Key Insights

- The crypto market recovered last week but has remained relatively stagnant with a slight bearish bias.

- Bitcoin is facing resistance at the $65,000 level and needs to clear it out for further upward momentum.

- Ethereum is close to a major resistance level of $2,800; a successful break could lead to a rally of $3,000 or more.

- Artificial Superintelligence Alliance (FET) has broken out of a descending wedge formation and is looking towards a bullish trend.

- Floki is approaching a key resistance level at $0.00015, and a break above this could help form a new high.

The crypto market recovered slightly at the end of the previous week, with Bitcoin breaking above the $60,000 mark and hitting the $65,000 zone.

However, the market hasn’t moved by much since and is even completely red, as shown by the crypto heatmap below:

The crypto market’s heatmap

The crypto fear and greed index shows major health signs, though, with a slightly greedy “neutral” reading of 56/100.

So far, some of the market’s best gainers include Artificial Superintelligence Alliance, Bittensor, Tron, and Aptos, which have gained 2.5%—7.8% in price in the last 24 hours.

The crypto fear and greed index

On the other hand, some of the market’s worst losers include ZCash, Polygon, Brett, Klaytn and Helium, with 5% – 6% declines within the same timeframe.

According to Coinglass, liquidations have been relatively mild, with $79 million taken from traders in the last 24 hours.

The crypto liquidation heatmap

While the bulls lost $52.8 million, the bears have around $26.41 million in losses, which means that the market is in favour of the bears.

Overall, the red on the crypto heatmap and the liquidation rates show that the bears have the upper hand in the market today.

This means that investors should be patient and conduct thorough research before opening any new positions.

Can Bitcoin Cross the $65,000 Hurdle?

According to the charts, Bitcoin’s price action has been sluggish lately but has done a great job of rebounding off the $49,000 low from 5 August and rallying to the top of the descending channel as shown:

Bitcoin’s price direction

As shown above, the cryptocurrency has also successfully cleared its 50-day SMA (blue line), which is a good sign overall.

The problem now is that Bitcoin is showing signs of rejection around $65,000, which is an important price hurdle to cross if a $70,000 retest will happen soon.

Bitcoin’s price action can proceed in two ways: either we see a continuation upwards to the top of the channel and a retest of $66,700, or the cryptocurrency reverses and retests its 50-day SMA around $61,920.

Either way, Bitcoin needs to clear the $66,700 price level soon and break out of the descending channel.

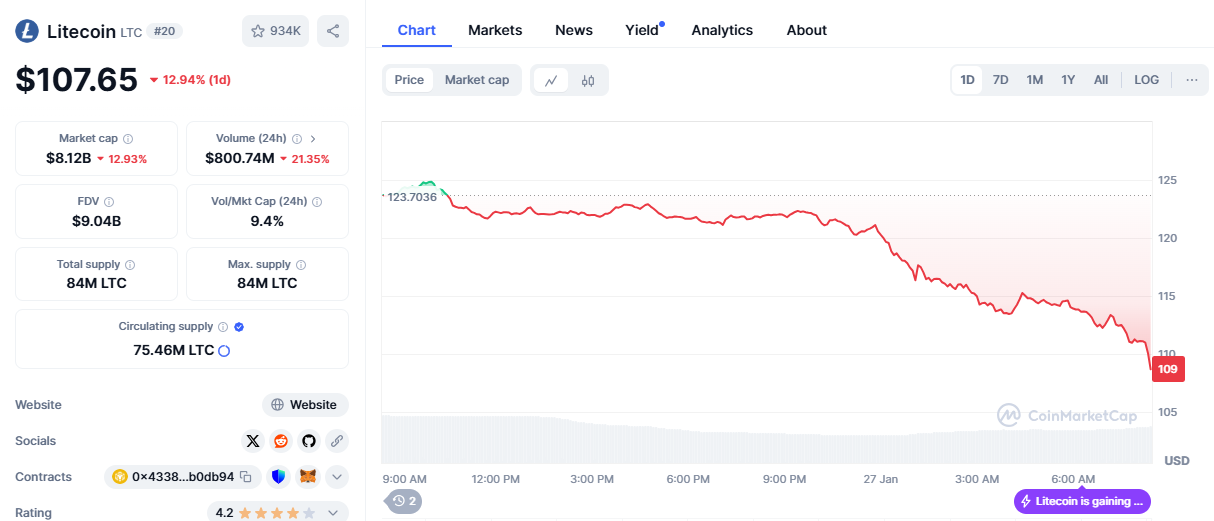

Can Ethereum Escape This Range?

The major resistance band preventing Ethereum from rallying upwards to the $3,000 zone once again was between $2,686 and $2,800.

Over the weekend, Ethereum broke through the first level in this range but appears to have slowed down at $2,800.

Ethereum’s price performance

Investors should keep an eye out for what happens around this $2,800 price level because a break above is bound to result in a rally upwards and a retest of Ethereum’s 50-day SMA around $2,792.

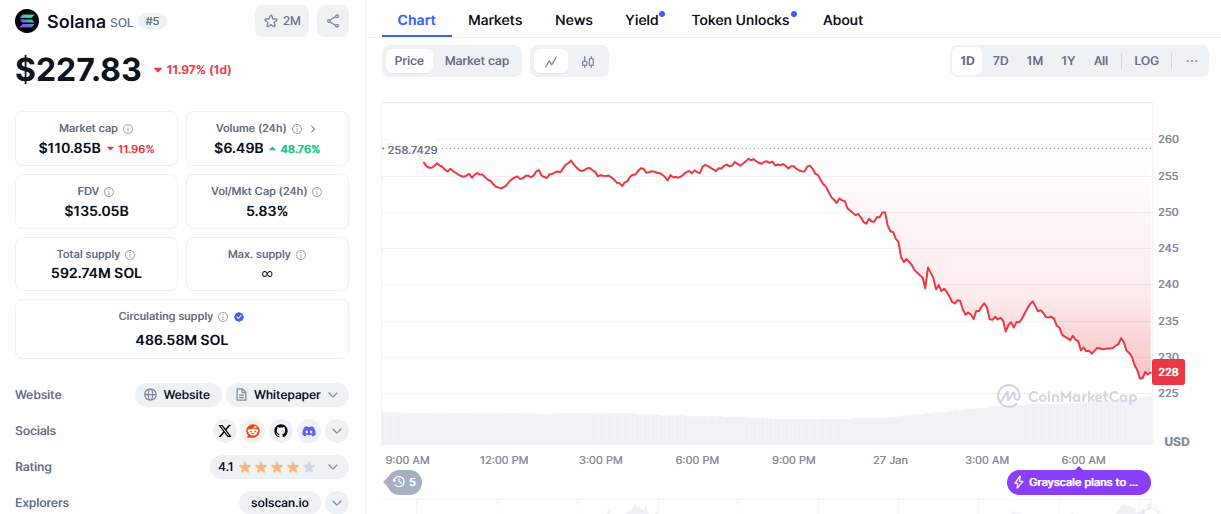

Artificial Superintelligence Alliance ($FET) Turns Bullish

Artificial Superintelligence Alliance, or FET, has been trading within a descending wedge formation since late March, as shown below.

The descending wedge on FET

However, very recently, we have seen a valid breakout from this formation after much consolidation.

Because of this, FET has flipped the tables from being bearish to being fully bullish.

The cryptocurrency is attempting to finalize its breakout from the $1.31 price level and should be able to keep itself stable for a while.

If we see a continuation from this $1.31 price level, FET could rally further to around $3.5.

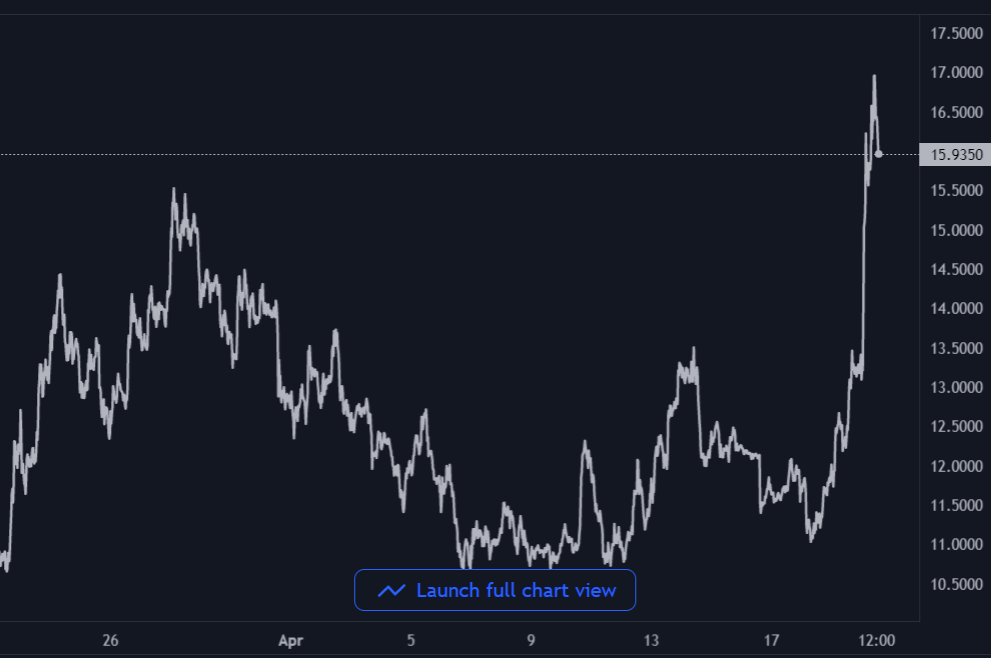

Watch Out for Floki

Floki is sitting on an important threshold, as shown in the charts.

After rebounding from a low of around $0.00009585 on 5 August, the cryptocurrency is now heading upwards and is attempting to clear the $0.00015 resistance.

Floki’s price performance

Breaking above $0.00015 would be the right step in the right direction for the cryptocurrency, especially when it comes to breaking above the $0.000211 price level and forming a new higher high.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.