Key Insights

- The crypto market’s capitalization increased impressively in the past 24 hours, with Bitcoin reaching $58,900.

- The market sentiment has improved despite remaining in the “fear” zone.

- Ordi, Sats, Mantra, DogWifHat, and Mantra saw some of the best price increases and are leading the market.

- However, despite Bitcoin’s price rise, the market’s liquidations were relatively low.

- Bitcoin’s engulfing candlestick pattern shows that an uptrend might be incoming.

The crypto market has moved significantly upwards over the last 24 hours, with a 2.6% increase in market cap and a Bitcoin price of $58,900.

The crypto market’s heatmap

The crypto heatmap has turned green over the last 24 hours, with the crypto heatmap recovering from a reading of around 43/100 to 47/100—which is still a fear reading but is much better than yesterday’s.

The crypto fear and greed index

Some of the best gainers include Ordi, Sats, Mantra, DogWifHat, and Mantra, all of which have experienced price increases of 10% to 21% in the last 24 hours.

On the other hand, some of the worst market losers are Tron and ImmutableX, both of which have relatively small price declines of less than 1%.

The crypto liquidation heatmap

Interestingly, the liquidations were relatively mild considering Bitcoin’s small price movement to the upside, with a $74 million figure.

The bears lost more than twice as much as the bulls, with $52 million taken from the sellers and around $21.95 million taken from the buyers.

Today, the market favours the bulls despite the need for even more momentum to keep things going.

Bitcoin’s Sign Of Recovery?

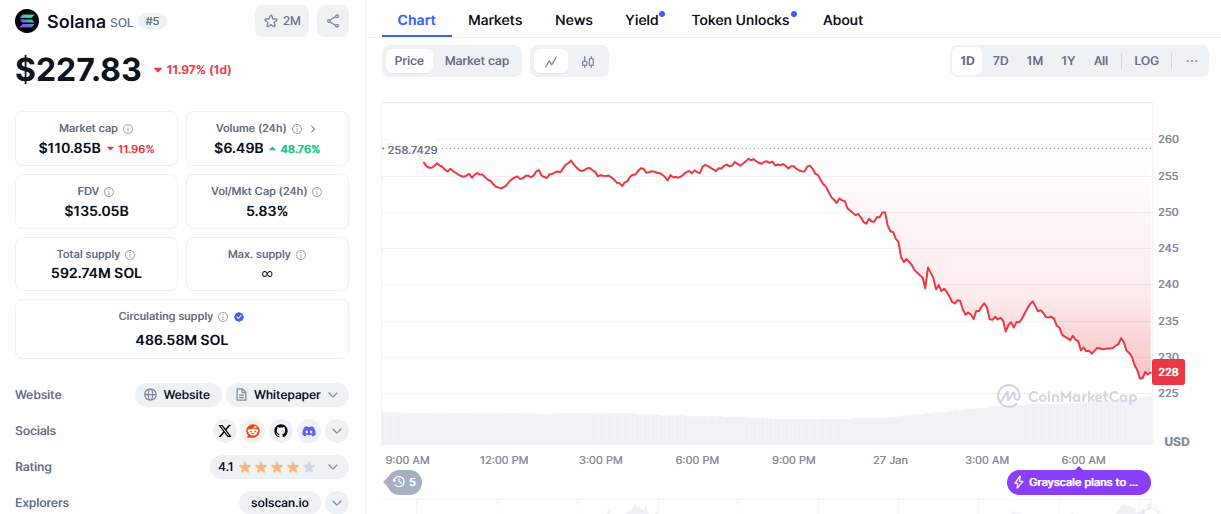

To start things off, Bitcoin’s bullish candlestick for Monday completely engulfed Sunday’s bearish one, which is a great sign.

Bitcoin’s price action

Bitcoin’s price action

Source: TradingView

The cryptocurrency appears to be having trouble breaking above its 25-day EMA of around $60,136, which is a great price level to watch.

Bitcoin last traded above this dynamic resistance on 31 July, and another break above it might positively affect the cryptocurrency’s price action going forward.

Can Ethereum Make It?

Just like Bitcoin, Ethereum’s candlestick for Monday completely engulfed Sunday’s, which is another good sign.

More importantly, Ethereum managed to clear the $2,515 resistance completely and is now testing it at the time of writing.

Ethereum’s price action

This retest is Ethereum’s attempt to convert this price level into support. If the cryptocurrency is successful at this and the bears do not cause another break below, we should see Ethereum consolidate for a while and then continue upwards once again.

Some major price levels to watch out for include $2,850, $3,086, $3,322 and $3,614 (where the breakout from the descending channel above will likely happen from.

Ordi’s Rally Has Begun

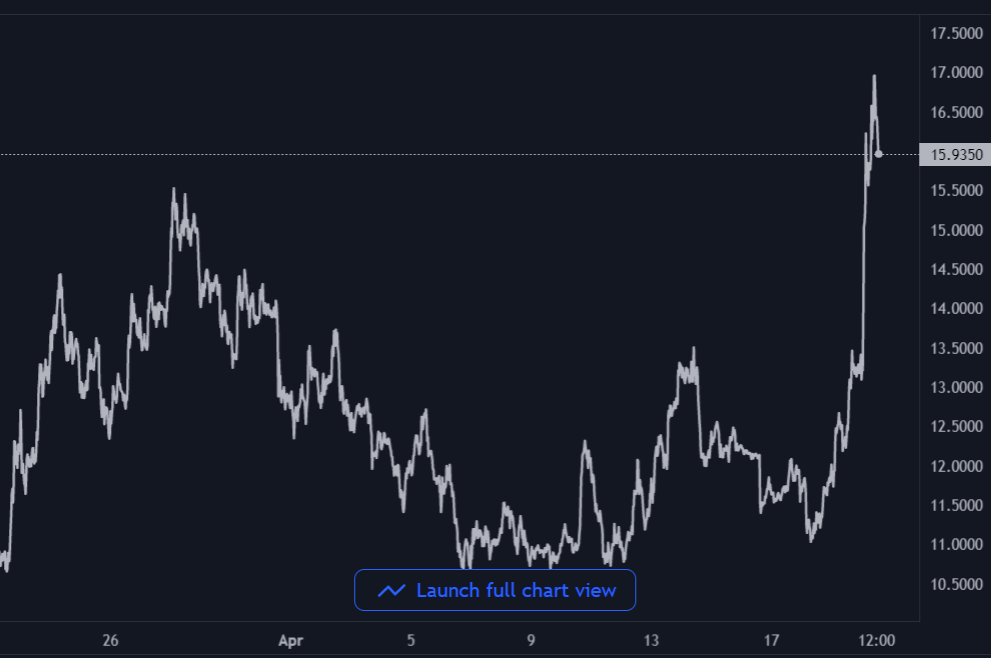

Ordi is in a great place at the moment after breaking out of the falling wedge formation below, reversing for a retest, consolidating and then rebounding.

Ordi’s price performance

This presents a great entry point for the cryptocurrency, and careful investors might want to wait for a new higher high above $37.24 to confirm that Ordi is now bullish and fit for investment.

For the best trading opportunities, look for $37.24, $50, $59, $68, $79.14, and $97.11.

Watch Out For DogWifHat 9WIF)

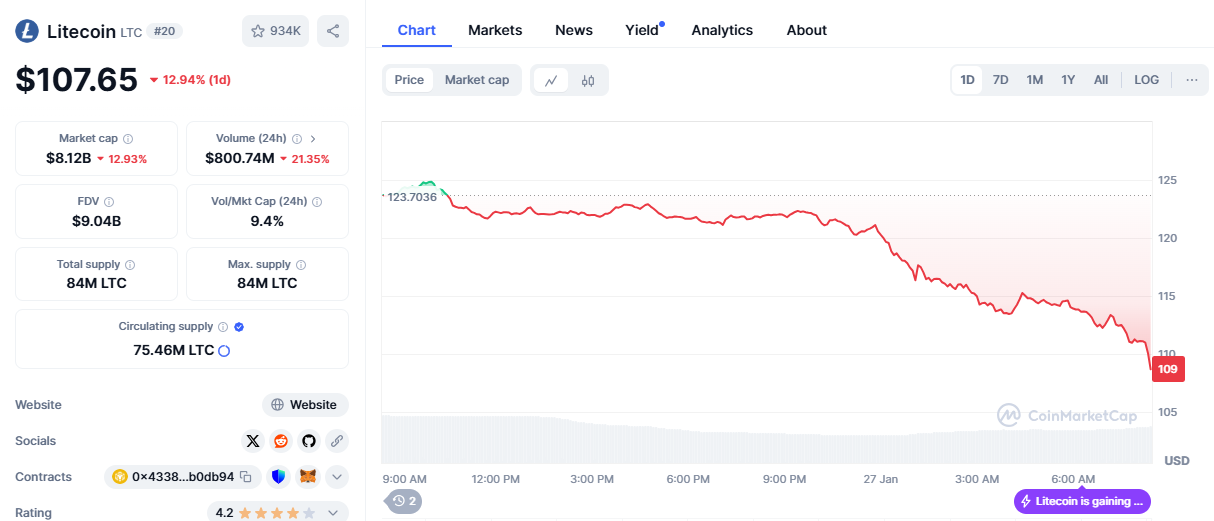

WIF, after hitting the lower trendline of the falling wedge above, is now trending upwards.

The cryptocurrency has even formed a mini ascending trendline and should soon test the upper boundary of the formation.

WIF’s price action

As shown, WIF is being pinned down by its 25-day EMA (red line at $1.641) and is attempting to break above.

That said, investors should watch out for what happens around this $1.641 price level, considering WIF’s current price of around $1.576.

A break above would accelerate the memecoin’s ascent, straight up to the psychological $2 resistance.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.