Key Insights

- Ethereum has been sluggish compared to Bitcoin in recent weeks, but it may be poised for a breakout.

- ETH’s MVRV indicator suggests that a new uptrend has begun.

- Whales may be trying to collect liquidity by influencing the market into a breakout from $1,800.

- Ethereum has pulled back slightly this week, but this is a normal and healthy development.

- Ethereum’s next major resistance level is the $2,020-$2,150 zone.

Ethereum, for some reason, has been relatively sluggish compared to Bitcoin over the last few weeks.

While Bitcoin made the initial move from $26,000 to $30,000, ETH price remained under the influence of its bears and repeatedly threatened a breakdown under the $1,523 zone.

The altcoin only started to move to the upside after Bitcoin broke through $32,000. Despite this, however, Ethereum has been stuck under $1,800 over the past week and may need some help getting back up.

But what if there was reason to believe that we may see a $2,00 Ethereum in November?

Let’s explore some of these reasons, shall we?

MVRV Indicator Shows We Are In An Uptrend

ETH still doesn’t look the part yet, likely because of this chart formation:

What you see above is ETH’s weekly chart. Notice the upper descending trendline?

Ethereum’s weekly candle continues to stall under this trendline and may need a means of escape.

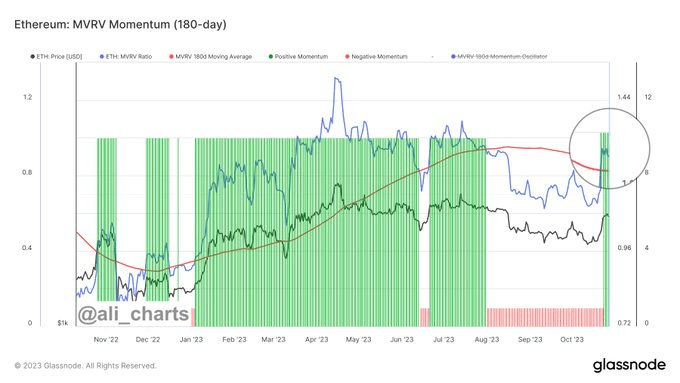

However, analyst and trader, Ali on Twitter, says that ETH’s MVRV suggests that a new uptrend has begun.

The MVRV is one of the most potent indicators for determining market trends.

It basically compares the realized value of an asset to the actual value and determines whether this asset is overbought or oversold.

Ali says that a massive amount of ETH was bought below the current price and is now profitable. This means that ETH may now fully be in an uptrend, and we can expect a breakout anytime soon.

Here’s Why We Might See A Breakout On ETH

The crypto market doesn’t just “create†free money.

The way that the whales operate is that they influence the market sometimes and cause sharp and unexpected volatility waves around specific price levels.

Shrimp and fish (smaller investors) often set buy/sell orders around these “specific price levelsâ€.

And when these unexpected price movements occur, a massive wave of liquidations sweeps the market clean.

Whales can then collect all of these liquidated funds and push the market up properly.

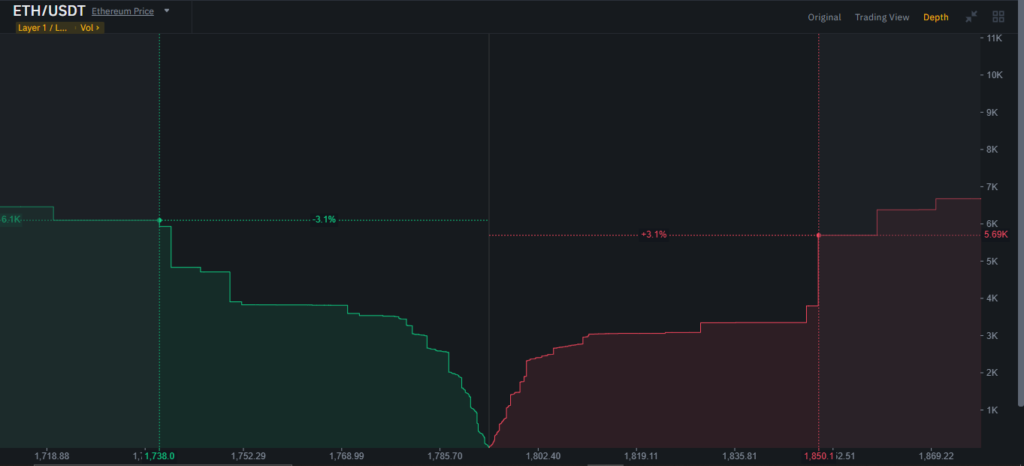

Take a look at this price chart. What do you see?

A good way to collect massive liquidity would be to influence the market into a breakout from $1,800 and then collect the liquidity that results.

The snapshot below even shows Binance’s depth charts.

It turns out that traders have set stop-losses massively around $1,850, and may be facing a serious liquidation crisis if ETH breaks past this price level.

Remember: Trade like a shrimp, and think like a whale.

Ethereum Weekly Outlook: Pullback or Rally?

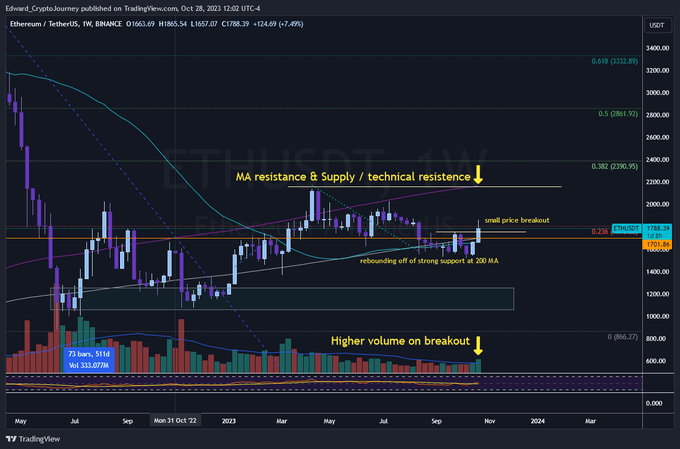

According to this tweet from analyst Eddie on Twitter, ETH has pulled back slightly this week, after a significant price breakout above $1,750.

This is a normal and healthy development, and the next few days will determine whether the pullback is over and ETH can continue its rally.

Eddie says that the breakout above $1,750 was a critically important event, as it showed that there is strong institutional and whale buying interest in Ethereum.

Ethereum has also found strong support at its 200-week moving average, which is a key technical indicator.

Overall, the next major resistance level for Ethereum is the $2,020-$2,150 zone. Here’s a breakdown of this entire paragraph:

Support: $1,750

Resistance: $2,020-$2,150

Trade Idea: Buy Ethereum above $1,750, with a target of $1,900-$2,000. Place a stop loss below $1,750 (also validated by Binance’s depth chart).

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.