Key Insights

- The crypto market saw a minor pullback, with Bitcoin retreating from $60,000 and the overall market cap declining.

- The fear and greed index has remained in the “fear” zone, which shows a cautious market sentiment.

- Traders (mostly bulls) suffered strong liquidations totalling around $150 million in the past 24 hours.

- Bitcoin’s immediate future hinges on whether it can hold above the $57,200 support level.

- Ethereum is attempting a recovery, with the $2,395 level acting as a key support.

The crypto market has slid downwards today, with Bitcoin now trading further away from $60,000, around $57,800 and the crypto market cap down by 0.82%.

The crypto market’s heatmap

The crypto heatmap has also turned mostly red over the last day, with Ethereum now trading at around $2,456 and most of the cryptocurrencies on the market showing small but considerable losses within the daily timeframe.

The crypto fear and greed index

The crypto fear and greed index now shows a more fearful reading of 43/100 after sliding downwards from 46/100.

So far, some of the best gainers include Helium, Artificial Superintelligence Alliance, and Starknet, which have experienced price increases between 2% and 5.5% in the last 24 hours.

On the flip side, some of the biggest losers are Dogs, Brett, Beam, and Aave, all of which experienced between 4% and 13% price declines within the same timeframe.

The crypto liquidation heatmap

In terms of liquidations, market traders have lost a total of around $150 million within the last 24 hours, with the bulls losing significantly more than the bears.

While the bears have around $28 million in losses, the bulls’ come in at around $123 million—nearly five times the bearish liquidations.

Overall, the market shows that the bears are in control today, and investors should consider approaching with caution.

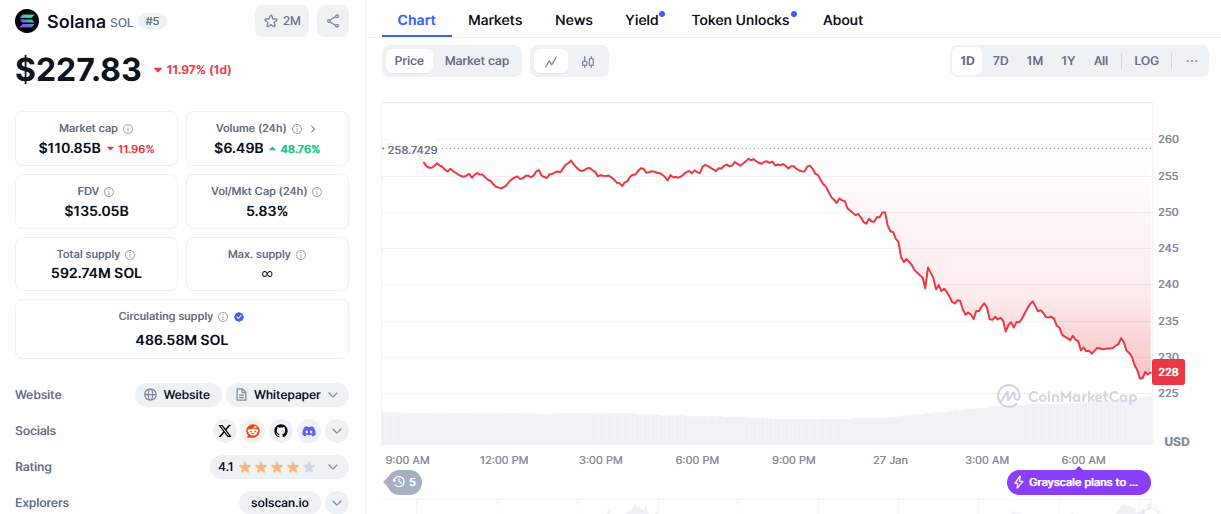

Can Bitcoin Rebound?

Bitcoin has had a particularly rough week over the last seven days and now trades considerably lower than the $65,000 mark.

The cryptocurrency’s decline brought it down into a retest of the $57,200 zone on Sunday, and Monday’s candlestick appears green so far.

Bitcoin’s price performance

This means that if the bulls prevent a break below this $57,200 mark, Monday’s candlestick might just turn out to be a recovery candle.

It gets even better if, by Monday’s candle close, the cryptocurrency manages to break above the $59,000 mark and completely engulf Sunday’s candlestick.

Overall, a “wait and see” approach is necessary to determine what will happen next with the flagship cryptocurrency.

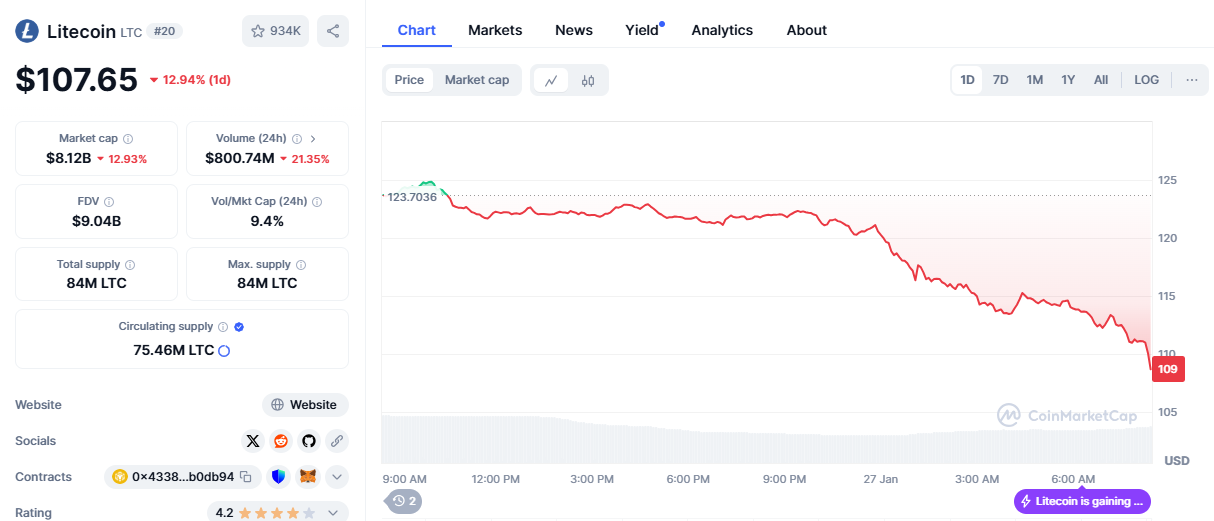

An Ethereum Recovery Might Be Inbound

According to the charts, the bulls held the $2,395 fort against the bears, preventing a further decline.

Ethereum’s price performance

This stability has caused some green to appear on the charts, indicating that, like Bitcoin, Ethereum is attempting to print a recovery candlestick.

Considering how far underneath most of its moving averages, Ethereum is, the closest target for the cryptocurrency is its 25-day SMA, which sits around the $2,633 zone.

Ethereum’s bulls can begin to negotiate further price increases if we see a break above.

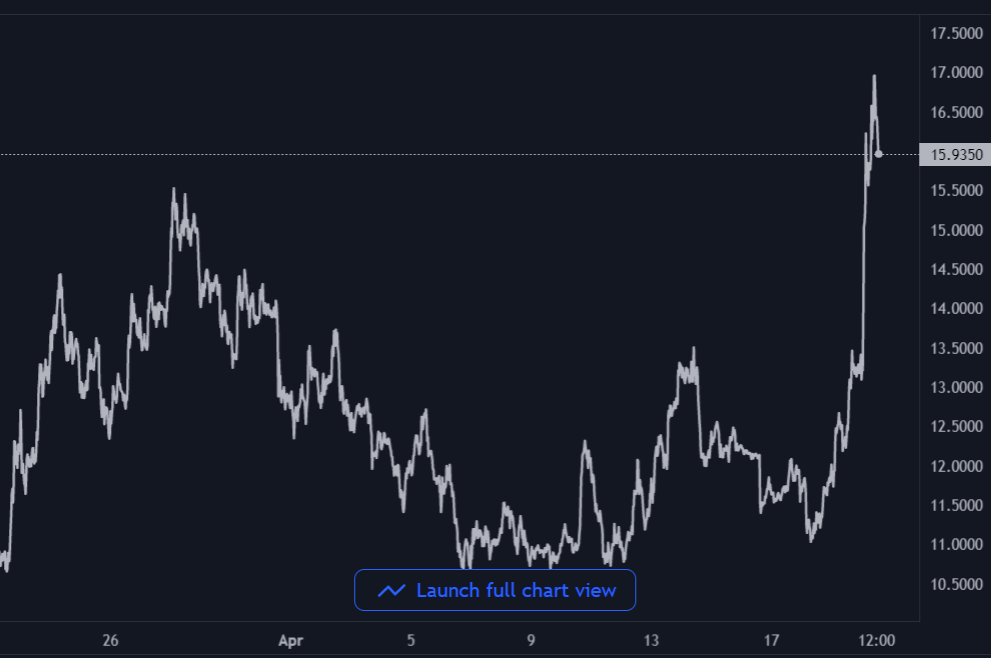

Artificial Superintelligence Alliance (FET)

According to the charts, FET is still negotiating its rebound after its ongoing post-breakout consolidation.

FET’s price performance

So far, the cryptocurrency has managed to hold its ground around the $1.11 price level, which is a good sign.

As long as this support continues to hold, FET remains poised for a rebound soon and should be ready to face the next valid resistance around $1.625 very soon.

If all goes well, price targets include $1.625, $1.978, $2.332 and $2.769.

Watch Out For Stellar

The charts show that Stellar appears to be cooking up something. To start with, the cryptocurrency is trading within a descending channel, which is a bearish formation.

Stellar’s price performance

However, within this channel, the cryptocurrency has managed to hold its standing above the $0.09 price level and is now gearing up for another retest of the channel’s upper trendline.

This is after three previous rejections between mid-July and late August.

If the Bulls manage to cause this rebound and give it enough momentum, we just might see Stellar break out around the psychological $0.1 level this time and target even higher highs.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.