Key Insights

- The crypto market is consolidating after a slight decline, with Bitcoin leading the way.

- Neither bulls nor bears are in control, with liquidations favouring the bears slightly.

- Bitcoin is struggling to break above $64,500, a crucial resistance level.

- Ethereum is also attempting a breakout above $3,500, with DogWifHat facing resistance at $2.52.

- Jupiter is looking at a breakout above a descending channel, followed by a 70% rally to $1.85.

The crypto market hasn’t moved by much over the last 24 hours in an apparent consolidation and is dealing with a slight 0.8% decline to the underside.

Bitcoin is slightly further below the $65,000 price level and currently trades at around $64,500, with the crypto market showing more red than green.

The crypto market’s heatmap

However, the bears’ actions haven’t been very drastic lately, considering the minor dips across the market.

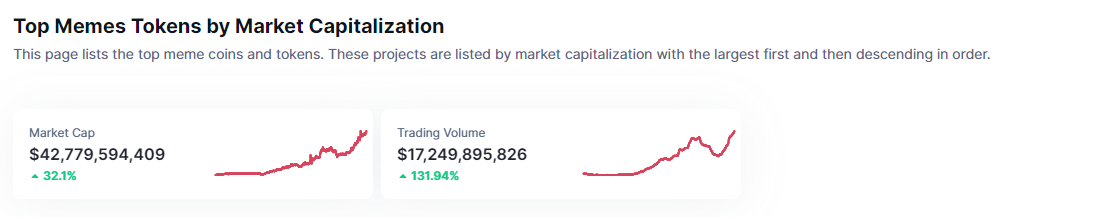

In the last 24 hours, the market has seen around $142 million worth of liquidations, with the bulls losing more than twice as much as the bears.

The crypto market’s liquidations

The snapshot above shows that while the leveraged bears lost around $40 million to liquidations, the bullish ones come in at around $102 million.

Unsurprisingly, most of the liquidations came from Bitcoin and Ethereum.

Today, we can conclude that neither the bulls nor the bears are firmly in control, and we are looking at more consolidation.

Bitcoin Continues to Struggle

Despite showing signs of a possible break above the $64,500 resistance yesterday, Bitcoin is still consolidating around this price level.

Bitcoin’s price action

This resistance level is a highly important one that investors and traders have to watch.

If we see a break above, the cryptocurrency will become poised to continue further upwards and hit the $70,000 price level.

However, the importance of breaking above $64,500 – $65,000 cannot be overemphasized.

If the bulls continue to stall around this price level, the bears will likely take the opportunity to sink prices lower and cause a major dip towards the lower trendline of the channel shown above.

Ethereum Is Attempting a Break Too

Ethereum is attempting to break above the $3,500 price level as well.

However, unlike Bitcoin, with an attempt at breaking above at least, Ethereum continues to consolidate underneath, risking a possible rejection the longer the bulls wait.

Ethereum in the charts

For now, short-term positions can be closed. Ethereum’s only bullish confirmation from here is a valid break and close above $3,510.

The RSI on the daily chart shows that the market is currently in bullish territory, increasing the odds of this bullish breakthrough.

However, Ethereum isn’t immune to another retest of the $3,000 zone in case of rejection.

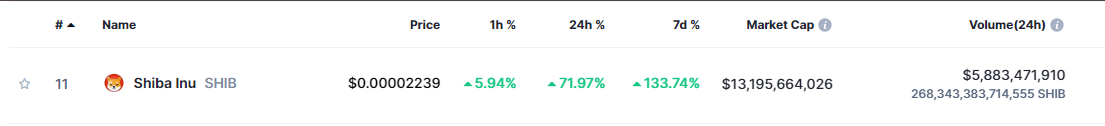

DogWifHat (WIF) Is Back

WIF is one of the best-performing cryptocurrencies on the market, among the top 100.

So far, it has taken its rebound from the ascending trendline shown below very seriously and has even been up by around 65% since.

DogWifHat in the charts

The cryptocurrency has increased by around 10.5% over the last 24 hours before writing.

However, it faces resistance around the $2.52 price level and must break above it soon if the bullishness continues.

Investors should know that if we see a rejection from $2.52, the cryptocurrency will likely retest the $2.25 price level and may even consolidate between both before making its next move.

Watch Out For Jupiter (JUP)

Jupiter trades within a descending channel, which means it is bearish in the short term.

In the medium term, we have seen the cryptocurrency rebound successfully off the base of this channel and rally towards the top.

However, its price action within the channel isn’t what we are after.

Jupiter’s price action

The event to watch for is a break above this formation, likely between $1 and $1.2.

If a breakout occurs, the cryptocurrency will become poised for a 70% rebound to its previous local high, around the $1.85 price level.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.