Bitcoin unexpectedly dropped below $110,000 after the Fed’s 0.25% rate cut to 3.75%-4.0%, as Jerome Powell’s neutral stance reduced December cut odds from 90% to 71%, triggering $700 million in liquidations amid ‘sell-the-news’ sentiment. Traders remain cautious, eyeing liquidity relief from ending quantitative tightening in December, while altcoins like Dogecoin and Solana showed mixed results in the volatility.

Key Insights

- Bitcoin unexpectedly fell below $110,000 after the Fed’s recent rate cut.

- While rates were cut this month, Jerome Powell hinted that no further cuts are guaranteed this year.

- Traders are moving with caution as markets await more liquidity in December.

Bitcoin plunges to $110K after the US Federal Reserve announced a 0.25% rate cut and hinted there may be no guarantee of another one this year.

The move was expected by most traders and triggered quick volatility across the crypto market. Many investors had already priced in the rate cut, which left room for disappointment after Jerome Powell’s tone.

Bitcoin fell to around $109,000, according to CoinMarketCap. This is interesting because only a day before, the cryptocurrency traded around $115,000.

Why Bitcoin Plunged to $110K?

The Fed lowered its benchmark interest rate to a range of 3.75% – 4.0%. This was its second cut of the year, after a similar one in September. The move ended a long pause in monetary easing and showed that policymakers want to support growth while still keeping an eye on inflation.

Powell confirmed that the central bank plans to stop Quantitative Tightening (QT) by December.

JUST IN: 🇺🇸 Federal Reserve announces it will stop shrinking it’s balance sheet on December 1 👀 pic.twitter.com/1SYilnW1cA

— Bitcoin Magazine (@BitcoinMagazine) October 29, 2025

QT involves letting government bonds mature without replacing them. This reduces liquidity in the system, and ending QT means more liquidity could return to markets in the coming months.

Despite this, Powell’s message was cautious. He said that officials have “not made a decision about December.” This means that traders are now uncertain about the Fed’s next move.

The statement was what caused the sell-off across risk assets, including crypto.

Bitcoin and Liquidity Expectations

Liquidity remains one of the biggest drivers of Bitcoin’s performance. When money becomes easier to borrow and invest, risk assets tend to rise. The upcoming end of QT could create a more favorable environment for crypto going into the rest of the year.

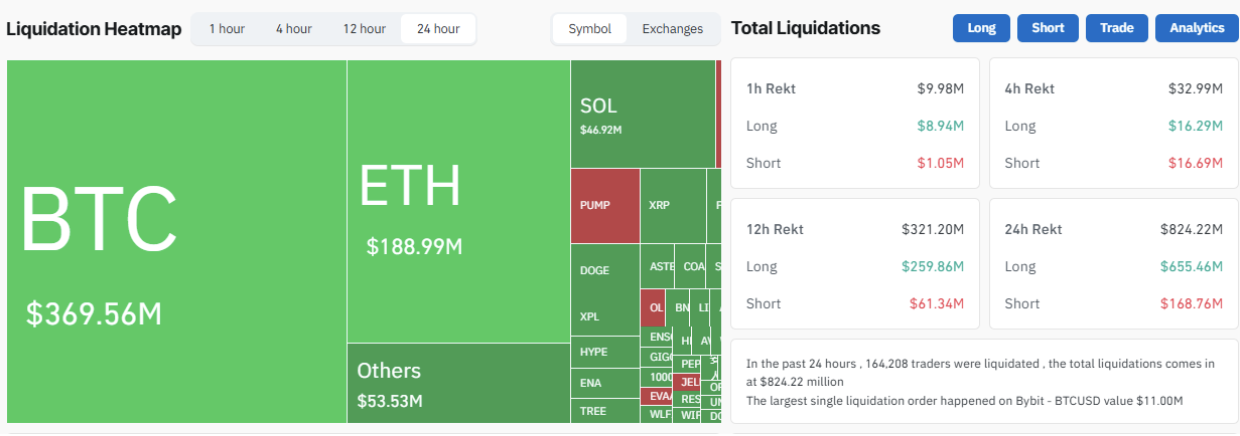

However, the immediate reaction showed that traders were expecting a clearer sign that the FED could continue easing. According to data from CoinGlass, over $700 million in leveraged crypto positions were liquidated within 24 hours of the Fed’s announcement.

Around 151,000 traders were affected as Bitcoin and Ethereum dropped.

Altcoins are showing mixed results after the rate cut. Dogecoin traded around $0.19 while Binance Coin hovered near $1,110. Solana stayed close to $194 and XRP was steady at $2.56.

Some traders rotated into altcoins, expecting lower rates to boost risk-taking, but volatility kept gains limited.

Powell’s Neutral Stance

During his press conference, Jerome Powell said inflation is “not so far” from the Fed’s 2% goal. He also pointed out the need for data-driven decisions.

He mentioned that policymakers had “strongly differing views” on how fast to ease rates. Some members even voted for a larger 50-basis-point cut, while others preferred no change.

JUST IN: 🇺🇸 Fed Chair Jerome Powell says “we’ll be adding reserves at a certain point” to their balance sheet 👀 pic.twitter.com/bngGQVgsMW

— Bitcoin Magazine (@BitcoinMagazine) October 29, 2025

His comments led traders to reduce expectations for another cut in December.

According to CME data, the probability of a December rate cut dropped from 90% before Powell’s speech to about 71% after. The two-year Treasury yield jumped 9 basis points as investors reassessed short-term expectations.

These mixed signals left traders weary. Bitcoin’s quick drop to $109,000 and recovery to $111,000 showed how sensitive the market remains to every Fed comment.

Historical Context of Bitcoin’s Response

Bitcoin has often reacted strongly to monetary policy changes. During the Fed’s emergency cuts in March 2020, Bitcoin lost nearly 39% before rebounding.

In contrast, the September rate cut produced only mild movement and showed that expectations were already built into prices.

The latest reaction fits that pattern. Traders expected a 0.25% cut so the move itself didn’t surprise anyone. What caught the market off guard was Powell’s reluctance to promise more cuts.

That uncertainty triggered a fast sell-off, but analysts believe it could be temporary.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.