Mid-tier Dogecoin whale sell-off analysis reveals 440 million DOGE dumped in 72 hours, pushing prices below the critical $0.18 support level. While smaller whales exit, larger holders accumulate, creating mixed signals that could determine whether DOGE recovers to $0.26 or falls toward $0.07.

Key Insights:

- Mid-tier Dogecoin whales sold around 440 million DOGE in 72 hours this week.

- DOGE price dropped below $0.18, which shows that there is some strong selling pressure.

- Analysts say that holding above $0.165 could prevent a fall toward $0.07.

A new Dogecoin whale sell-off analysis reveals that major holders have drawn attention again after on-chain data showed a massive sell-off of hundreds of millions of tokens.

Over the past few days, wallets holding between 10 million and 100 million DOGE collectively offloaded roughly 440 million coins. This large movement came as Dogecoin’s price slipped below the $0.18 support level for the first time in weeks.

Dogecoin Whale Sell-Off Analysis: How Bad Was The Dump?

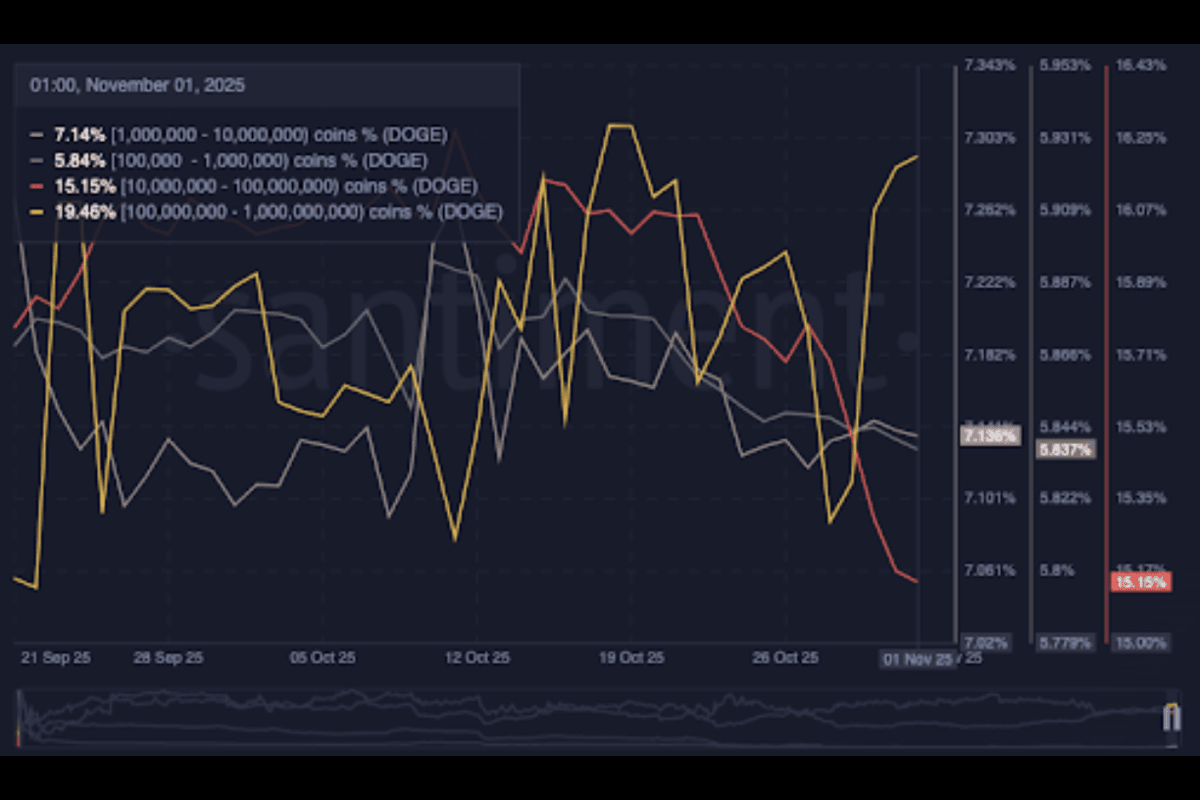

Data from Santiment shows that these wallets’ total share of DOGE supply fell from 15.51% to 15.15% within three days.

That decline stands as one of the steepest short-term liquidations by mid-tier holders this quarter.

The pressure quickly spilled over into the market, with Dogecoin’s price losing nearly 6% over the past week and around 27% in the last month.

Trading volume surged to 3.37 billion DOGE, which is more than four times the daily average.

This sudden increase in volume shows intense selling activity as stop-loss orders and algorithmic trades worsened the drop.

Whale Behaviour Kickstarts Market Volatility

As mid-tier holders sold, those controlling more than 100 million DOGE began accumulating again. Their holdings increased from 19.28% to 19.46% over the same period.

This trend shows that some of the largest investors are buying the dip while others are reducing risk exposure.

Meanwhile, holders with balances between 100,000 and 10 million DOGE have stayed mostly steady. Analysts say that this mix of selling and accumulation may set the stage for a shakeup over the short term before any clear trend emerges.

Santiment’s whale transaction data also shows that activity is cooling. Transactions involving $100,000 or more in DOGE also fell from 119 on October 30 to just 15 a few days later.

This drop indicates that whales have paused their heavy selling for now and are creating a brief window of calm in the market.

DOGE Price Action Turns Bearish

Dogecoin’s drop to $0.18 stood as a critical moment for traders. That level had acted as strong support since early October. However, once it broke, sellers took control and DOGE fell to as low as $0.164 before some buyers stepped in.

Analysts see this area between $0.165 and $0.150 as a possible short-term demand zone where past accumulation occurred.

Interestingly, Dogecoin has also shown brief signs of resilience. Earlier this week, DOGE rebounded as Elon Musk’s X introduced its new Handle Marketplace, reigniting speculation about increased real-world utility and renewed community momentum.

However, recovery attempts have so far failed. Each rebound toward $0.176 or $0.18 has been met with heavy selling. This confirms that institutional players are still in control of the market direction.

Daily outflows also reached $22 million, while futures open interest fell by 4% to $1.67 billion. This shows that leveraged traders are closing positions instead of opening new ones.

Analysts Watch The $0.18 Level

Crypto analyst Ali Martinez pointed out $0.18 as a level that could determine Dogecoin’s next move.

He noted that if DOGE holds above $0.165 and rebounds, it could rally to $0.26 and possibly $0.33. This means that there could be room for recovery if buyers regain control.

$0.18 is crucial support for Dogecoin $DOGE. Hold it, and a move to $0.26 or $0.33 is possible. pic.twitter.com/IDTlZhDRPL

— Ali (@ali_charts) November 1, 2025

Other market watchers like Bitcoinsensus have taken a longer-term view and have pointed out that Dogecoin has followed repeating cycles in the past.

Their prediction indicates that a full recovery could lead to another major run-up, possibly towards $1.70 later in this market cycle.

Still, most short-term traders are moving carefully. Many now see rallies into the $0.176–$0.180 range as opportunities to exit or short positions.

This said, to shift gears, DOGE would need to close above $0.185 on the daily chart. Until that happens, the overall outlook is likely to stay bearish.

What Traders Are Watching Next?

Dogecoin’s immediate future depends on how it behaves around the $0.165 support zone.

If it continues to trade below $0.18, it is likely to keep the bearish sentiment in control. A strong defense here could trigger a brief bounce, but analysts agree that any real recovery needs more market strength (especially from Bitcoin).

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.