Key Insights

- Ethereum is facing increased selling pressure as a large whale has transferred 15,000 ETH to OKX.

- Ethereum has outpaced mega-cap stocks like Zoom and Microsoft in terms of revenue generation, with Google being the only exception.

- The number of traders in loss for ETH has reached an all-time high, which could lead to a rebound in the near future.

- Ethereum beats Bitcoin in terms of client diversity, with the former having a more decentralized network.

- ETH is currently trading at $1,526 and is holding steady above the $1,526 support. Ethereum needs to stay above this zone to avoid a drop towards $1,200.

Ethereum continues to struggle somewhere around $1,600, avoiding an imminent drop to $1,535 for now.

CoinMarketCap’s data shows that the cryptocurrency is up by about 0.86% over the last day, and down by about 3.81% over the last week.

This isn’t particularly bullish for Ethereum, we’d add.

However, what this cryptocurrency does have is stability in the face of general market bearishness.

The only thing that threatens this stability, however, is the selling pressure on the cryptocurrency, as you will soon see.

Another Whale Moves $23.8M ETH Into OKX

According to reports, an EVM address identified as belonging to Ethereum co-founder Vitalik Buterin transferred 400 ETH to Coinbase.

According to a tweet from the blockchain data aggregation and analytics platform, Spot On Chain:

In just ten days, Buterin sent a staggering 2,421 ETH (equivalent to $3.79 million) to several centralized exchanges (CEXes) like Kraken, Bitstamp and Paxos.

According to a recent tweet from Whale Alert, however, another unknown wallet has just transferred 15,000 ETH (worth about 23.8 million dollars) to OKX.

The crypto ecosystem has been abuzz with speculation ever since, with experts arguing that the wallet may belong to an ETH whale who is now taking profits.

If this theory is true, ETH now has its stability directly challenged and may be facing increased selling pressure as the days roll by.

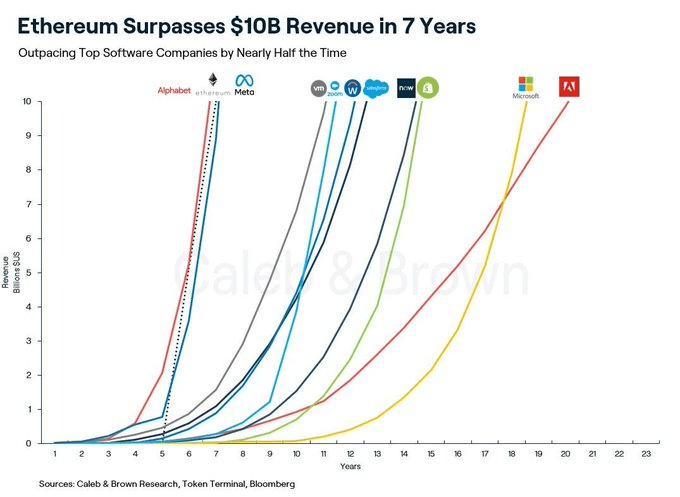

Is Ethereum Better Than Most Mega-Cap Stocks?

According to Token Terminal, Ethereum has spent the last seven years generating $10 billion in revenue.

This is amazing, because Token Terminal in this tweet, notes that Ethereum has outpaced several mega-cap stocks like Zoom and even Microsoft.

The only mega-tech company stock that managed to outpace Ethereum, according to Token Terminal, is none other than Google.

Zoom, despite being fueled by the COVID-19 lockdown period took 11 years, Microsoft took a staggering 19 years, while Adobe took roughly 20 years to achieve what ETH did in a meager 7 years.

One can only wonder what milestones ETH may achieve next, as the years come and go.

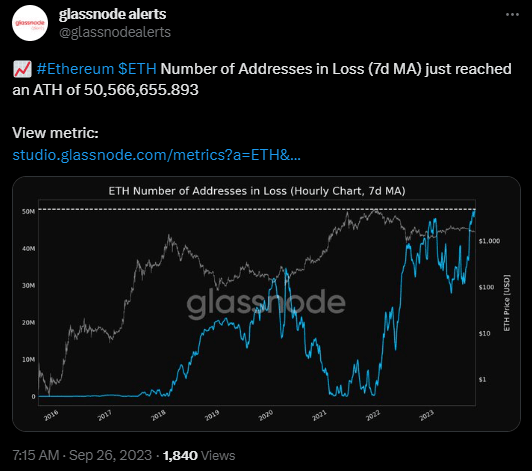

Number of Addresses in Loss (7d MA) Just Reached ATH: Glassnode

According to a recent tweet from Glassnode Alerts, the number of traders now in loss has reached an all-time high.

In particular, Glassnode says that this metric now sits at a record high of $50 million.

This leads to some degree of speculation though: If the number of traders in loss is now at an all-time high, does this mean that the whales may be close to collecting enough liquidity to start buying again?

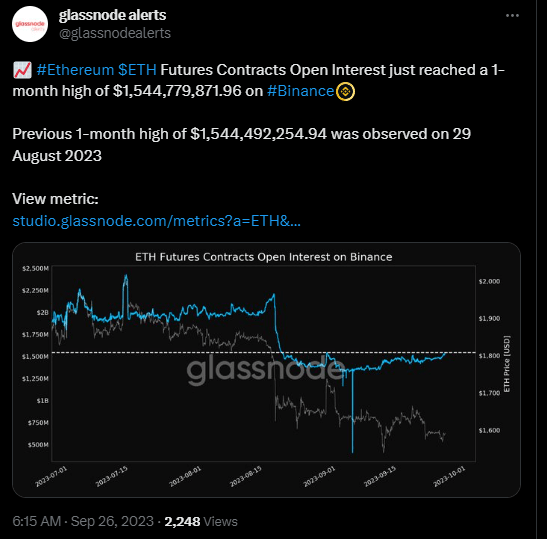

Glassnode alerts also note that Ethereum’s Futures Contracts Open Interest just reached a 1-month high of $1,544,779,871.96 on Binance.

According to Glassnode, this metric also sat at a 1-month high of $1,544,492,254.94 on 29 August 2023. However, this metric has now soared by only a small margin and is now at a 1-month high.

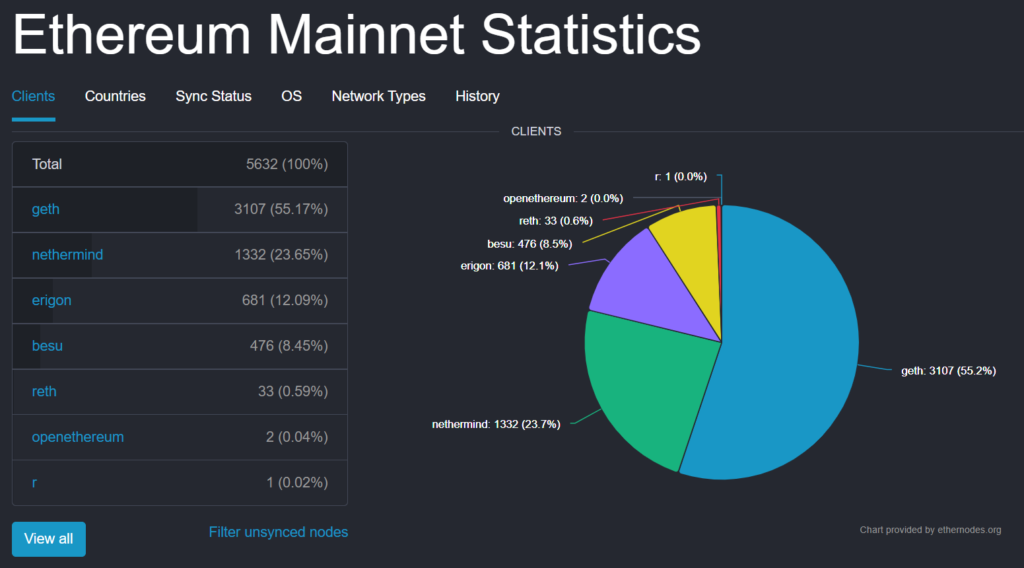

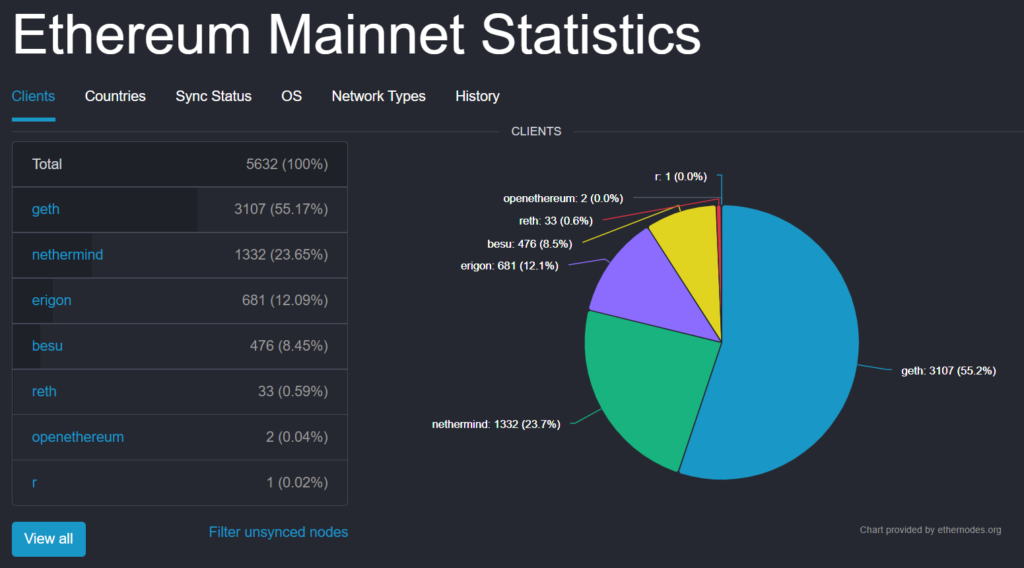

Ethereum Beats Bitcoin in Client Diversity

According to a recent tweet from Justin Bons, the chief investment officer (CIO) and founder of one of Europe’s oldest crypto funds, Cyber Capital, ETH is better than BTC in a few ways.

According to Bons, Ethereum is far more robust than Bitcoin, with the latter not even close.

Bons says that the distribution of complete nodes across different ETH clients is proof of the network’s “unparalleled” degree of decentralization.

Decentralization in cryptocurrencies, according to the expert, is frequently disregarded, but Ethereum “sets the bar high.”

This is one of the many arguments for “the flippeningâ€: An event in which ETH’s market cap and therefore dominance soars far above Bitcoin’s closing the gap and setting Ethereum, not Bitcoin, as the “king of cryptocurrenciesâ€.

Ethereum (ETH) Price Analysis

ETH, at the time of writing, is trading at $1,526.

In the charts, the cryptocurrency is holding steady above the $1,526 support and does not seem to be at risk of a drop, as long as it stays above this zone as illustrated below.

The RSI on the daily chart is close to the neutral zone but is closer to bear territory. This means that while Ethereum is safe for now, the bears may have more of a stronger hand on the cryptocurrency than the bulls.

Overall, Ethereum will inevitably drop further down towards $1,200 if a break below $1,526 occurs.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.