Key Insights

- An Ethereum whale just bought $250 million worth of ETH in 4 days, and could potentially influence the market.

- The address “0x7a9…” accumulated 87,819 ETH at an average price of $2,875 in four days, and now holds 132,585 ETH (0.1% of total supply), worth $390 million.

- Technical analysis: If bulls push ETH above $3,000 anytime soon, further gains could be possible.

- On the flip side, If bears take control, a price drop and a consolidation under $3,000 might occur

Ethereum has been on a bullish roll for weeks now.

However, it appears that Ethereum has run out of fuel around the $3,000 zone, and may need some help with breaking above.

Help is on the way though.

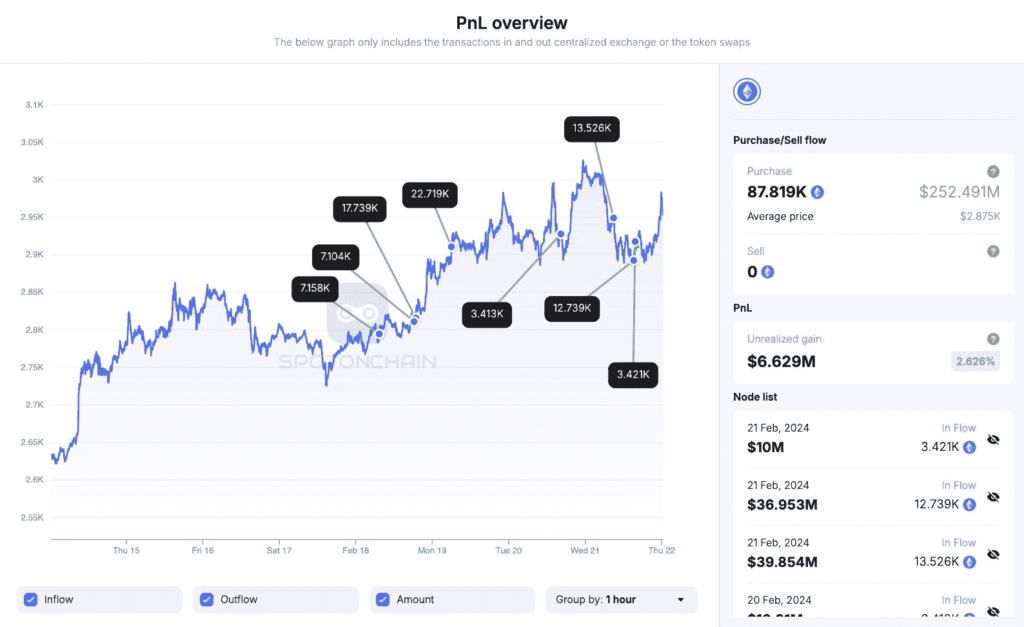

According to a recent report from SpotOnChain, a whale has been buying massive tranches of the cryptocurrency, and could possibly be lending a hand towards this breakout the bulls so desperately need.

A Single Whale Rakes In $250 Million Ethereum

According to a CoinMarketCap community post from SpotOnChain, a whale has entered a massive buying spree and has invested o$250 million in ETH in just four days.

This whale, with the address “0x7a9…â€, according to data from SpotOnChain, has bought a total of 87,819 ETH between February 19 to February 22.

SpotOnChain notes that this whale bought these Ethereum tokens at an average price of around $2,875 per token, adding up to a staggering $252.5 million investment.

The whale has also been observed, moving these funds around on different exchanges, the biggest of which are Binance and 1Inch.

For example, SPotOnChain notes that on February 22, the whale pulled 9,277 ETH off Binance, right before buying 6,883 ETH with 20 million USDT on 1inch.

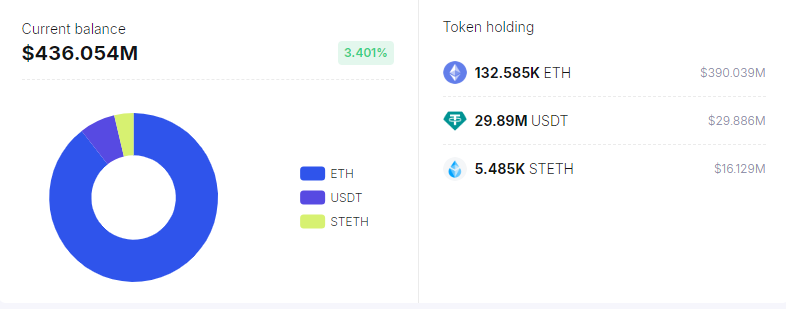

As of 23 February SpotOnChain data shows that the “0x7a9†whale holds 132,585 ETH in its wallet, worth about $390 million at the current market price of $2,940.

This means that the whale has already made an unrealized profit of $14.587 million, which it can take out at any time.

Moreover, it gets crazy when we realize that this whale also holds a staggering 0.1% of the total ETH supply.

What Does This Mean For Ethereum?

This is a very important question.

Considering how this whale holds 0.1% of the total ETH supply, it is safe to say that they have some pretty strong influence over the market.

The whale might decide to sell its ETH at any time, leading to sudden downward pressure on ETH that might cause a bitter crash.

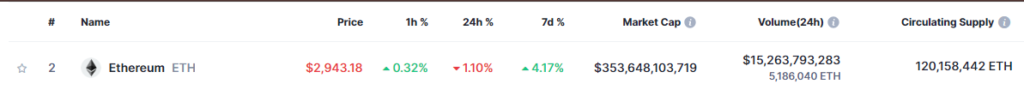

Moreover, Ethereum currently sits at a delicate position under the $3,000 zone and may have its bulls run out of strength to push the market further.

Ethereum is currently trading at $2,940, and is down by around -1% over the last day, according to CoinMarketCap.

According to the chart illustrated below, there might be some risk of an Ethereum decline, straight down to a retest of the ascending trendline shown:

If this trendline holds, we will see Ethereum consolidate for a while between $3,000 and the base of this formation, before we see any kind of breakout above $3,000.

The only way to escape this scenario is if the bulls gather the strength to push Ethereum into a break above $3,000 before the bears gather enough strength to manipulate the market.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.