House Democrats introduced the MEME Act in February 2025 to ban politicians from issuing memecoins, targeting Trump’s $TRUMP token that surged to $15B before crashing 82% and causing $2B in losses for 800,000 investors while netting the Trump family $100M in fees. With zero Republican support and GOP control of Congress, the bill’s passage is near impossible, serving more as partisan theater amid ethics concerns over foreign influence and insider trading.

Key Insights

- House Democrats introduced the MEME Act to ban politicians from issuing memecoins.

- Trump’s coin surged to $15 billion, then crashed 82% with over 800,000 investors losing money.

- The bill has a near-zero chance of passing under Republican control.

House Democrats rolled out a new bill Meme act targeting President Donald Trump’s controversial TRUMP meme earlier this year.

California freshman Democrat Rep. Sam Liccardo introduced the Modern Emoluments and Malfeasance Enforcement (MEME) Act in February, and this bill is aimed at stopping politicians from cashing in on crypto tokens.

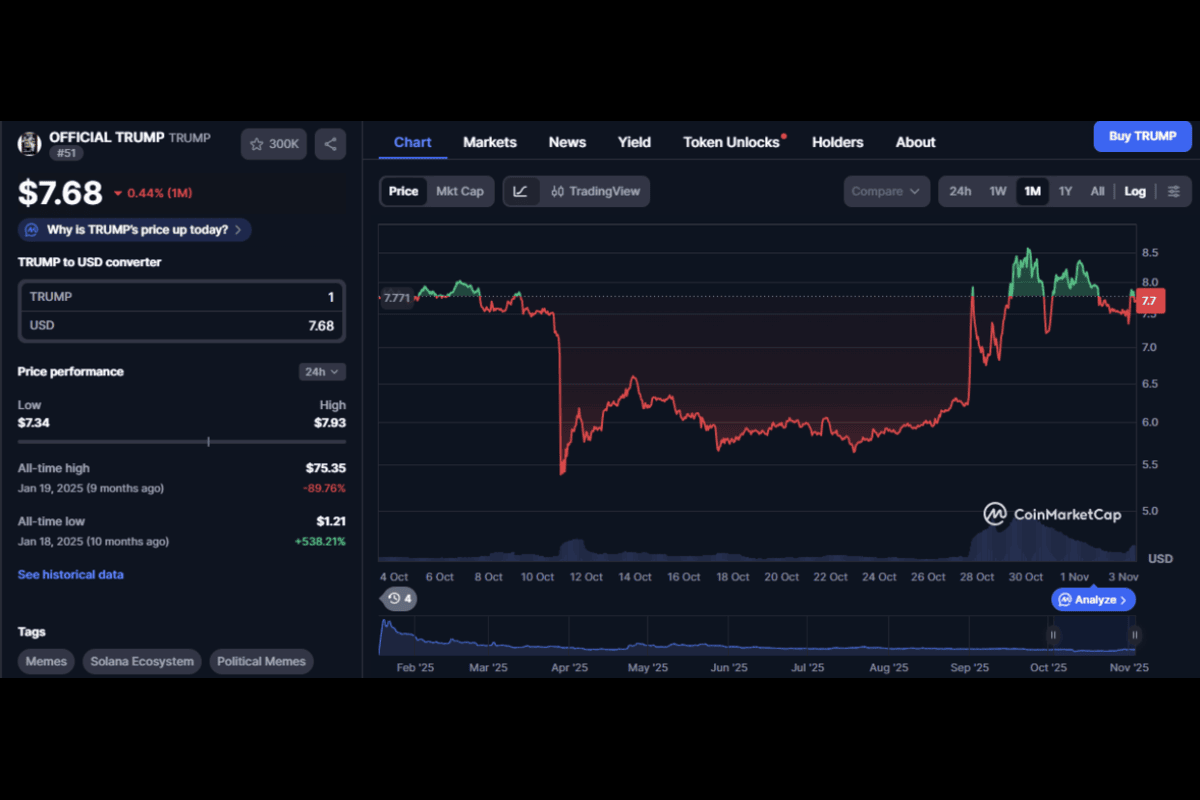

Trump’s meme coin soared in value to above $15 billion after its January launch. The token was initially tagged as a success amid this valuation, all before it came crashing down.

What the MEME Act Would Do

The proposed law is attempting to cast a wide net. The MEME Act would prohibit the president, vice president, members of Congress, senior executive branch officials, and their spouses (even any of their dependent children) from issuing, sponsoring or endorsing a security, future, commodity or digital asset.

Any violators would face serious consequences, and the bill would impose criminal and civil penalties.

Liccardo pulled no punches when he said, “The Trumps’ issuance of memecoins financially exploits the public for personal gain and raises the spectre of insider trading”.

800,000 Investors in the Red

The numbers showed a brutal story. Almost every one of the 800,000 people who bought the memecoin lost money. So far, according to CoinMarketCap, the token has dropped by around 82% from its peak value.

More than 813,000 crypto wallets have lost a total of $2 billion so far after buying President Donald Trump’s memecoin. Meanwhile, the Trump family made millions. The Trump Organisation and its partners reportedly gained $100 million in trading fees.

The losses hit hard as regular investors bought in at high prices. These investors were forced to watch as their money evaporated while the coin plummeted. At the end of the day, early insiders and whales made millions while retail traders got crushed.

Why Is This Bill DOA?

Here’s where the political theater becomes obvious. While Liccardo’s bill is not expected to become law over the next two years under Republican majorities in the House and Senate, Democrats are pushing forward anyway.

Republicans currently control both chambers and have shown no interest in restricting Trump’s business activities. The bill also has a dozen Democratic cosponsors, which means that it has zero Republican support.

The freshman Democrat said that the president and first lady made a windfall on their respective meme coins and are working to build support with the Democratic majority.

All of this means that the bill might only see the light of day after the next election.

Trump’s Crypto Empire Under Scrutiny

The memecoin controversy is just one piece. Trump has built an extensive crypto portfolio with two Trump-owned entities (CIC Digital LLC and Fight Fight Fight LLC).

Both of these together hold 80 percent of the coins remaining after the initial offering.

This ownership structure also raises some red flags. Since January, more than $324 million in trading fees have been routed to wallets tied to the project’s creators. Even worse, the Trump family profits from every transaction.

Foreign influence concerns are also another layer. Senator Elizabeth Warren wrote in a January letter that “Anyone, including the leaders of hostile nations, can covertly buy these coins, raising the specter of uninhibited and untraceable foreign influence.”

The Memecoin Market’s Dark Side

Trump’s coin isn’t alone in the chaos. The president of the Central African Republic and the president of Argentina have all endorsed or launched their own tokens in the past month.

Both of these times, these political tokens crashed after insiders cashed out.

Overall, Democrats frame the MEME Act as ethics legislation. Republicans see it as partisan harassment.

But both sides know the bill won’t become law.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.