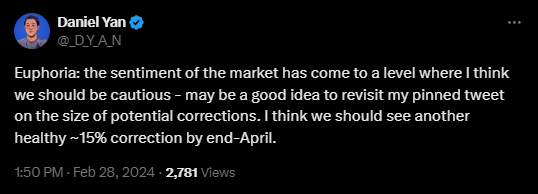

Daniel Yan, the co-founder of Matrixport took to Twitter to share his thoughts on what has been going on in a post.

In the post, Yan opined that now might be the time for investors to be cautious in their doings, as far as the crypto market is concerned.

Yan says that the current market sentiment has reached a state of “euphoriaâ€, and that Bitcoin is poised to undergo a “healthy correction†of around 15% by the end of April.

Yan says that several macroeconomic factors might kickstart this sell-off in March.

One of these is the upcoming meeting of the U.S. Federal Reserve.

Others include the Bitcoin halving itself, as well as the upcoming Ethereum Dencu upgrade (all of them, less than a month apart).

While Yan admitted that it might be hard to figure out the timing and direction of the Bitcoin market when these events occur, the facts point to them happening all the same.

“From where, 65k or 60k or now? I really don’t know. I don’t even know which comes sooner – a new ATH in BTC or the correction. Again – you don’t have to bother too much on this if you are a long-term holder. For those who are tempted to trade the short-term moves, watch March,”

Bitcoin ETFs Fuel The Rally

Bitcoin’s latest surge may have also been due to the approval of several spot Bitcoin ETFs earlier this year, by the U.S. SEC.

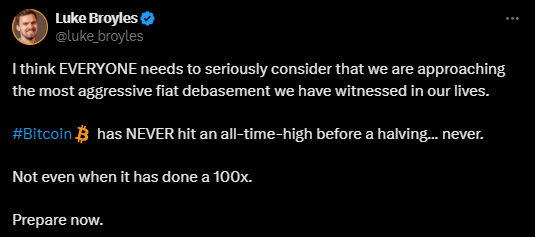

One thing to take note of is that Bitcoin has never, for once, rallied this hard before a having event.

This recent pump on the flagship cryptocurrency has been attributed to everything from the halving itself to a new class of investors and even better institutional adoption.

However, one of the most prominent theories is that the spot ETFs have somehow affected Bitcoin’s market dynamics.

For example, the iShares Bitcoin Trust, launched by BlackRock has attracted more than $7.5 billion in assets under management since its launch, making it one of the largest crypto funds in the world.

These ETFs have turned out to be major boosts for the adoption and confidence in Bitcoin among institutional investors, as shown by the “extreme greed” reading of the crypto fear and greed index.

All of these facts point to Yan being right about a possible correction.

Bitcoin is rallying by this much even before the halving, the RSIs show strong overbought conditions, and the fear and greed index shows “extreme greed” among investors.

Why Things May Not Be So Bad

One of the major factors to consider is how Matrixport has been wrong about some predictions in the past.

For example, the firm predicted against the approval of the spot Bitcoin ETFs on 3 January 2024, citing “political and regulatory risksâ€

Eight days after, 11 of these ETFs got approved in the US, and have seen inflows worth billions of dollars since then.

Since the approval of these ETFs, Bitcoin has gained more than 50% in value, reaching new highs and outperforming most other assets.

On the flip side, if Yan and Matrixport happen to be right, and we do see a correction, now might be the time to get in on some ALtcoins.

Popular analyst, Michaël van de Poppe in a recent tweet, mentioned that Bitcoin is set to stabilize very soon.

When this happens, the analyst predicts that we are set to see several altcoins double from their current price levels.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.