Key Insights

- The crypto market experienced a 3% decline on 27 August, with Bitcoin retreating from $65,000 and Ethereum falling below $2,700.

- Despite the crypto market’s downturn, the fear and greed index has remained hopefully neutral, which indicates underlying health.

- Heavy liquidations occurred in the last 24 hours, with the bulls losing a lot more than the bears.

- Bitcoin is facing resistance at the $63,000 level, and a break below could lead to further declines.

- On the other hand, Ethereum is stuck in a consolidation between $2,686 and $2,800, with a break below $2,500 likely to cause further weakness.

The crypto market has taken a step backwards today, with a 3% decline in the total market cap and Bitcoin back at the $63,000 zone after briefly tapping $65,000.

On the other hand, Ethereum has slipped below the $2,700 zone and is now fighting to reclaim it.

The crypto market’s heatmap

Like yesterday, the market is almost entirely red today but has maintained its optimistic, neutral reading of 56/100 according to the fear and greed index.

The crypto fear and greed index

So far, some of the biggest gainers on the market include Helium, Akash, and Artificial Superintelligence Alliance, all of which have experienced 10%—14% price increases within the last 24 hours.

Others, like Notcoin, Sats, Ordi, and Toncoin, are the heaviest losers, with 6% and 10% declines within the same timeframe.

The crypto market’s liquidations

The liquidations from the last 24 hours were relatively heavy, with around $109 million taken from traders overall.

Coinglass data shows that the bulls suffered the worst, losing around $90 million compared to the bears’ $18.77 million loss.

Overall, the Bears have the upper hand today. Again, investors should consider approaching the situation with caution.

Is This It for Bitcoin?

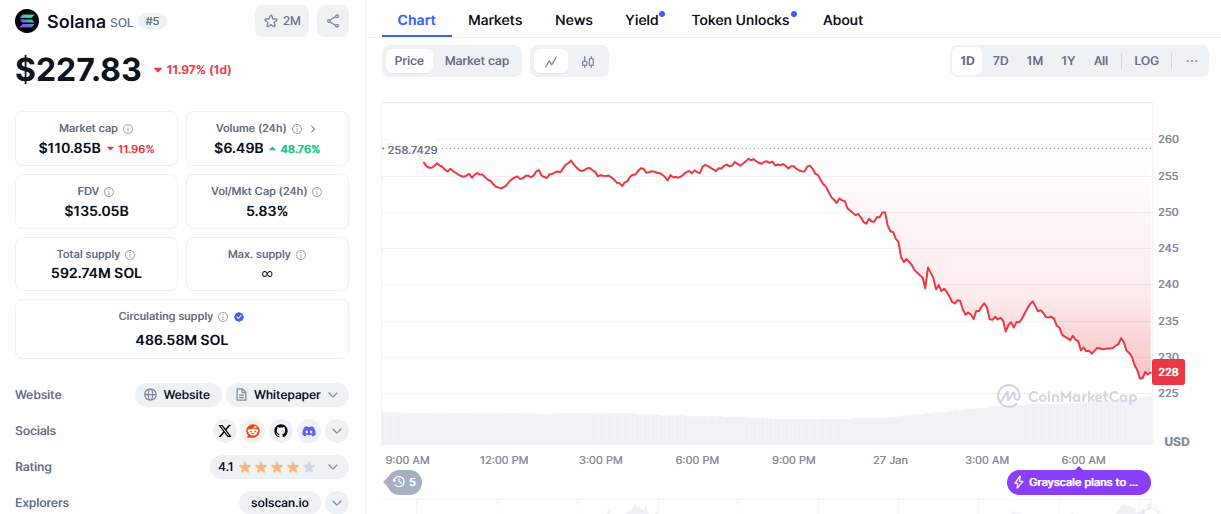

According to the charts, Bitcoin is showing more pronounced signs of a rejection from $65,000.

The cryptocurrency trades at $63,148 at the time of writing and continues to travel downwards, with yesterday’s decline alone sitting at around 2.6%.

Bitcoin’s price performance

The $63,000 mark is now supporting the cryptocurrency and is maintaining its standing above this price level.

This was also the major resistance that kept the cryptocurrency down throughout most of early and mid-August.

That said, if we see a break below, Bitcoin will inevitably crash lower until the bulls step in and cause a rebound.

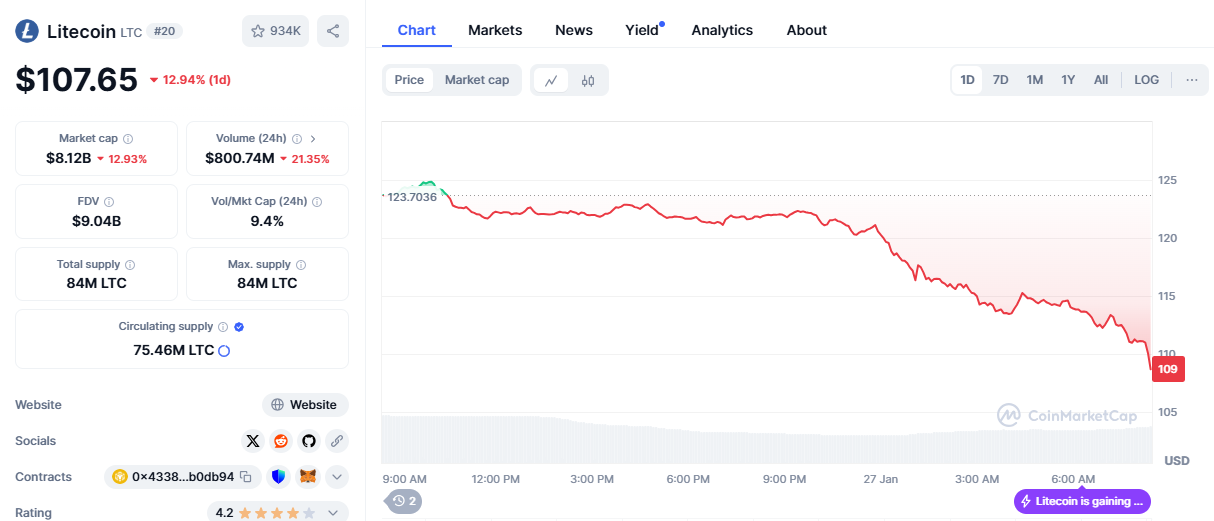

Ethereum Stuck in a Consolidation

After successfully breaking above the $2,686 price level, Ethereum was rejected at around $2,800.

The charts show that the cryptocurrency is now stuck within this range and aims at a rebound from $2,686.

Ethereum’s price performance

This means that the bulls have to maintain the price of Ethereum above this $2,686 level, which would inevitably cause a crash further down.

Ethereum needs to keep itself afloat above the $2,500 zone if said crash happens because a break below would be another lower low, which is a sign of further decline.

Watch Out for Helium (Hnt)

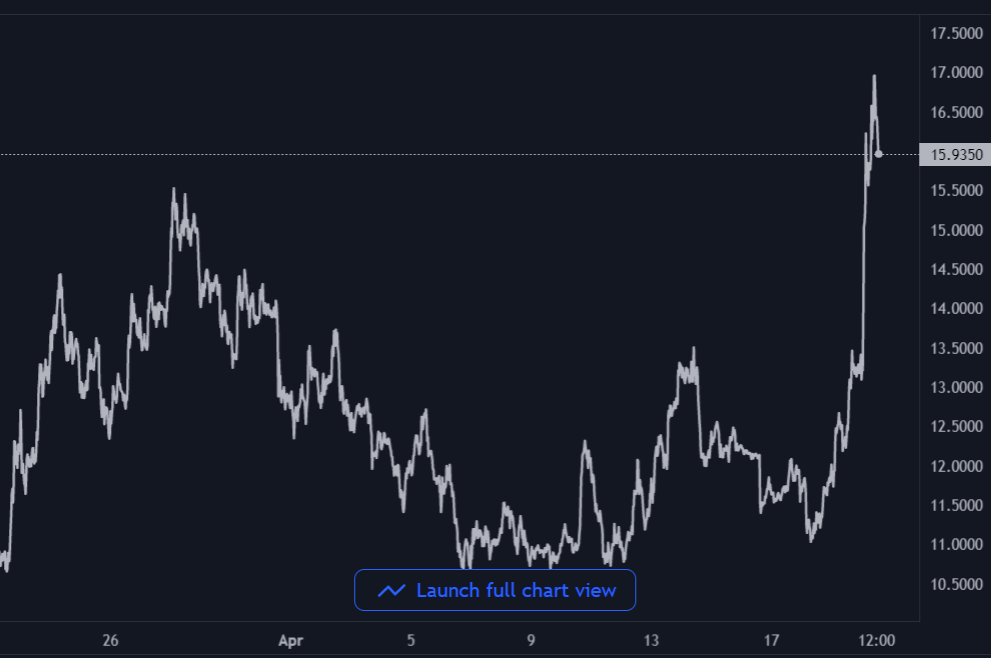

As mentioned earlier, Helium is one of the best-performing assets on the market by far in the daily timeframe.

It also turns out that cryptocurrency follows its Fibonacci retracement levels much more clearly than the average crypto, which makes it easy to predict.

Retracement levels on Helium

The chart above shows that on 18 August, after being rejected from the $7.99 price level, the cryptocurrency declined and tested the $6.289 price level (50% on the FIB).

The bulls caused a rebound from here, which means that if Helium is to form a new higher high and break above $7.99, the likely price target would be $8.9 (23.6% on the FIB)—which means that Helium has a rally of 25% at least, to complete from here.

If the bulls feel a bit more generous, we might see a rally towards $11.23.

A Strong Rebound on Akash

According to the charts, Akash has rebounded strongly off the base of the descending channel below and is already forming a minor ascending trendline.

Akash in the charts

This makes the cryptocurrency poised to continue further upwards and retest the $4 resistance block.

Upon hitting this resistance, the bulls and bears might have to decide on what happens next with Akash, whether breakout or rejection.

However, in the meantime, the cryptocurrency has a clear 31% rally incoming before this $4 retest, which is a modest price increase.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.