Key Insights:

- Bitcoin falls below $100k, Ethereum below $3500.

- Altcoin markets witness severe price correction.

- Memecoins break the bullish trend, with all coins suffering huge losses.

- However, RWA markets remain in the green territory.

- As Gensler prepares to leave office, the SEC has approved a combo of Bitcoin and Ethereum ETF.

Market Movers and Shakers

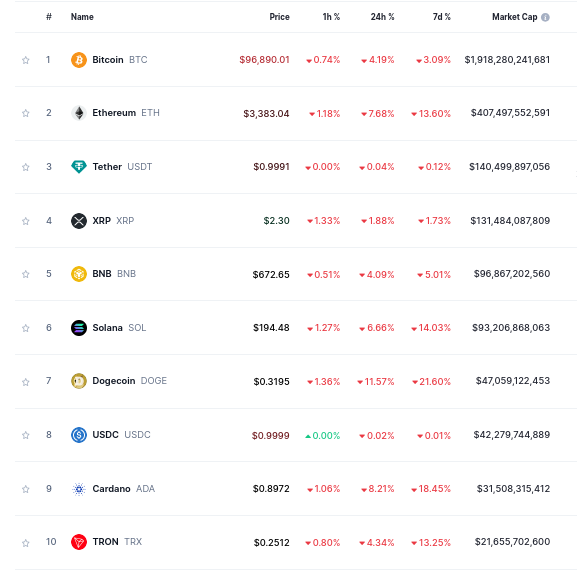

Price corrections have intensified in the crypto markets since yesterday. At press time, Bitcoin was below $100k, Ethereum fell to $3400 levels, Solana dipped below $200, and Dogecoin barely clung to bull markets by a thread.

Top 10 Cryptos Today

However, XRP seems to retain most of its gains, with just a 1.2% loss over the week, possibly due to Gensler leaving office and the SEC seeing a 4:1 Republican domination in the body.

Memecoins have lately seen their losses mounting after the market correction has intensified. Though Dogecoin barely hands to the bull trend at $0.31, Shiba Inu has seen a deeper correction of 21% and trades around $0.000022. Other memecoins saw an even deeper price correction.

Top RWA token Mantra (OM) has gained 0.85% over the week to reach $4.04. Its YTD gains are phenomenal, at 15,469% at press time.

Top Crypto News

Combo Bitcoin and Ethereum ETFs Approved

A month prior to demiting office, SEC chief Gary Gensler approved combined Bitcoin and Ethereum ETFs that would allow investors to buy both Bitcoin and Ethereum through the same ETF.

The two approved ETFs were the Hashdex Nasdaq Crypto Index US ETF and the Franklink Crypto Index ETF. Both these ETFs will initially hold Bitcoin and Ethereum in a pre-determined ratio (say 75% and 25%), but will later adjust based on market conditions.

This approval also opens the way for other index ETFs in crypto market sectors, such as Memecoins, Real World Assets, AI and Crypto, Altcoins, and others.

The Bitcoin President Halts Its Progress in El Salvador

El Salvadorean President Nayib Bukele, who became famous as the most pro-crypto leader in the world, has reportedly agreed to halt and potentially reverse their pro-Bitcoin policies. The decision has been taken to appease the IMF for a $1.4 billion loan.

El Salvador had earlier shocked everyone when their Bitcoin purchases saw the doubling of its value as Bitcoin hit $100k. Nayib Bukele has also been known to vocally oppose IMF through his tweets.

ETFs See First Outflows in December

After grossing three weeks of net inflows of around $500 million per day, Bitcoin ETFs saw their first outflow yesterday. The net outflow on 19 Dec 2024 was $671 million with Fidelity’s FBTC seeing the highest outflow at $208.5 million.

Ethereum ETFs, too, saw a net outflow of $60.5 million, with the largest outflow from Grayscale’s ETHE at $58 million.

However, with the introduction of combined ETFs and the possible approval of XRP and SOL ETFs under Trump could see major diversification in these markets. With more options, crypto ETFs could finally dream to beat their traditional counterparts in the future.

Macroeconomic Outlook: Expecting a Summer Rally in 2025

After the US Fed’s decision to have only two interest rate cuts in 2025, we assume the high-interest regime in the US would continue for a year or so or until inflation falls down below 2%.

Despite the markets receiving this as trauma, interest rates are not the only thing propping crypto markets up. Positive regulatory decisions under Donald Trump’s presidency on matters like ETFs, taxation, agency overstepping, and others will be the most important triggers for the next set of bull rallies.

Further, according to past experience, it takes around one year for interest rates to fully impact the markets. This means that the first 0.5% rate cut on 18 September 2024 hasn’t fully reached the markets yet and would take at least one to two more quarters to do so. This means that we can expect a major crypto rally in the summer of 2025.

This is also why whales have been accumulating cryptocurrencies in this dip.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.