Key Insights

- Ethereum has surprised many with a sudden surge on the daily chart, outperforming other major cryptos.

- The price break above $2,400 has analysts like Mortensen Bach optimistic about a potential rally to $3,500 or even $4,000.

- Many analysts, including Jordi Alexander and Pentoshi, are bullish on Ethereum, with Alexander suggesting $3,500 and a “liquidity black hole” in January.

- A successful whale with a 100% win rate and a history of buying low and selling high recently dumped their Ethereum holdings

Ethereum has flipped the tables over the last day and has outperformed several other “top” cryptocurrencies in terms of price action.

According to data from CoinMarketCap and TradingView, Ethereum has rallied from $2,175 and has gone as high as $2,445 in a 9% price rally.

Ethereum’s bullishness was so unexpected that the bearish liquidations on the cryptocurrency currently sit at around $53 million.

In this article, we will be going over some of the most interesting takes about Ethereum on the internet, so that you as an investor, can get an idea of what is going on under the hood.

Will Ethereum Continue Further Upwards?

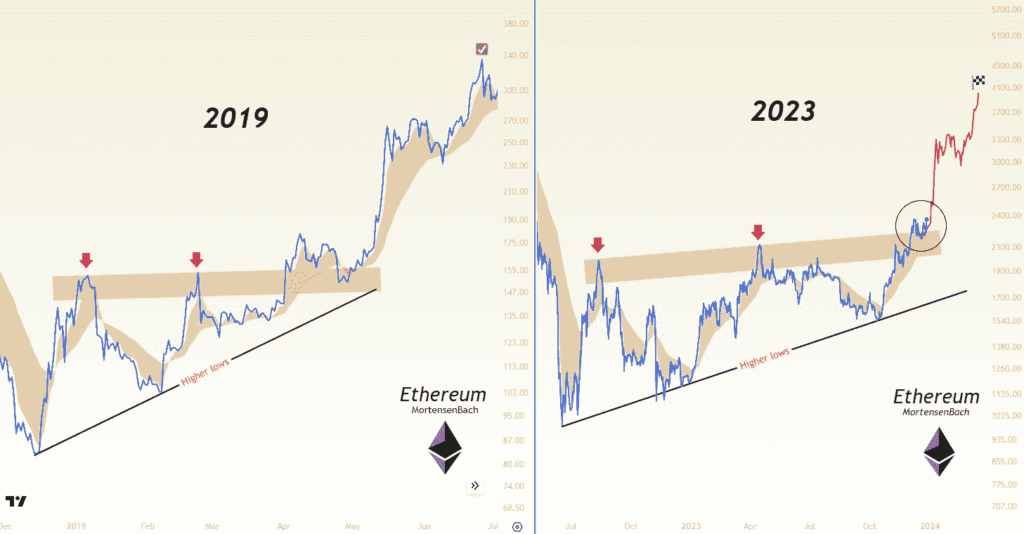

Let’s take a look at Ethereum’s price chart.

According to the chart above, the candlestick from 28 December broke through the $2,400 resistance, represented by the red line.

But why is this significant?

The $2,400 – $2,500 zone is one of the most valid resistance points on Ethereum’s charts, and analysts like Mortensen Bach have theorized that a break above $2,500 might be the confirmation we need for a possible Ethereum rally to $3,500 or even $4,000.

Others like Jordi Alexander in a recent tweet, have implied that Ethereum’s current price action has made everything “line upâ€, and the bullishness will now “run for weeksâ€.

Alexander also posits that the risk-to-reward ratio on ETH is “so compelling”, that we might see a “liquidity black hole” in January.

Ethereum Will Go Up Slowly, And Then “All At Onceâ€

Analysts like Pentoshi believe that Ethereum will go up slowly, then “all at onceâ€.

In a recent tweet, Pentoshi shared a snapshot of Ethereum’s price chart, with the $2,750 and $3,495 resistances marked as targets.

Pentoshi says that Ethereum is likely to begin slowly, as we are now seeing. After this “slow†phase, Ethereum is expected to continue further upwards “all at onceâ€.

Mags, another analyst, shares Pentoshi’s opinion in a recent tweet, and states that Ethereum is “going far away from home, and never going to come backâ€.

In essence, Ethereum is expected to hit $3,000 very soon according to all of the above.

However, here’s some disturbing news.

“Strategic†Whale Bets Against Ethereum

According to a recent tweet from blockchain monitoring platform, LookOnChain, one of the most successful whales may have just bet against Ethereum.

According to LookOnChain, this whale held around 17,700 ETh as of yesterday.

However, as soon as Ethereum rallied to $2,384, this whale dumped all of their holdings and made a cool $5.8 million.

LookOnChain notes that this whale has always done things this way for the past three months, buying at swing lows and selling again at highs, with a 100% win rate.

This means that if the whale’s predictions are as accurate as LookOnChain says, Ethereum might be coming down soon.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.