This crypto sentiment fear rally prediction analysis reveals how extreme fear levels matching Bitcoin’s $18,000 lows in 2022 could trigger an unexpected November rally. Santiment data shows retail capitulation as the Crypto Fear & Greed Index hits 15 out of 100, while long-term holders and institutions quietly accumulate ahead of what analysts predict will be a strong 2026.

Key Insights

- Crypto sentiment has dropped to extreme fear levels, similar to when Bitcoin traded at $18,000 in 2022.

- Analysts from Santiment say that this fear could trigger an “unexpected November rally” as weak hands sell to stronger holders.

- Long-term investors and institutions are quietly accumulating ahead of what many believe will be a strong 2026.

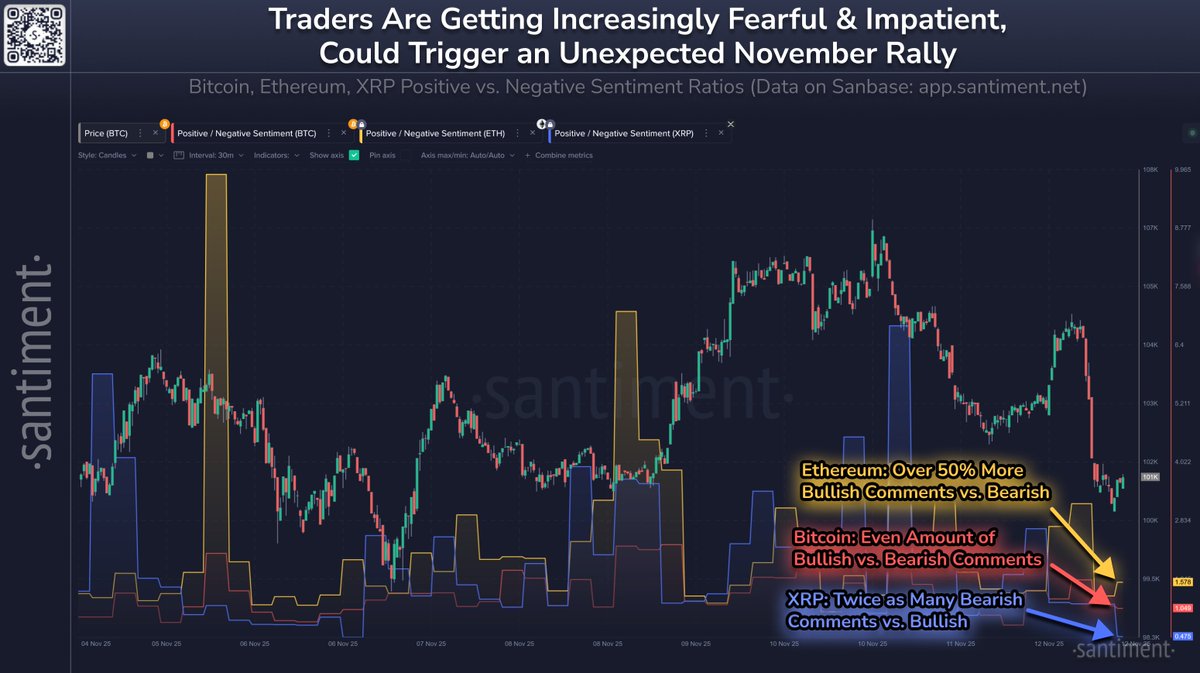

As the crypto market turns extremely fearful, the setup for an unexpected November rally becomes clearer, with extreme fear levels creating classic contrarian opportunities. Understanding this crypto sentiment fear rally prediction is crucial for investors, especially as market intelligence platform Santiment reports that social media sentiment toward Bitcoin, Ethereum, and XRP has turned sharply negative.

They believe that this is expected and is what often happens before a recovery.

Crypto Sentiment Fear Rally Prediction: Fear Signals Turning Point

Santiment data is showing that conversations about Bitcoin are split evenly between optimism and pessimism.

Ethereum has slightly more bullish comments than bearish ones, while XRP has become one of the most negatively discussed assets in the market. The firm described the current sentiment around XRP as one of the most fearful moments of the year.

The crypto sentiment fear rally prediction gains credibility from the Crypto Fear & Greed Index, which tracks overall investor emotion and fell to 15 out of 100 this week, marking extreme fear levels not seen since February.

Analysts are now saying that this is similar to market behavior seen in 2022 when Bitcoin traded near $18,000.

This crypto sentiment fear rally prediction is supported by Joe Consorti, head of Bitcoin growth at Horizon, who noted that sentiment now resembles the early stages of past rebounds when retail investors capitulated.

Completely wild.

F&G Index at $18,000 → 20

F&G Index at $100k → 20 pic.twitter.com/SNS1bqhx68— Joe Consorti (@JoeConsorti) November 12, 2025

He noted that this level of fear often shows that retail investors have started to capitulate. This is a moment when long-term holders usually step in to buy.

According to Santiment, “When the crowd turns negative on assets, especially top ones like Bitcoin and Ethereum, it shows that we are reaching the point of capitulation.”

Analysts Expect a Strong Setup for 2026

While the short-term mood continues to be grim despite the optimism, some market players are seeing the current weakness as positive for the next phase of growth.

Matt Hougan, Chief Investment Officer at Bitwise, said that the lack of a strong year-end rally actually improves the outlook for 2026.

Hougan spoke at The Bridge conference in New York City and explained that if crypto prices had surged too early, it might have triggered another downturn in 2026. The slower pace this year is thus leaving room for a healthier and more sustainable recovery.

“The underlying fundamentals are solid,” Hougan said. “Institutional investment, regulatory clarity, stablecoins and tokenization are all gaining strength. Those forces are too large to ignore.”

Retail Fear vs Institutional Confidence

While many retail traders have left the market after last year’s turbulence, institutional investors seem to be doing the opposite.

Hougan said “crypto-native retail is depressed” after enduring events like the FTX collapse and the failed meme coin boom. Many have paused trading and are waiting for clearer signals of a new bull cycle.

However, available data shows that traditional retail and institutional investors are very active. Spot crypto ETFs continue to see strong inflows, and major financial firms are actively interested in blockchain-based products.

Crypto Sentiment Fear Rally Prediction: Why Fear Is Bullish

Across the market, fear is generally seen as a contrarian indicator. When enthusiasm fades and prices stall, it’s usually because most short-term traders have already sold.

This leaves the market in stronger hands and sets the stage for a rebound.

Santiment’s analysts believe the current environment fits that pattern. “Traders’ sour moods could be welcomed news for the patient,” they said. They added that an “unexpected November rally” could emerge as sentiment bottoms out.

Bitcoin’s price has hovered around $101,700, and Ethereum trades near $3,400.

While some earlier predictions, like Arthur Hayes’ call for Bitcoin to hit $250,000 this year, now seem out of reach, analysts agree that the next major move could still be upward.

While fear dominates short-term sentiment, broader macro factors are also influencing market expectations. As the U.S. government will be releasing nearly $300 billion back into the economy after the shutdown ended — a move that some analysts say could strengthen liquidity conditions for risk assets.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.