Key Insights

- Ethereum’s price has lagged behind Bitcoin in recent months, despite the overall crypto market expansion.

- Ethereum’s decline may be because of massive liquidations in futures contracts, and its high transaction fees.

- Ethereum L2 scaling solutions are rallying because they offer cheaper transaction fees.

- Ethereum’s TVL is increasing despite the price decline, indicating strong DeFi activity.

- Ethereum’s price outlook remains uncertain, and investors are advised to watch the $2,150 support level.

Ethereum, over the last few months, has lagged slightly in price.

This happened despite the crypto market’s expansion and Bitcoin’s rally to $45,000.

Ethereum has grown along with the rest of the market. However, this growth has been slow and painful for investors.

Take the quarterly returns for Bitcoin for example. According to data from Coinglass, while Bitcoin is up by more than 55% this quarter, Ethereum has only risen by about 34%.

Ethereum, now, has declined along with Bitcoin from $2,400 to about $2,200 and we would all like to know:

When will we see an Ethereum price recovery?

Ether Price Correction

On 11 December this week, Ethereum dropped by nearly 10% from a $2,400 high to about $2,156 according to data taken from TradingView and shown below.

This dip in Ethereum came just as Bitcoin’s bears swung into action around $44,700 (just as Bitcoin was about to take the $45,000 zone).

Some analysts attributed the price drop to the massive liquidations in futures contracts across several exchanges.

Even a day after the $400 million in total liquidations across the crypto market, data from Coinglass still shows that Ethereum futures contracts are witnessing about $2 billion in liquidations from Binance, and about $1.43 billion from ByBit.

This indicates that Ethereum’s decline is a deep-seated one, with the backing of several technical indicators.

Ethereum Network Fees Remain High Despite Layer-2 Solutions

Have you noticed the latest price rallies in Ethereum L2 scaling solutions? These L2 blockchains, especially Avalanche have been on the rise as of late, breaking multiple resistances in mere days.

CoinMarketCap data even shows that Avalanche has moved up by about 14% over the last day at the time of writing, and by an impressive 119% over the last month.

Why are the Ethereum L2 scaling solutions rallying though, and why is Ethereum stuck in the mud?

The answer may lie in the now-expensive transaction fees required by the network to process transactions.

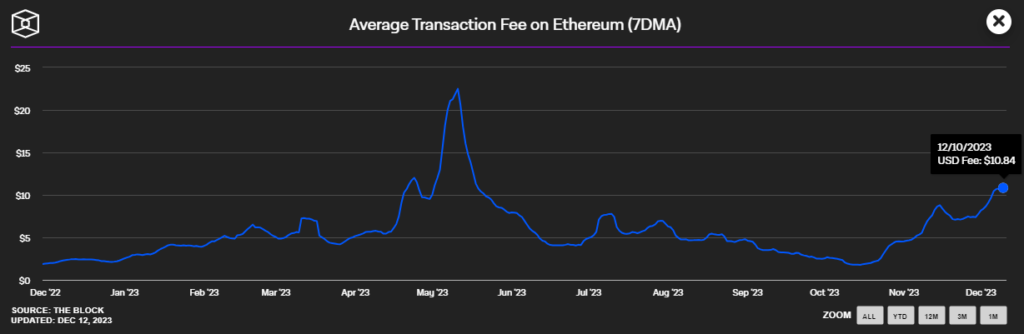

According to data taken from The Block, we can see that Ethereum’s transaction fees have been soaring, despite the relatively slow price movement.

The Block calculates these fees at about $10.8 for a single transaction, at the time of writing.

The relative decrease in the price of Ethereum, while the L2 scaling solutions are on the rise, only shows that Ethereum’s transaction fees may be too expensive for most users and Dapps, leading to investors choosing more inexpensive alternatives.

Ethereum’s TVL Shows Promise

It isn’t all bad for Ethereum.

High transaction fees on a blockchain mean that there are too many users, competing for the limited resources the network can afford.

According to data taken from DefiLlama, despite the obvious decline in Ethereum’s price, the network’s DeFi TVL is also at a high and is increasing with each passing day.

Ever since hitting rock bottom in late October, Ethereum’s TVL has been on the rise and now sits at about $28.2 billion.

This means that Ethereum still controls more than half the market share, as far as Defi TVL is concerned.

Ethereum Price Outlook: How Soon Will We See A Price Recovery?

At the time of writing, Ethereum currently trades at $2,210. This is after its rejection from the $2,400 zone and its resulting decline into a retest of $2,150.

As shown above, the bulls are currently hanging on a ledge, with Ethereum right on the spot above the $2,150 support.

The previous decline was validated by a bearish crossover in the daily RSI as shown below, indicating that Ethereum’s bearishness is a valid and necessary one.

Ethereum should be safe from further price declines as long as it stays above $2,150. However, what are the odds of this not happening, considering the position of the RSI?

The outlook for Ethereum remains that there are no strong indicators, showing that Ethereum will recover soon. Investors are advised to watch $2,150 however, because this is the single most important price level on Ethereum’s chart at the moment.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.