XRP price rebound from the $2.70 support has renewed optimism in the market. Analysts and whales now see momentum building toward a $4 breakout.

Key Insights:

- XRP’s price bounced nearly 7% from $2.70 support after Monday’s dip.

- Whales accumulated 30 million tokens, which means that they have strong confidence in a rebound.

- Analysts are seeing bullish patterns pointing toward a $4–$5 target range.

XRP Price Rebound Sets Stage for $4 Breakout

XRP price is drawing attention, especially after XRP price rebound sharply from its recent lows

Analysts are now pointing to a possible rally toward $4, just as the cryptocurrency has climbed nearly 7% from $2.70 and is holding near $2.84.

Market watchers say the rebound rests on strong support at $2.70. If this level holds, the XRP price could extend gains toward resistance at $3 and beyond.

Analysts Highlight Bullish Technical Setups for the XRP Price

Charts show that XRP has been consolidating inside a symmetrical triangle. This is a pattern that often comes before sharp breakouts. This said, a decisive move above $3 could trigger a measured run toward $4.08. This could mark a possible 42% gain from current levels.

Trader CasiTrades noted that XRP price formed a double bottom near $2.70 on the four-hour chart. She described this as a valid Wave 2 structure, as long as the price stays above that level.

🚨XRP's Double Bottom: Setting Up For Wave 3 Impulse! 🚨$XRP experienced a highly volatile move RIGHT at the end of its consolidation, creating a massive wick down to a double bottom near $2.70. This type of volatility is expected at the end of a consolidation! The market is… pic.twitter.com/Rfb1J9W2ri

— CasiTrades 🔥 (@CasiTrades) September 23, 2025

Major resistance zones to watch are $3.40 and $3.66, both of which must be cleared before a breakout to $4.

Other analysts seem to be optimistic as well. CryptoBull pointed to a bull flag formation in the charts and argued that if confirmed, XRP price could even push to $5 as early as October.

Whale Accumulation Adds support

On-chain data shows whales are quietly increasing their holdings during the XRP price rebound.

Santiment reports that wallets holding between 1 million and 10 million XRP added 30 million tokens this week. These wallets now control 6.77 billion XRP, which equals 11% of the circulating supply.

This kind of accumulation during the XRP price rebound shows confidence and helps reduce selling pressure.

Glassnode data also confirms this trend, with the net holder position change turning positive since late August after weeks of profit-taking.

The pattern indicates that whales see value at current levels and expect higher prices ahead. Their activity can push retail traders to follow suit, which will add more buying pressure to the market.

Sentiment Among XRP Holders Grows

Optimism has spread beyond technicals. Harry Harald, a well-known long-time XRP supporter, recently said he expects the token to push toward $4.

His comments rekindled enthusiasm among holders who had become cautious after the recent 25% pullback from $3.66 highs.

When Harry speaks I listen

— Cobb (@Cobb_XRPL) September 21, 2025

XRP $4.00 https://t.co/0Bpfx0cnjH

Technical analyst Ali Martinez also pointed out a TD Sequential buy signal on the four-hour chart.

This indicator has historically marked the end of downtrends with 60 – 70% accuracy on higher timeframes. Legal expert Bill Morgan noted that three out of four such signals since 2022 led to strong rallies, which adds weight to the bullish case.

Speculation Builds Around an XRP ETF

Discussion about a possible ETF is adding fuel to the ongoing XRP price rebound narrative. Reports indicate that the U.S. Securities and Exchange Commission could decide on an application as early as next month.

If approved, analysts believe an ETF could attract institutional inflows, which will boost liquidity and price stability.

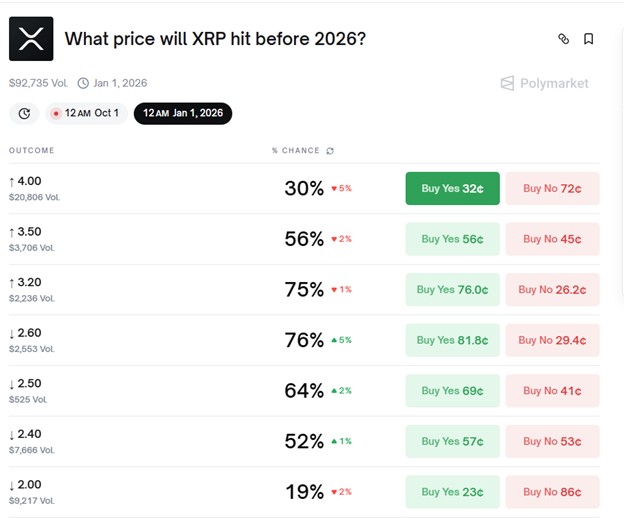

Prediction markets are also cautious. Polymarket traders currently assign only a 30% chance of XRP reaching $4 this year. This is down from 53% the week before, and Kalshi traders give a 34% chance of XRP price breaking above $4 this year.

Moreover, they give only a 17% chance of a move above $5.

XRP Price Outlook into Q4

XRP’s price is facing a clear roadmap. If the token holds $2.70 support and breaks above the $3 resistance, analysts believe the path opens toward $4 and possibly $4.40.

A drop under $2.70, however, could shift focus back to $2.58.

For now, traders will watch closely as the XRP price tests the $3 level, which could define its movement into the final quarter of the year.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.